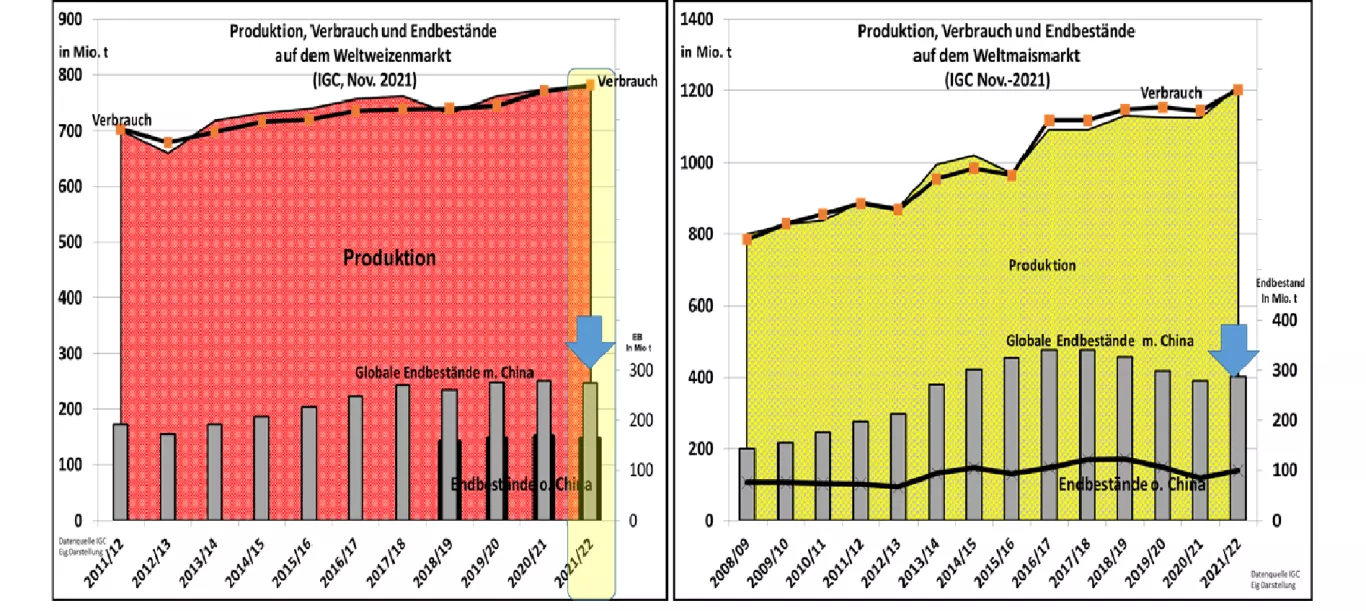

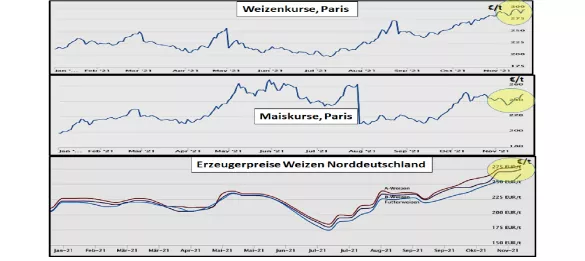

Nov. 2021: IGC corrects world grain supply slightly downwards in 2021/22 In its November 2021 edition, the International Grain Council (IGC) estimates the global grain harvest to be 2,287 million t or 3 million t lower than in the previous month. Compared to the previous year, the result is + 3.4% higher. Consumption is estimated to be slightly lower than in the previous month to 2,290 million t . This means that the overhang stocks remain at 600 million t . The global supply figure increases again to 26.2% final inventory for consumption. In the previous years the number ranged from 28 to 27%. The supplies last for around 95 days, 3 years ago it was 105 days. If one examines the market situation without China, one comes to a supply figure of 15.4% final stock for consumption compared to the previous years with 16 to 18%. The supplies last unchanged for 56 days. The global wheat harvest remains at 777 milliont still at record levels. Compared to the previous year, however, the increase is only +0.5%. Consumption is estimated to have changed little compared to the previous month at 781.5 million t (previous year 770 million t) . The inventories are reduced to 274 million t, as is the supply figure with 35% final inventory for consumption (previous year 36%). However, there are considerable differences in the individual production areas. In Canada , wheat production is around approx . -35% liked it. Russia harvests around -12% less than in the previous year. In the USA , the result is around -10% worse. In contrast, the high harvests in the Ukraine with + 28% and the EU with around + 10% were confirmed. Australia has a bumper crop for the second year in a row.On average, increases and decreases partially offset each other, but the failures in important exporting countries as well as in transport lead to scarce availability and supply fears for the importing countries. The IGC estimates the global corn harvest at 1,212 million t or +7.6 % higher than in the previous year. The corn harvest in the USA as the world's largest producer and exporter is estimated at 383 million tons. In the Ukraine , an increase in harvests and exports of around + 28% is predicted. In China , too, earnings are expected to be 4.6% higher. Chinese imports are expected to halve. In contrast, the Brazilian corn harvest fell by around 16% and exports by 37% last year. Global corn consumption is expected to increase by around 5% year-on-year to 1,203 million t. Increasing consumption in China is particularly contributing to this. Global inventories are in the course of the maize marketing year 2021/22 by approx. 3% to 287 milliont (previous year: 278 million t). The number of supplies increases slightly to around 23.9% final inventory for consumption. 4 years ago, the excess stocks were up to 30% based on consumption. Global supplies last for 86 days (34 days without China; 44 days ago 2 years ago). Overall , it can be stated that the supply situation is still lagging behind that of previous years. The increased generation is largely offset by increased consumption. The supply situation in the corn sector is not so tight. In contrast, bread wheat is scarce worldwide. This leads to rising wheat prices, which rub off on other types of grain. Additional price increases come from the high freight rates. The Paris prices are aiming for the 300 € / t mark. The corn courses follow suit at the level already reached.