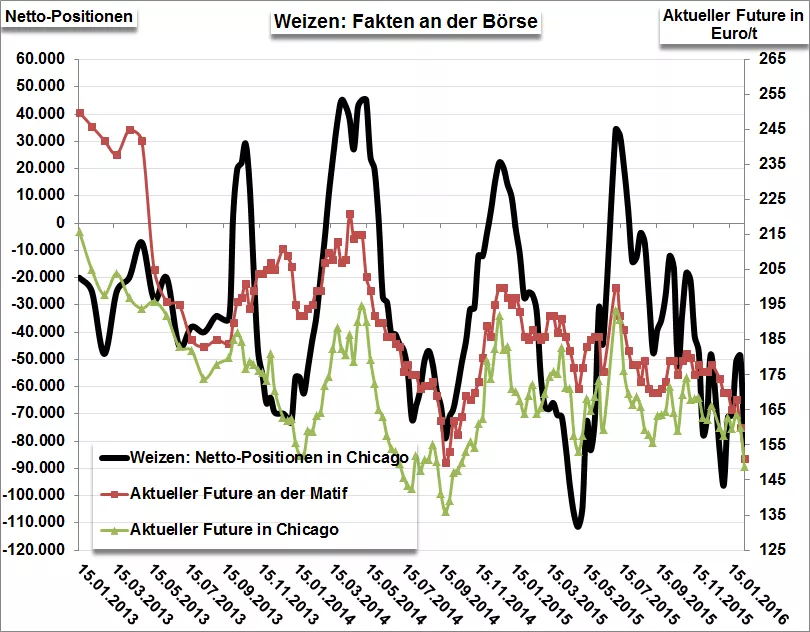

In the reporting week to the 09.02.2016 the wheat speculator in Chicago have expanded the net short positions significantly (plus 32.360 contracts) on now 81.045 NET short positions. The courses were similarly under pressure.

Currently think many establishments of the (other) sale of grain. Certainly "painful thoughts" especially among those who have sold 2016 not so much from the harvest of 2015 and for the upcoming crop. Others are largely in 2015 and think more about 2016. The grain markets are currently well supplied, what the current USDA figures for the marketing year (WJ) 2015/16, but already the new IGC and FAO estimates for the WJ 2016/17 (harvest 16 northern hemisphere) show. High stocks of cereals, especially when the main exporters, but also growing stocks at the importers (E.g. China) dampen the hopes of farmers on rising prices.

For the old harvest running out of time for a successful marketing and the courses are heavily under pressure. May 16-future records currently approx. 6 EUR per tonne higher than the Mar. 16 future, which has also 1:1 on the spot market prices (in about the same base). Therefore a delivery would be cheaper than now direct in may even though the goods in the third camp is located.

Is enough time for marketing the harvest of 2016, but yet the price expectations are crucial. According to current state can be expected no large increase in inventories (global resources) in the upcoming WJ with the grain. It is still far too early for a reliable estimate. Especially the corn is often not yet in the ground, while the income expectations, particularly in the United States play a major role. The fact is now: the grain warehouses from the last harvest are still abundant in the United States. What happens if this year have an average harvest possible? Even with a weaker harvest, there is still enough (export) goods. Only a catastrophe such as the heat in the corn belt last could take effective pressure in 2012 of the "stock boilers".

Many farmers respond to the various uncertainties with the partial sale of the crop 2016 or think about wheat options, one minimum price contract after. The advantages of the latter possibilities: In case of falling or falling wheat prices are producers on the safe side. Falling prices / price against loss of revenue ensures, when rising prices it participates by the higher spot market prices. The downside: In both cases, the minimum price / option costs money (much like a hail insurance). A wheat price insurance costs until later this year at present between 9 and 15 euro / t, the options that can be traded on the stock market the cheapest are tending to. However, not all of this possibility have so that a minimum price contract is the alternative. But caution: arrange the minimum price contract any price increases also 1:1 to take advantage of.

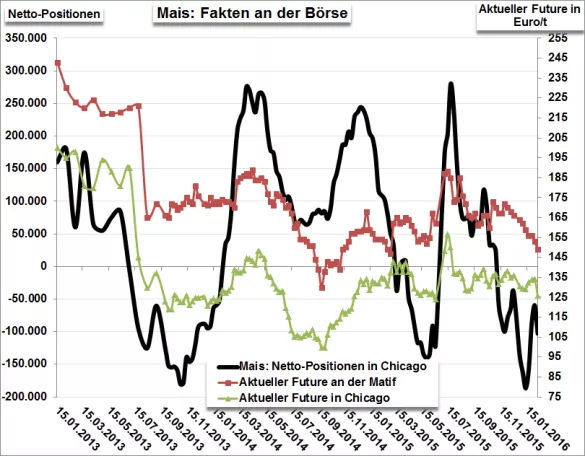

In the reporting week to the 09.02.2016 corn speculators in Chicago have expanded the net short positions significantly (plus 43.306 contracts) on now 102.785 NET short positions. Accordingly, the prices came under pressure.