Perspectives on the EU milk market 2019 - relaxed balance

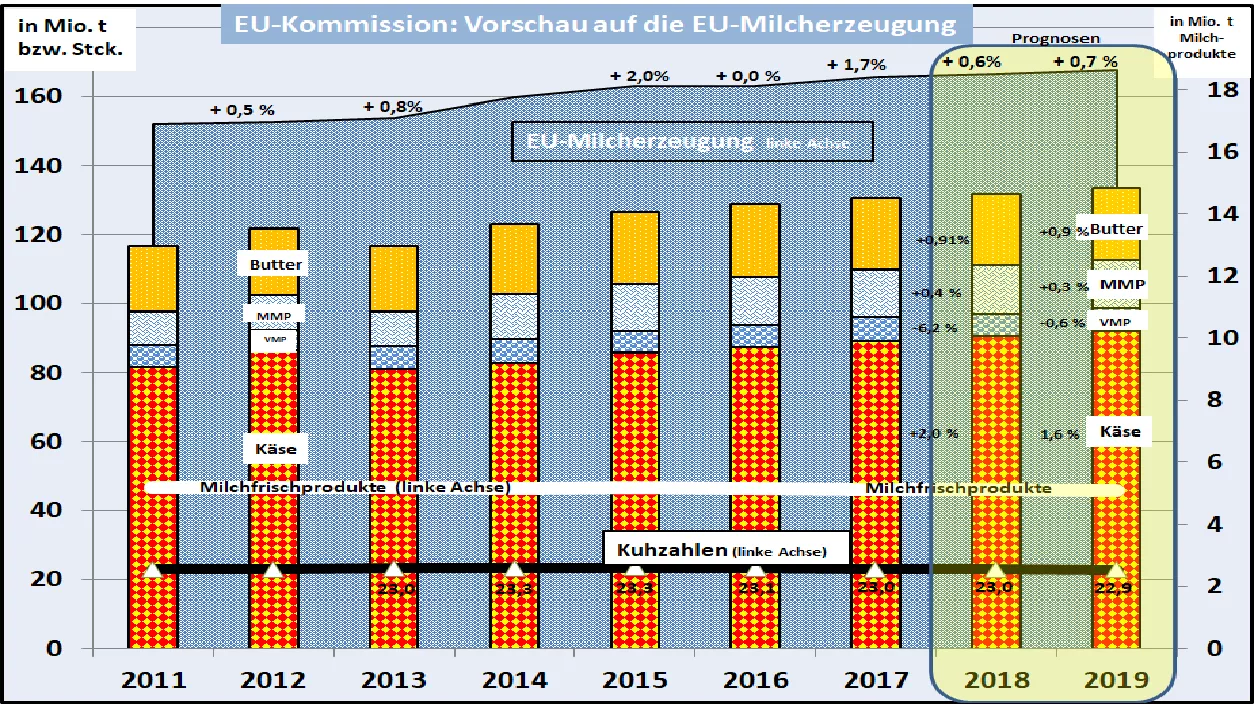

In its quarterly forecast on the agricultural markets, the EU Commission also included the EU milk market in 2019 among other things. As a result, milk production is expected to increase by 0.6% to 168 million tonnes. A decline in cow numbers is overcompensated by the increase in output . The delivery to the dairies is to increase to a similar extent as the production.

Uncertainty exists with regard to the drought-induced basic feed supply in large parts of the production area. It is not excluded that the old cow numbers are reduced more. In any case, milk deliveries in the first half of 2019 should be weaker.

Fresh milk production and consumption amounting to 45.2 million tons - approx. 25% of production - as in previous years, continues to decline. For every head of the population the consumption amounts to approx.86 kg compared to 5 years earlier with 90 kg .

EU butter production will increase to 2.4 million in 2019 in the small multi-year framework t. The consumption of butter increases to the same extent. The per capita consumption remains constant with 4.4 kg of butterfat. The export of 177,000 t should not change appreciably in 2019. The final stocks go back slightly. The background is provided by the international better-served international milk fat market , which still has above-average prices compared to the high price of prices in the previous years.

High public and private skimmed-milk powder stocks are expected to be reduced from their peak of 500,000 t to 146,000 t by increasing MMP exports. The intervention stocks should be reduced to almost zero . This would put an end to a three-year phase of state intervention in the EU dairy market. There is a noticeable increase in the chances of rising MMP prices above the intervention level .

Whole milk powder production in 2019 is expected to rise slightly and return to the average level of earlier years. The consumption is approx. half each in the export or in the domestic sales.

EU cheese production will continue its steady increase in production in earlier years in 2019. Of the 10.6 million tonnes, 9.88 million tonnes remain in Germany and boost the ever- increasing per capita consumption to 18.6 kg per inhabitant. But cheese exports are also experiencing strong export growth. On the other hand, imports fall to less than 10% of the export volume.

All in all, the EU dairy market should be able to free itself from the price pressure situation of previous years in 2019 and be able to fill up margins . The integration into the international market plays a decisive role here. The EU is at the forefront of global market activity and therefore has a significant impact on market trends.

The future price development will be reflected in the future forward rates for dairy products on the stock exchanges.After initially weak price developments, rising price trends will be traded in all divisions later in the year.