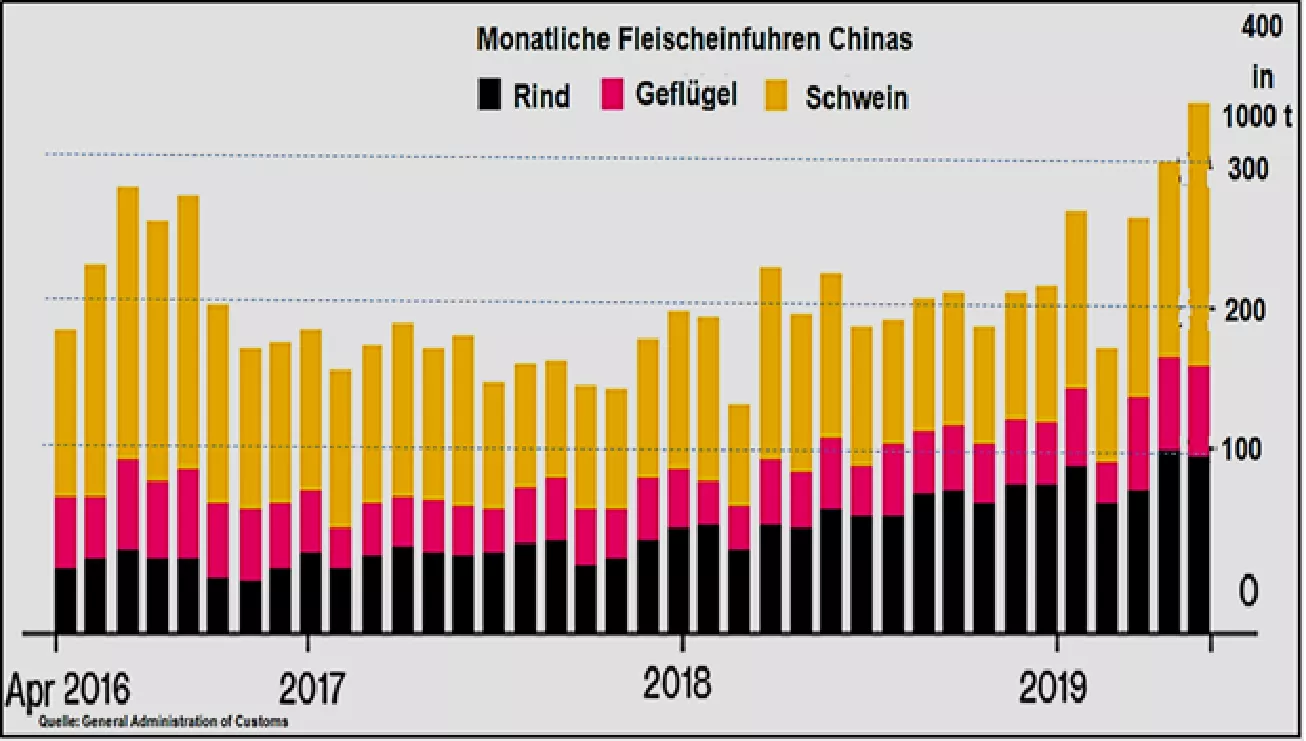

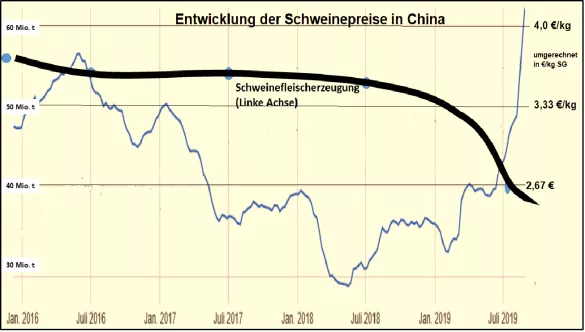

China rises to become the world's largest meat buyer - End of Aug 2019: Chinese pig prices at € 4.15 / kg China's 1.4 billion consumers traditionally like meat, almost 55 kg per capita and year , but most preferably 35 kg of pork. Poultry meat is with approx. 11 kg not despised, but there is this poultry virus , which can be dangerous to humans in a particular variant. In recent years, it has held back with it. With 5 kg you stick to the consumption of beef only in the beginning. For decades, China was self-sufficient in terms of meat . The Chinese pig population accounted for just over half of the world's stock . Production rose steadily to meet the growing demand for a rising population with rising incomes. This development has been decisively interrupted by African swine fever (ASP) .A loss of 25 to 35% of the pig population tears a deep hole in the supply situation with animal proteins. It lacks the equivalent of 13 to 15 million t of pork. This corresponds to the total production of the USA and Canada together. Another benchmark: the total world trade in pork ranges from 8 to 9 million tonnes . It can be assumed that the Chinese meat deficit can not be fully compensated for overnight. For the time being, reconstruction of the pig population is hardly to be considered because the risk of reinfection is far too great. Experts estimate that 5 to 7 years will elapse before China has a reasonably secure grip on pig production. At the same time, humans are the decisive factor that contributes significantly to the supraregional dissemination of ASP. The risk of infection among the animals remains regionally limited at a rapid death. An increase in poultry meat production is rapidly reaching the limits of bird flu .In fact, China does not yet regain the production levels of earlier years. Increasing own beef production is less promising, because the small production concentrates on low-yield steppe landscapes in the north and west of the country. The high yielding locations in the east and south are needed for more competitive agricultural products. Unfortunately, more beef is coming to the market because high meat prices are tempting to abuse beef and dairy cattle through stock slaughter for short-term business. And the further consequence: it lacks milk or dairy products, which are already in deficit anyway. What remains is meat import. The Chinese have tripled their pork imports from just under 1 million tons to 3 million tons this year over the last 5 years; By 2020, 4 million tonnes of imports are expected . However, possible