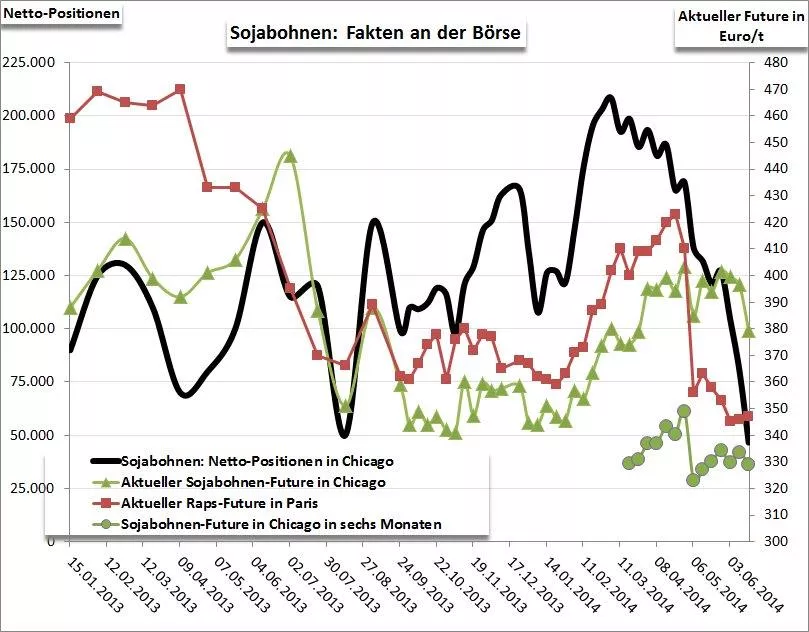

in the last week of the report, speculators reduced the net long positions in the soy beans with 33.519 contracts clearly on only 46.624 net long positions. This represents the lowest for more than a year number of speculators who expect rising prices. In the next few weeks seems even a transition in the net-short range as likely. Therefore the current courses in Chicago will move further in the next few weeks almost certainly down, allowing also for the rare courses in Paris seems no upside potential in sight. In the oilseeds there is thus clear signs: the estimated growth of the world end stocks to less than 100 million tonnes is no impetus for rising prices despite continuing Chinese imports. The granivores will be pleased, when the soy meal prices finally another move down.