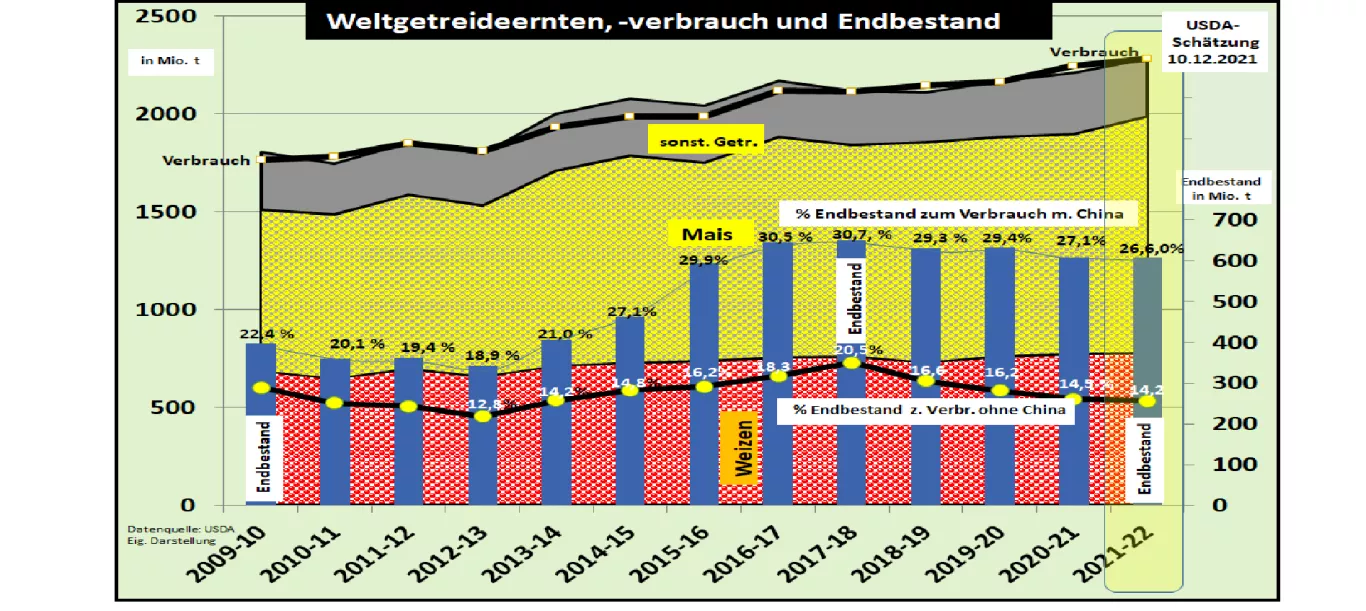

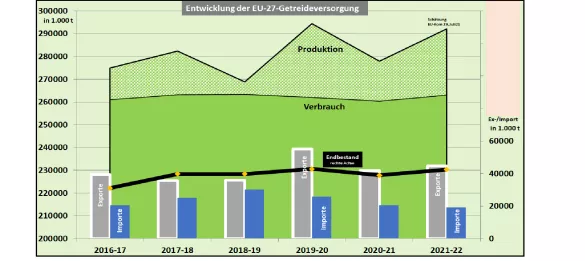

Grain market at the turn of the year 2021-22 Current grain prices between 20 to 30 € / dt are the result of a scarce supply situation. The bottleneck exists on a world level and affects local market and price developments through exports and imports. Beyond the supply-demand ratios, the increased transport costs are driving prices up. Fears of importing countries about security of supply lead to increased imports and increase inflation. World grain production has increased in 2021/22, but consumption is growing even faster. As in previous years, the inventories are being reduced significantly. The reserves are becoming scarcer. On the supply side , Russia, Canada, the USA and Australia are of crucial importance this year. As the world's largest wheat exporter, Russia initially restricted its exports for production reasons and will cut deliveries massively from February 2022. Canada's harvest has fallen by approx.35% smaller; the export volumes shrink by around 50%. The US grain quantities are below average; therefore the export of wheat and maize is decreasing. Australia's bumper crop can only partially offset the shortfalls in the other areas. On the demand side , the countries with high import needs have increased their imports. With its increasing purchasing volumes, China is becoming the most influential factor. China's EU-27 grain export share rises to 15%; in the case of wheat it is 40%. Chinese traders have even ordered wheat in Germany. The EU grain harvest in 2021 delivered an above-average result. A slight increase in consumption leaves a lot of scope for exports. The low euro exchange rate favors the export price and provides a competitive advantage. Little is left to build up supplies. The German grain harvest has once again been below average and is now only slightly above consumption.However, bread wheat is exported and feed corn is imported. Follow-up purchases of the mills are expected in the coming months. The prospects for 2022 are shaped by low stocks, below-average harvest expectations and persistently high demand. Grain production is unlikely to reach a high level because the global scarcity of fertilizers and high fertilizer prices will contribute to lower area yields. However, the unpredictable weather development is still causing uncertainty in both directions. The stock exchange prices show a persistently high price level of around € 280-290 / t wheat for the first half of 2022. For the delivery months in and after the 2022 harvest , the rates only fall moderately to the order of 250 € / t.