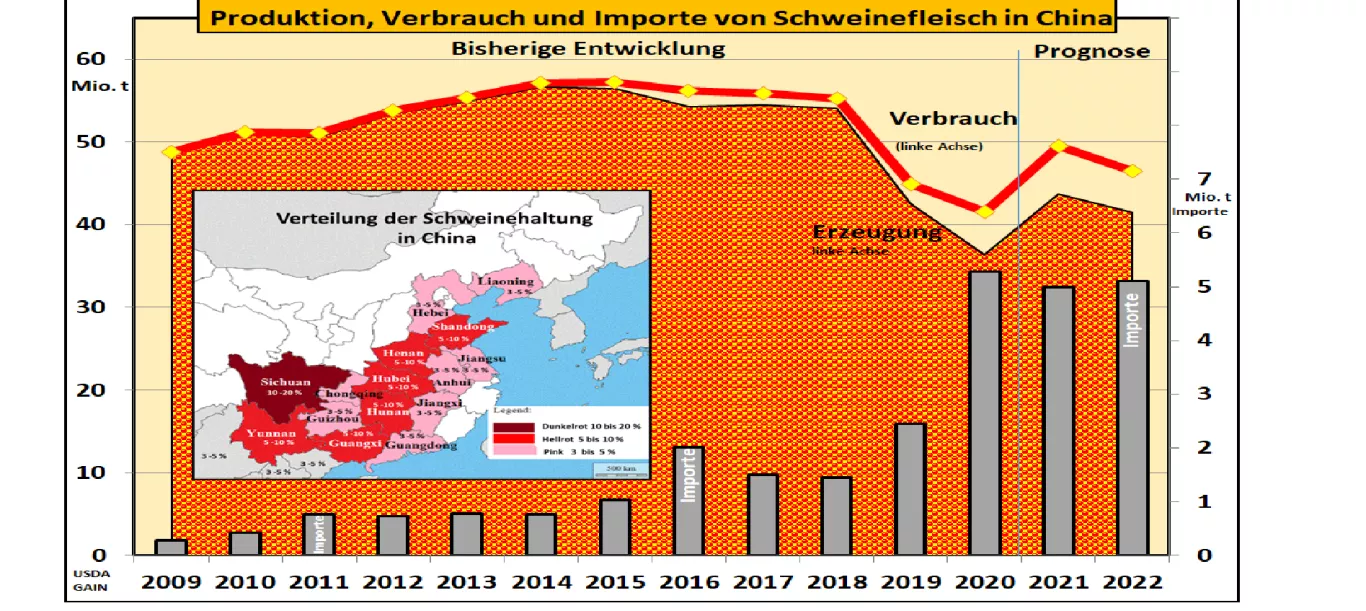

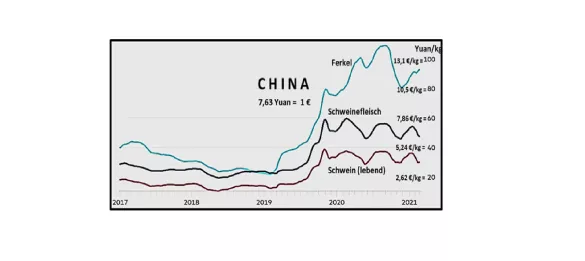

US Department of Agriculture: China's pork production will decline in 2022 The reconstruction of Chinese pork production after the ASF slump in 2018/19 is not going smoothly. Although it was possible to increase in-house production from 36 million t to 44 million t in 2021, it still lags behind the starting level before the ASP period of 54 million t. Pork imports fell slightly below the 5 million t mark. Consumption is hovering around 50 million t, still 6 million t below the previous level. The considerable increase in the supply of pork through in-house production and import in 2021 led to a drastic drop in prices from the equivalent of over € 5 / kg to € 2.70 / kg; at times even below. Pig farmers have fallen into the red with barn prices above € 200 per 20 kg piglets, grain prices above € 30 / dt and soybean meal prices at € 50 / dt, as well as less productive feed conversion rates of 3.5. The average rearing performance is well below 20 piglets per sow; Excluding top companies.Fattening pigs were sold prematurely in a panic. Sows that did not perform well were slaughtered immediately and not replaced. The intermittent excess supply made prices worse for a short time. The import of breeding pigs has been reduced. The increase process is experiencing a major setback. In addition to ASF and its mutants, other diseases are also virulent. In particular, the 6.5% decrease in the sow population will lead to a reduction in the number of slaughter pigs in the coming period. The willingness to increase remains low. The information network of the US Department of Agriculture estimates based on Chinese data that pork production could be around 14% lower in 2022. Despite adjusted consumption, this should contribute to an increase in pork imports above the 5 million t line. The futures prices on the Dalian stock exchange show converted pig prices of well below € 3 / kg for the first half of 2022. This means that prices are close to the loss threshold.The Chinese government has taken a number of measures to prevent high price fluctuations in the future. In the event of low prices, state stockpiling is intensified. If the prices are too high, the development is to be slowed down by the dissolution of the state meat stocks and support measures to be increased. In addition, the regional authorities are instructed to control prices. The government announced that it would massively counter high pig price speculation in the future. In July 2021, pig prices fell to 14 yuan / kg live (around € 2.45 / kg SG). The piglet price fell to the equivalent of around € 220 per 25 kg animal. At the end of August 2021, prices returned to their starting level in April / May 2021. Until the Chinese New Year at the turn of the month Jan./Febr. In 2022, with the peak of pork consumption, Chinese pork prices will tend to rise. For the month of Jan 2022, prices will be traded at the equivalent of € 3 / kg on the Dalian stock exchange.Even if higher Chinese imports can be expected, the international pork exporters will have to adjust to the Chinese who are less willing to pay than in the past.