GDT auction: 2 strong declines in a row

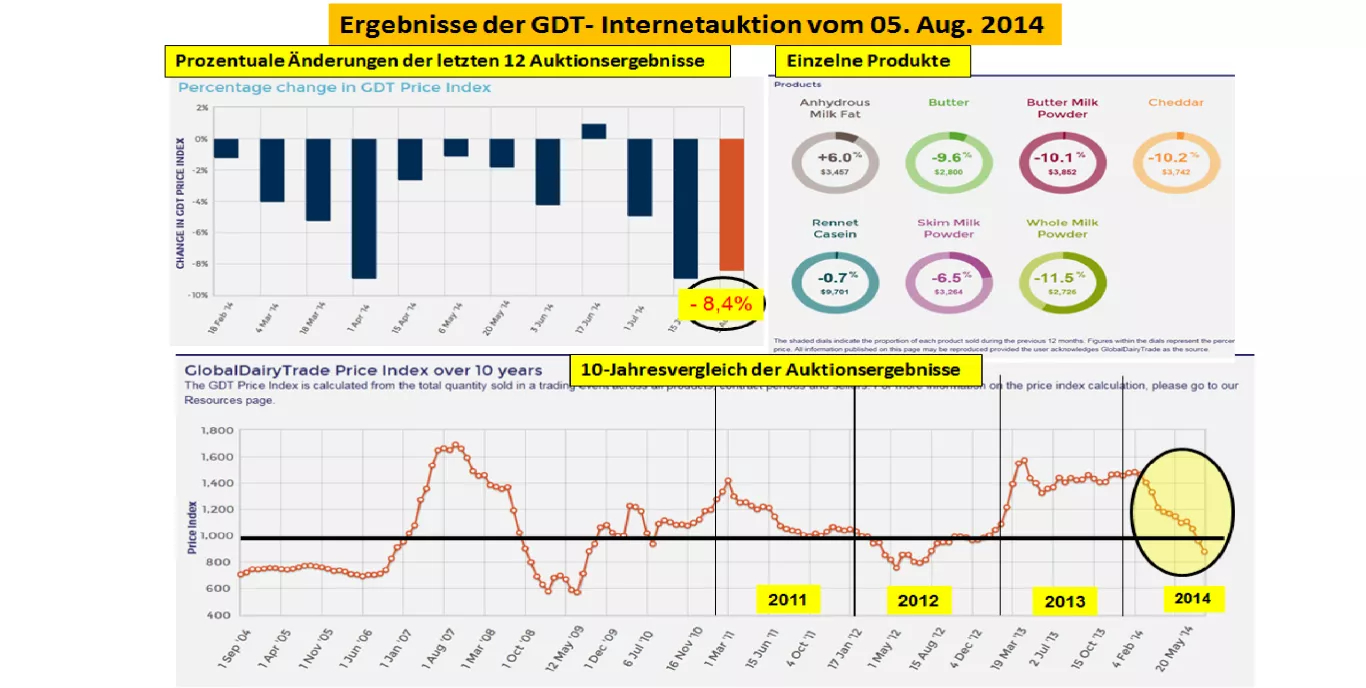

After 9% 14 days ago now again - 8.6% price reduction in the last two auction dates for dairy products the global dairy trade a stricter milk price adjustment down represents. Significantly below the long-term average. The current courses are halfway to the catastrophic figures for the year 2009 at times of the global financial crisis.

Is the major cause of this price decline in the + 33% acquisition supply to look for. The demand is clearly flattened after the strong import activities of the Chinese in the first half with unusual increases of 40 to 60%.

The biggest price drop experienced with whole milk powder - 11.5% due to an increase in supply of + 48% at the previous auction. -23.5% price reduction the September 14 deadline was particularly weak. But in the Feb 15-date with discount-10%, also the rear courses indicate that the milk market into a new period of lower prices has occurred.

Skimmed-milk powder recorded only a decline of - 6.5%. The increase in the supply of AMUL, ARLA, dairy America and FONTERRA suppliers fell with + 23% off something more moderate. The Feb. 15-courses, which indicate a certain recovery provide a some glimmer of hope. However, the traded quantities were very small.

The normal butter sales reached above-average price discounts with - 9.6%. Also in this case the range increase is likely by + 22% made a significant contribution to this result. For the individual delivery months between Oct. 14 and Jan. 15 were paid between 7.5 to 13.1%.

However, butterfat is presented with an Auktionsplus of 6% from the better side. The explanation is simple: a falling to-12% range. The front dates-including Dec. 14 were especially in demand. The Jan. - and Feb-15 price clearly fell off.

Weak noted also the Cheddar cheese with a range increase of 46% compared to the prior Auction - 10.2%.

The in New Zealand started milk year will achieve its peak in Oct 14, if the cows have Calved off and reach the highest milk yield. Crucial will be the grass growth on pastures, where the weather phenomenon EL Nino plays a wayward role.

High increases of milk production are in the EU-28 registered. Sales declines force towards Russia to other distribution channels. Algeria and the Middle East are large consumers in the field of milk powder. Butter sales is, however, much more difficult.

The milk production in the United States always suffers the after-effects of drought especially in the focus area California and several southern States.

Milk prices in the second half of 2014 will be significantly lower than in the first half. The price reactions were relatively low on the Chicago Stock Exchange. Alone MMP showed course corrections after strong declines in the previous days upwards.