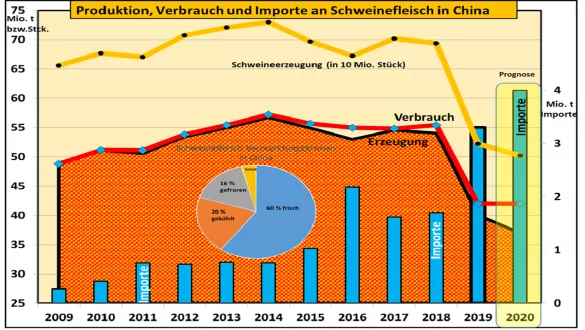

ASP conditional 3rd stage of the Chinese price increase in pigs foreseeable - with what end? African swine fever (ASP) has spread since the beginning of last year, starting in China and adjacent areas. By May 2019 , a reduction of approximately 25% of Chinese pigs or sows is said to have occurred, if one can believe the official information. That would be approx. 100 million animals in China alone . In Vietnam , 10 to 12% of the pig population or 3 million pigs are said to have fallen victim to the disease. Laos and Cambodia follow. The Chinese pig prices reacted from 2.0 € / kg to 2.35 € / kg after a first climb in the fall of 2018 , but then paused for a few months at a higher level. After a short intermediate low in the first months of 2019 there was a 2.Level of inflation to the level of € 2.65 / kg , which lasted for a few months. In addition to the meat intake from the inventory reductions , frozen meat stocks of approx. 2 million t provided. In addition, some have switched to other types of meat and has ultimately reduced the consumption of meat . Increasing imports with a focus on the EU have made a strong contribution to stabilizing the increased price. Now a third stage of price increases is recognizable. Within 2 weeks the prices rise to 2.85 € / kg . It is speculated that the reserves mobilized so far are slowly coming to an end. But in 25% less sows is missing the supply of not reared piglets. The spiral of a supply shortage continues to revolve one round. Usually, pork consumption increases towards autumn / winter. The highlight is regularly to the Chinese New Year week beginning of February.2020 achieved. Further import increases are therefore foreseeable. But one thing is clear. The shortage of pigmeat in China, at 14 to 16 million tonnes (equivalent to the annual production of pork in the USA and Canada), can not be covered by imports of all kinds of meat . USA and Canada are largely absent due to tensions in trade policy as suppliers. The Chinese focus is on the EU and Brazil. In the first 5 months of 2019, EU deliveries of pork to China have increased by almost 40%. A fundamental reversal of Chinese production development is not foreseeable for the time being. New cases are still reported by ASP, even if the number has become smaller. The number of unreported cases , however, remains high. A replenishment of pig stocks is not to think for the time being in view of the high Reinfektionsgefahr . In any case, there will be an excess of demand that drives up Chinese and international meat prices.It is speculated that the Chinese pig prices are still expected to increase by + 70% by the end of January 2020. Pork prices of 4.50 € / kg could not be excluded, they say.