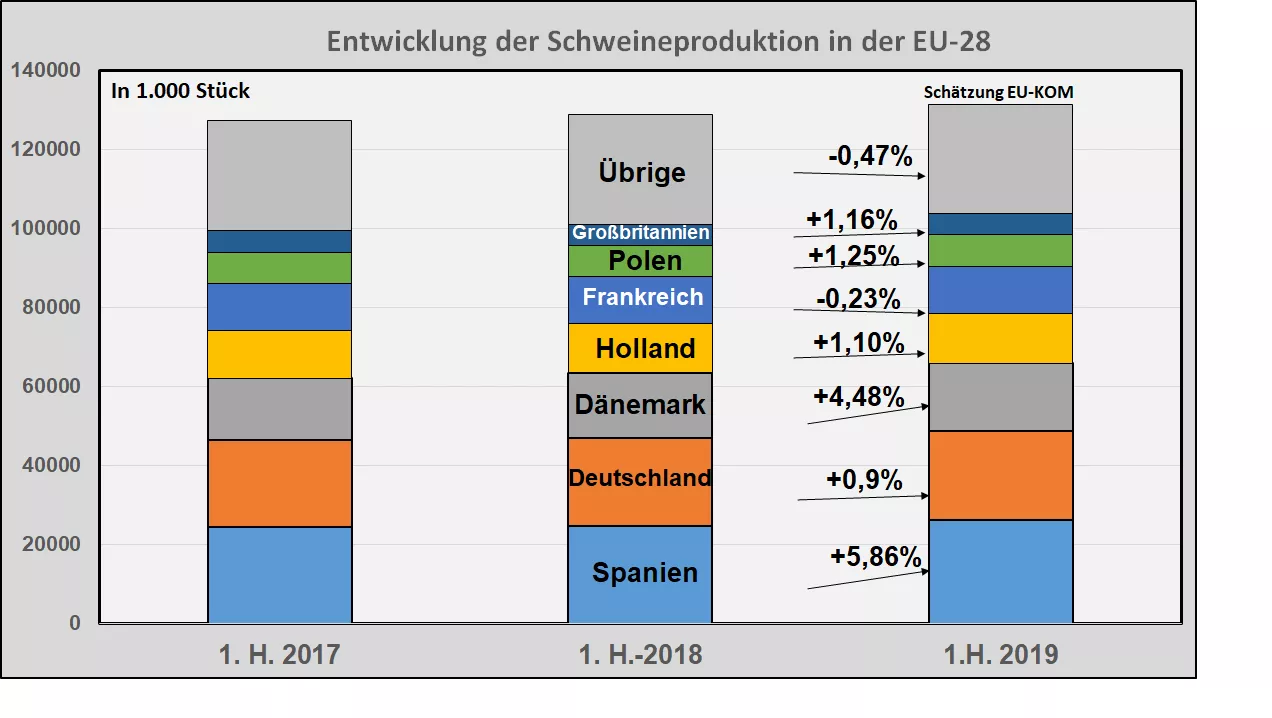

1st half of 2019: + 0.7 to + 2.7% more pigs Spain and Denmark are moving forward

The results of the EU livestock census results for pigs give different results: the EU-COM calculated an increase in EU pig production in the first half of 2019 of approx. 2.7% compared to the same period last year. The panel of experts in the EU is only growing by 0.7%. Different interpretations of the data base lead to the different assessments.

Although the results differ in magnitude, it can be seen that the trend in pig production in 2019 is still upward throughout the EUshows.

Different directions of development emerge for the individual member states. Spain continues its long-established path of production growth. The increases are estimated at over 5% for the first half of 2019 .

Denmark's pig industry has picked up again after years of stagnation. As in the last two years, the production increase will continue. The forecasts vary between 3 to 4.5%.

Estimates for Germany range from -1.7 to almost +1%. In any case, the lower numbers of piglets will lead to a decline in significantly decreasing numbers of sows.But piglet imports will replenish part of their own production. In addition, piglet prices in Germany must be more attractive than in the competing import areas with a focus on Poland.

For France , a decline is expected in any case. Piglet production and fattening pig production have been on the decline for some time in the main production region of Brittany .

Seit dem EU-Beitritt im Jahre 2004 ist die Schweinehaltung in Polen fast halbiert worden. In den letzten beiden Jahren ist jedoch ein Wiederanstieg zu erkennen. Dabei stammen die Ferkel zu rd. 40 % aus Dänemark. Der östliche Teil des Landes wird durch die Ausbreitung der ASP an einer Produktionssteigerung gehindert.

Für die 20 übrigen kleinen EU-Erzeugungsgebiete setzt sich in der Summe der Erzeugungsrückgang weiter fort.

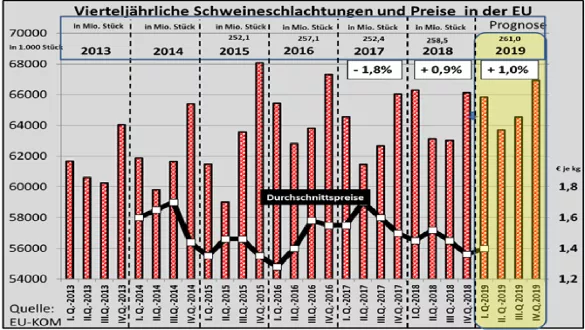

Pig production is currently suffering from persistently high feed costs and modest producer revenues throughout the EU. Economic pressure will contribute to continued structural change, which will vary in different Member States. Especially in Germany , the highly- fledged animal husbandry debate is aggravating.

A big question mark still stands behind the consequences of a Brexit . The UK has only a self-sufficiency level of approx. 50%. The necessary imports come from Ireland, Denmark, Holland, France and Germany . Where do the flow of goods flow, if in the case of a hard Brexit import tariffs complicate the GB trade to a large extent?