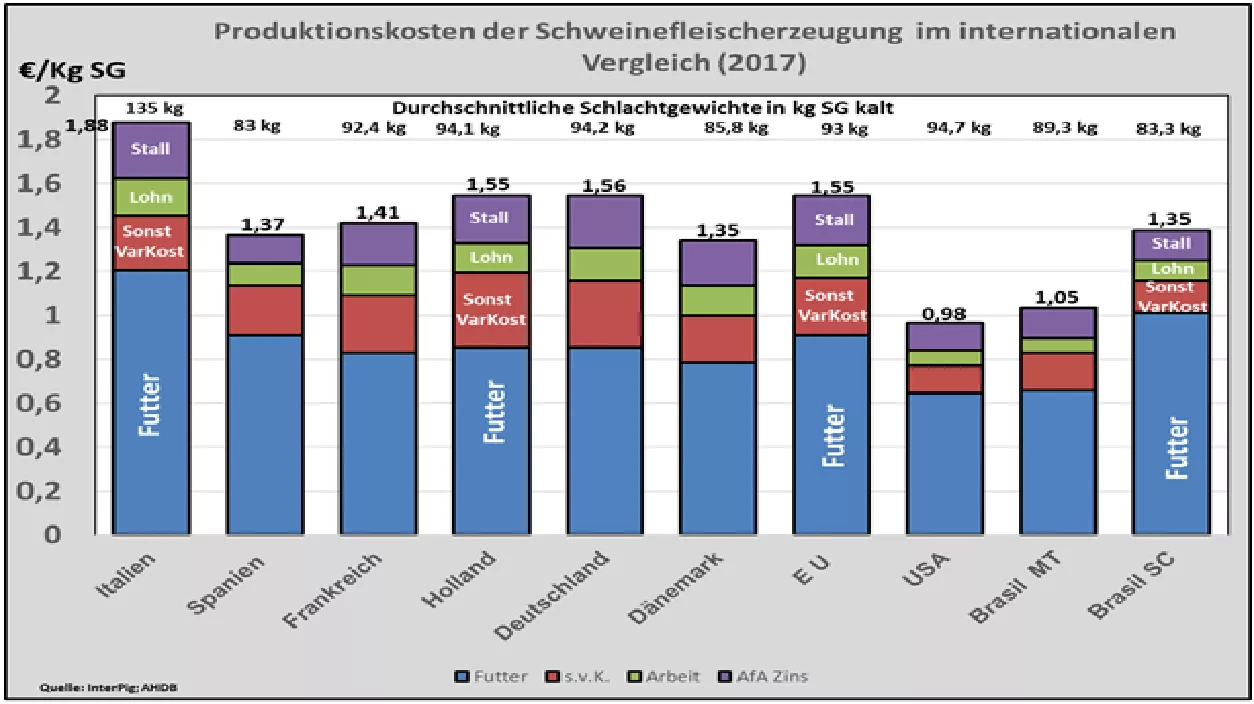

InterPig: Relative production costs of international pork production

InterPIG is an expert group of agricultural economists in major pig producing countries . Each year, the panel brings together production and economic data for the Piglet Production and Pigments interconnection system. For 2017, 17 regions were examined. Below are some important sites selected.

For the EU average, InterPig calculated in 2017 relative production costs of € 1.55 / kg at a slaughter weight of 93 kg.Of this, € 1.18 / kg was accounted for by the variable costs, with a focus on € 0.91 / kg feed costs . In the EU average, a feed conversion of 2.83 and daily increments of 819 g was calculated. The loss rate in the fattening phase was 2.78%. The fixed costs amounting to 0.37 € / kg consist of the labor costs of 0.15 € / kg as well as the depreciation and interest costs for the stable.

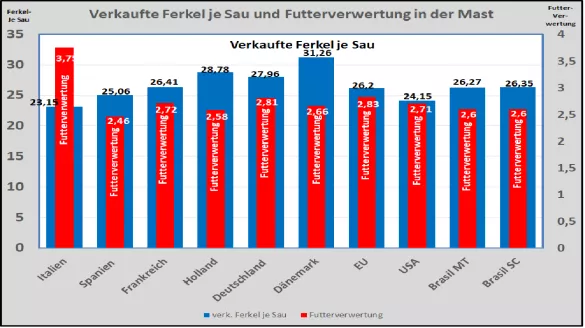

With approx. A pigmeat production of 2,427 kg SG per sow and year was calculated for 26 piglets .

Particularly favorable are the relative production costs in Denmark and Spain of 1.35 and 1.37 € / kg slaughter weight, respectively. The Danish benefits consist in low feed costs due to a low carcass weight of just under 86 kg combined with feed conversion of 2.66 and high daily gains of 971 g.

Denmark has a meat production of 2 with 31 piglets .683 kg per sow and year.

Spain has high feed costs due to the food shortage, which has to be compensated by expensive imports. In part, this disadvantage is mitigated by a very favorable feed conversion of 2.46 . The low carcass weight of just 83 kg also contributes to this. Low barn costs due to the mild climate and low wages make it possible to compensate for the cost of feed. For piglets of 25 per sow and year, only one pork production of 2,081 kg per sow is achieved in Spain .

France's pigmeat production owes its below-average production costs of € 1.41 / kg SG to its favorable feed prices with only average feed conversions and daily gains. Remarkably high are the other variable costs. With 27 piglets 2,440 kg of meat are produced per sow .

Germany and Holland are at € 1.56 and € 1.55 / kg SG, respectively, at EU average . Both countries have high feed costs, which are initially triggered by a comparatively high carcass weight of just over 94 kg . With a relatively low feed conversion rate of 2.66, Holland compensates for the relatively high feed prices as a result of strong import requirements.Germany's feed costs of € 0.86 / kg are due to a feed conversion of 2.81 with below-average feed prices. Both countries have remarkably high fixed costs and other variable costs as a result of high wages, construction costs and environmental regulations. The meat output of 2,634 kg is achieved with 28 piglets per sow and year.

Italy's pig farming falls with an unusually high carcass weight of 135 kg (including Parma pigs) from the frame. The production costs of 1.88 € / kg are correspondingly high. Despite an unfavorable feed conversion of 3.75, the feed costs remain within the range of € 1.21 / kg SG. With 23 piglets , meat production of well above 3,126 kg per sow and year is achieved due to the exceptional slaughter weight .

Compared with other countries , the US is the cheapest with production costs of € 0.98 / kg . The decisive advantage is the low feed costs of € 0.65 / kg. Here, the feed conversion is with 2.71 in the good average. Feed prices in 2017 were just under € 170 / t compared to the EU average of € 240 / t. Favorable are also the other costs with comparatively low wages and stable place costs in the USA. The meat production of 2.287 kg is due to low 24 piglets per sow andYear.

Brazil's pig production costs vary greatly depending on the location. In the central Mato Grosso, the largest corn and soybean area, the feed costs with a relatively favorable feed conversion and feed prices of 184 € / t are crucial for the low cost level. The cost advantage is necessary to offset the low sales revenues due to the high marketing costs to the distant consumption locations.

In Santa Catarina, in the southeast corner of Brazil, with 28% of Brazilian pork production and over 40% of pork exports, feed prices are 50% higher than in Mato Grosso due to the long transport distances. However, the lower marketing costs and the closeness to the port are favorable for sales. In both regions of Brazil, with 26 piglets, a meat yield of 2,500 kg per sow and year is achieved.