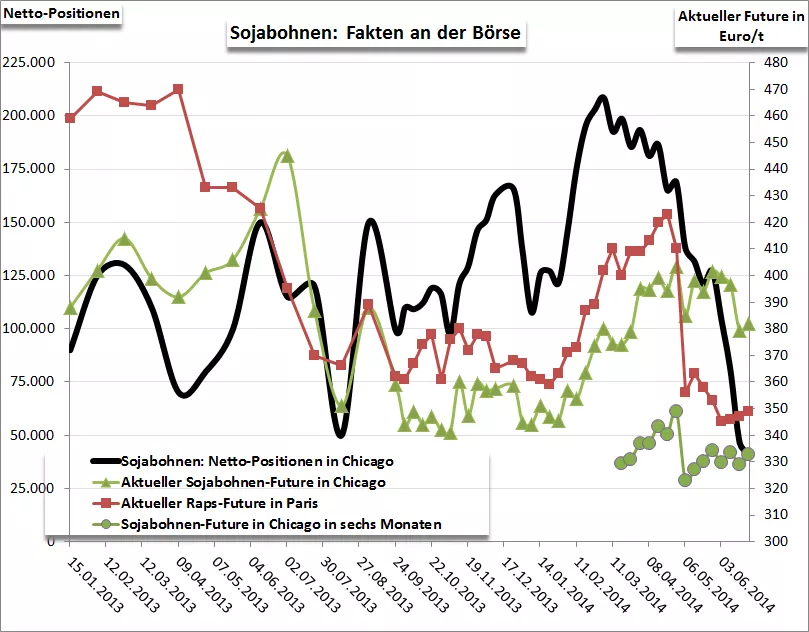

speculators push soya prices by increasingly going out from the net-long range. The causes lie in the higher-than-previously expected acreage for the upcoming harvest and higher end stock figures from the last year in the United States. The South American overhangs and thus increasing final inventories in the 2014/15 marketing year confirm this trend. It is expected that the net positions soon change after more than a year from the net long area in the net-short range. The dismantle is continuously existing 41.221 net long positions in the last week of the report, as a result the current rates came in recent days increasingly under pressure. The soya prices in Chicago are current numbers early next year equivalent of 50 euros / t lower than she and thus provide more course direction.