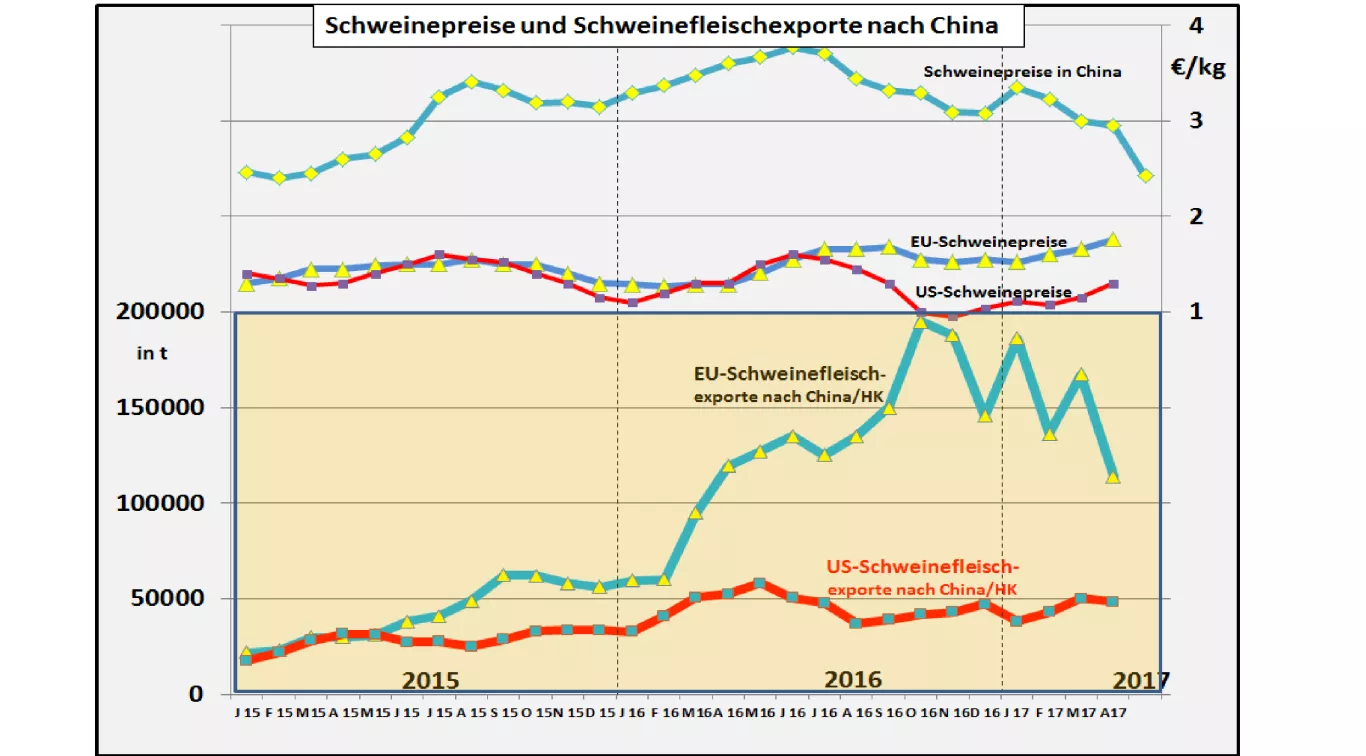

Will falling China exports be a blow to EU pig prices? Currently , the EU is still exporting approx. 50% of its pork exports to China / Hong Kong. But sales volumes are declining. The big boom in China deliveries took place in 2016. The export volumes tripled from March to Oct. of the year . Exports to China / Hong Kong reached the whole of 2016 An order of 2.22 million tonnes, for China alone 1.86 million tonnes. This boomphase is over. Monthly exports to China / HK are ongoing. In October-16 the monthly deliveries amounted to almost 200,000 tons, only 167,000 tons were shipped for Apr.-17. The main reason for the decline in China imports is the fallen Chinese pork prices. In mid-2016, the Chinese experienced a maximum of 3.85 € / kg. Beg. June 2017 the prices fell to 2.35 € / kg . The lower price level indicates that the previously strained supply situation has improved fundamentally. The main reason is a slowdown in consumption. A new orientation in consumer habits is also the most recent argument.In the middle and upper income classes, according to the western model, more and less calorie-rich and less calorie-rich diet is to be placed. As poultry meat is increasingly neglected because of the dangerous bird flu, high-quality beef is increasingly demanded and introduced. Beef imports have increased fivefold within four years. The Chinese own production of pork has risen comparatively little. It is only in the autumn of 2017 that there will be an increase in the number of offers from the New stables are to be delivered. The production from the failed backyard holdings is to be partly replaced.The possible reason for the restrained Chinese import demand can also be explained by the high prices of the eligible countries of supply. Pig prices in the USA and the EU are currently at an above-average level. Canada and Brazil with more moderate pig prices are only available to a limited extent. However, the exported less valuable parts are only slightly affected by the general price increases. Even though Chinese imports are slowing down, the magnitude of EU exports is still at a level twice as high as before the boom. In addition, EU shipments to other importing countries such as Japan, South Korea and Australia have grown significantly. For the first quarter of 2017, a 7% increase in EU pigmeat exports is recorded, albeit from a low level. The next quarterly results will be considerably lower than the boom-like development of the previous year.The current pork prices owe their high-price level to the ongoing grilling season with strong demand, limited livelihood , little supplies in the refrigerated warehouses and a solid, but no longer booming export business . For the autumn / winter 2017/18 is to be expected with decreasing courses!