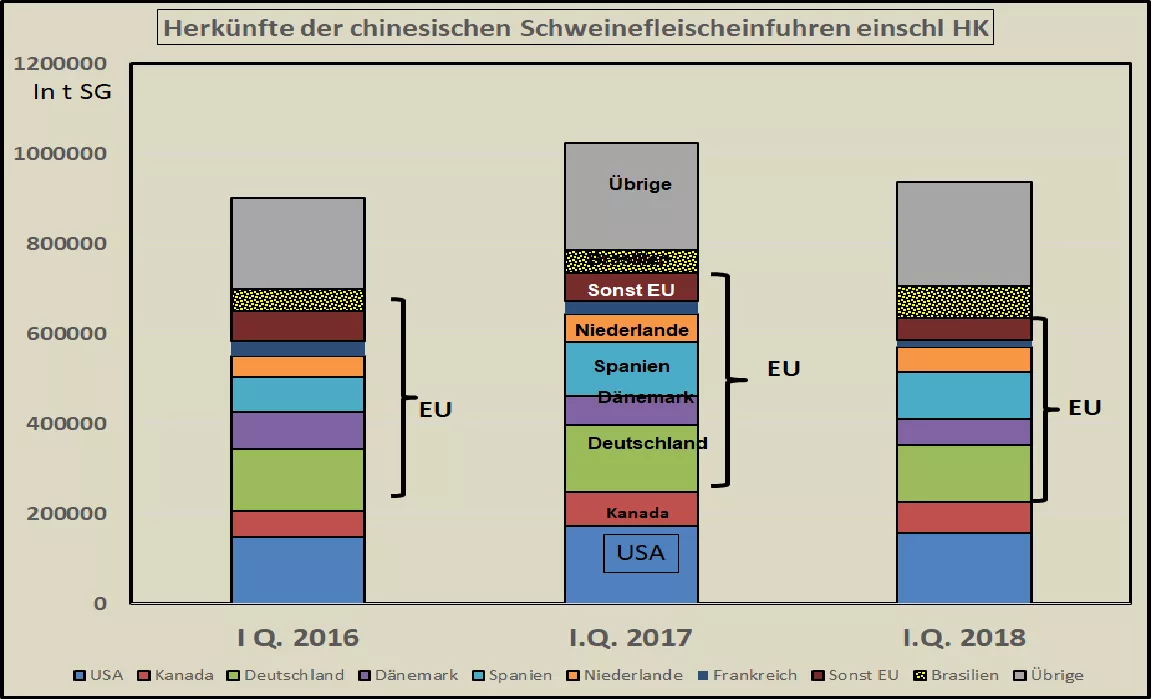

China reduces pork imports - EU supplies hit hard - prices have fallen China is trying to bring back the domestic production, which has been falling back three years, back to its old state. From the initial year 2014 with 56.71 million t of pork, production fell to 53.4 million t in the year 2017. For the year 2018 , the People's Republic is again aiming for an amount of 54.65 million tons . Consumption fell from 57.2 million tonnes to 54.8 million tonnes over the same period. In 2018 , consumption of 55.9 million t is expected . So it still calculates an import requirement of approx.1.5 million t . In the peak year of 2016, 2.2 million tonnes were imported. However, the current increase in self-generation is no longer meeting the strong demand potential of 4 years ago. As a result, Chinese pork prices have fallen from an average of € 2.50 / kg to a current € 1.85 / kg . At such low prices, the willingness to import and pay is comparatively low. Recent EU deliveries to China returned an average price of € 1.38 / kg compared to € 1.50 / kg previously . This is already evident in the figures for the first quarter of 2018 . Overall, the import volumes of approx. 1.02 million t to 0.93 million t resp .8.5% down on the same period last year. The EU with a delivery share of approx. 47%, the decline in imports is particularly strong. In the first quarter, EU exports to China fell by just under 16% . Despite the interim punitive tariffs, the Americans have so far lost only 9% of their supply to China. By contrast, Brazil was able to assert itself with a 38% increase in low-price offers. China exports were a welcome replacement for the import ban to Russia. Germany's market share is approx. 14% and so far has suffered little from the decline. By contrast, Denmark has approx. 2% lost market share.In the summer months , the import demand usually continues to decline. The trade tensions between the US and China are likely to contribute more to US supply cuts. Already, China's oversight measures are tightening excessively, putting the economics of US exports in jeopardy. The EU supply cuts could be less affected. However, this should not result in a price advantage , because the low-priced competition from Brazil with prices below € 1 / kg ensures sustained price pressure. The Brazilians themselves are again under North American price pressure in other markets.The further development can hardly be estimated; on the one hand, new stables on an industrial scale are put into operation in China, on the other hand, pig prices do not cover the high production costs in China. Therefore, there will also be considerable production settings. This process will continue for some time, and the outcome is barely predictable, even to Chinese market experts.