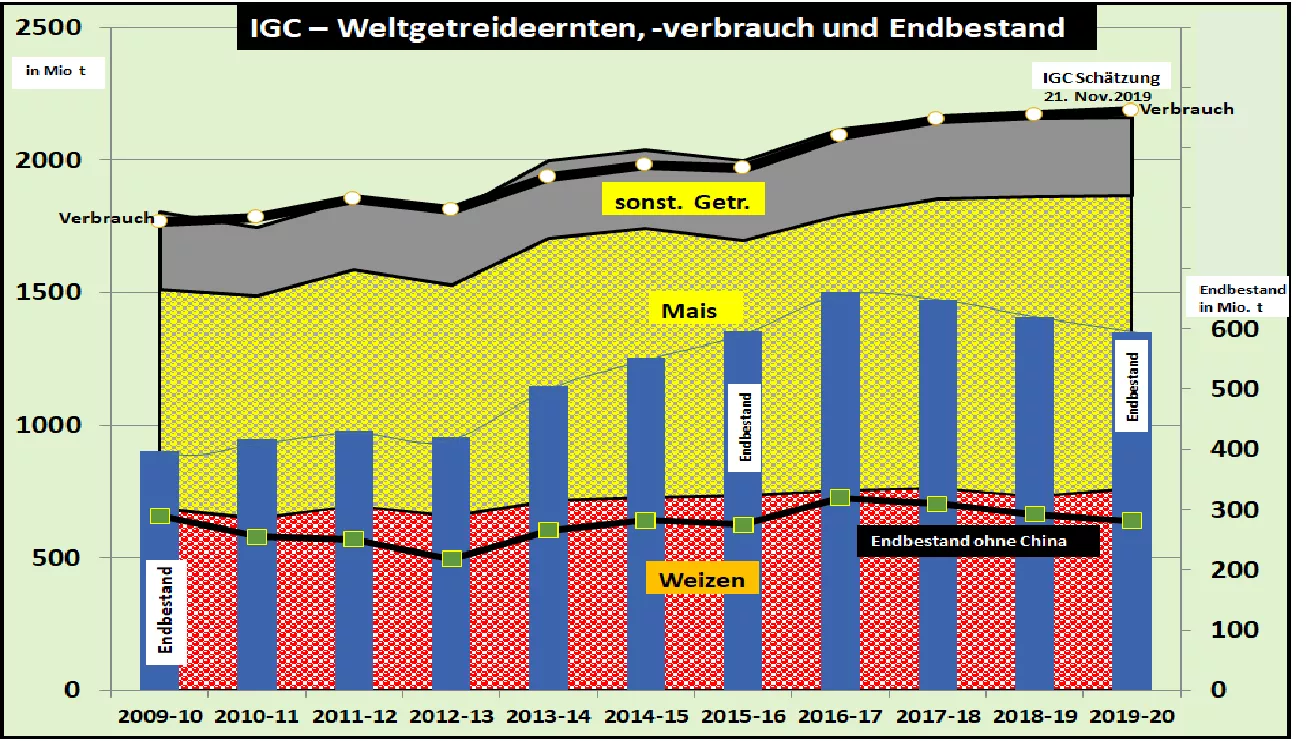

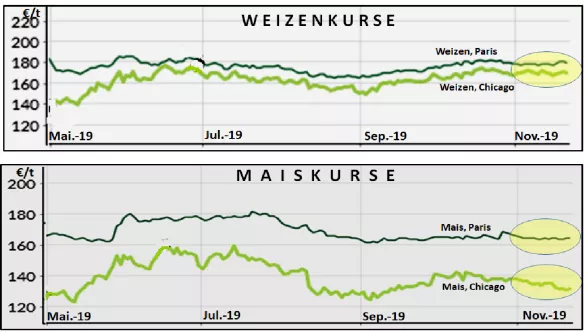

IGC estimates global grain supply almost unchanged - wheat prices are picking up - corn more stable In its Nov. issue, the International Grains Council corrects the world grain supply for 2019/20 only in a few points compared to the previous month's estimate. The world harvest is rated at 2,162 million t. Consumption is estimated at 2,188 million t. The surplus stocks fall from 620 million tonnes last year to 594 million tonnes; the supply rate drops from 28.5% to 27.1% final consumption, in each case in comparison with the previous year. The global wheat market is estimated to have changed marginally to 762 million production and 756 million consumption. The final stocks rise from 265 last year to 271 million t. However, if China is left out of consideration for its lack of participation in world trade, the supply situation in the wheat sector remains unchanged compared to the previous year for the rest of the world. The range of supplies is 81 days.The worldwide corn crop should amount to 1,103 million t. The slight improvement resulted from the increase in the US crop from 341 tonnes to 345 million tonnes the previous month. Meat consumption is estimated to be slightly higher at 1,142 million tonnes, essentially an increase in industrial consumption . The final stocks fall worldwide by 30 million tonnes to 279 million tonnes. The supply number o. China falls from 14% to 11% final inventory for consumption. The range of supplies shrinks from 47 to 40 days. Given the still-to-be-left outcome of the difficult US crop, there are still some risks in this year's corn supply. The recent estimates of world grain supply show decreasing corrections to its predecessors. There is agreement that the global supply situation in 2019/20 is significantly smaller than in the two previous years. The wheat market is better off than the still critical corn market .Rising wheat prices have recently been observed on the leading stock exchanges . In Paris, the 180 € / t line serves as a guide for wheat, while in Chicago the 170 € / t line sets the direction. The hitherto weak corn prices in the USA indicate strengthening tendencies . For the assessment of the local market and price development, the export of grain from the Black Sea countries Russia, Ukraine and Kazakhstan plays an important role. All three countries together are expected to export 106 million tonnes of grain (previous year: 104 million tonnes) . At 53 million tonnes, Ukraine will still be ahead of Russia with 45 million tonnes, while Kazakhstan will only reach 8 million tonnes. By comparison, US exports will drop to 77 million tonnes (previous year: 85 million tonnes). EU deliveries to third countries are estimated at approx. 40 million tonnes (previous year 35 million tonnes).Especially in the case of the EU and the Black Sea countries , it is about the competition of the common markets on the North African Mediterranean coast and the Middle East . So far Russia has been at the top with cheap offers. Experience shows that the approaching winter period leads to transport-related subsequent delivery problems. In conjunction with a moderate euro exchange rate, the EU could gain export significance.