supplier countries are limited as a result of trade disputes with the US and Canada.However, the massive drop in pork prices in the US and Canada offset some of the high tariffs , so small amounts of US pork are still being exported to China / Hong Kong. The predominantly eligible export countries are the EU Member States with significant pig farming. The EU export potential is estimated at 3 million t SG in 2019. In addition, Brazil has access to 0.85 million tonnes . But the Chinese approval of the Brazilian slaughterhouses is delayed. And finally, despite ASP in the country, Russia is hoping for supply. Anyway, there is invested diligently. Chinese poultry imports have risen from 0.25 million tonnes to almost 0.6 million tonnes in the last 5 years. The fear of bird flu is the decisive braking factor. There is still the import of beef . In fact, in 4 years, Chinese imports have increased from 0.66 million tonnes to the current 2 million.t tripled. It should be noted that, in addition to the official imports of beef, on average about 1 million tonnes of goods are smuggled into the country. The supplies come from neighboring countries with which there are no trade agreements, because cattle diseases can not be ruled out there. However, as the demand for imports increases, the percentage of so-called "gray goods" is decreasing. The rising meat imports of China lead in their unusual magnitude to rising international meat prices . In leading EU countries with pork exports, prices have risen by approx. 30% increase. In the United States, Canada and Brazil , there was great expectation of increasing sales in China, which led to high price fluctuations in the summer months. Meanwhile, the prospects of export and high prices have been grossly disappointed . In contrast, the Russians are hoping for a future export of China in spite of ASP in the country; There is a lot of investment there.In 2019, beef prices , which have come under pressure in previous years, have reached a higher level. In particular, the prices in Australia and New Zealand are experiencing a strong upswing. The Brazilian and Argentine beef prices have also benefited initially, but have recently suffered a major setback by currency turmoil. By contrast, prices in Uruquay have risen to levels around € 4.30 / kg. In the EU , low beef prices are showing signs of recovery. Conclusion: The Chinese meat deficit has dimensions that set the global meat market in motion. The unusually high import volumes encounter limited supply capacities among exporting countries. The resulting global shortage causes rising international prices, which can last for a longer time.