Russia and Ukraine will export 2014/15 fewer crops.

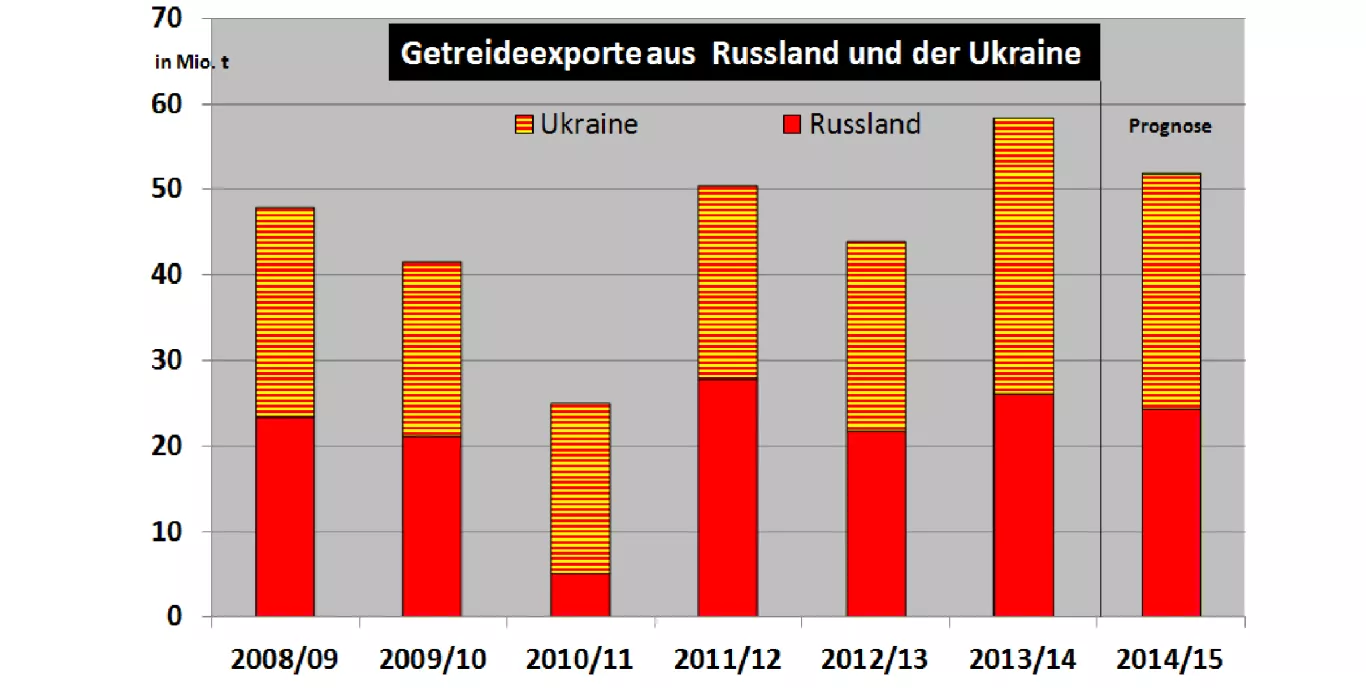

To the change of the marketing year, the agricultural ministries in Russia and the Ukraine have drawn a preliminary balance sheet of their export activities of the year 2013/14. Both countries together have achieved the highest mark with approximately 58 million tonnes.

Due to the continental climate with cold winters and hot summers, both regions are subject to weather fluctuations in harvest that reflected in strongly varying quantities of exported automatically. In previous years, a restrictive export policy was among others operated until to the export ban when the harvest amounts to cover the power supply no longer threatened. However, it met little approval importers, which rely on greater reliability and regularity.

In the meantime, a State-controlled storage policy is operated in both countries. The State buys goods in good harvests to a considerable extent or obliges private fee to warehousing. The stocks if weak crops are dissolved in the Gegenzuge. In this way, ensuring an orderly and reliable delivery of importing countries.

In the year 2013/14, Ukraine managed to get the highest amount of 32 million tonnes from abroad, Russia came only on average 26 million tonnes. In the case of Russia is more than 80% to wheat exports. In the Ukraine, it has shown a significant shift in recent years. The wheat share has dropped to one-third, while maize exports to 20 million tonnes are grown. This is reflected also the cultivation conditions, corn and have evolved to the more competitive.

For the marketing year 2014/15, both countries expect a significant reduction of exports due to lower classified harvest volume. Russia starts from just under 24 million tonnes of total exports and 6%, respectively. Ukraine estimates a decline of 14% and an export amount of 27.5 million tonnes. In both countries, but uncertainties prevail on the actual crop output and thus the potential of export. Last but not least, there are political and financial problems that make the projections in question.

The export activities of Russia and the Ukraine concern EU exports to a significant extent. Although the Black Sea countries have lower transport costs to the large import areas on the Mediterranean coast of Africa, but the EU can come up with better grades, higher delivery reliability and continuous exports throughout the year. In the winter, Russia and the Ukraine regularly have availability problems from the hinterland to the ports. The focus of Black Sea exports is therefore in the post-harvest period until Nov./Dec. a year. followed by about month exchange a more or less intensive winter break, back full speed is taken after the first in March.