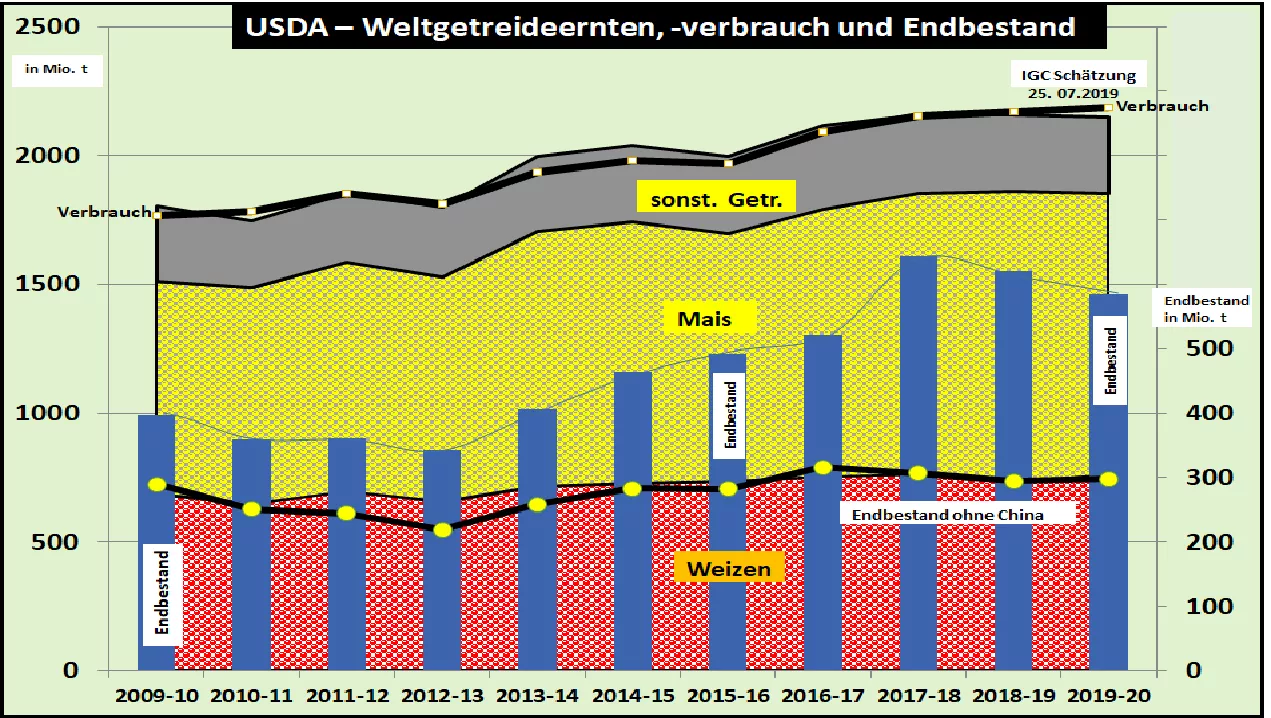

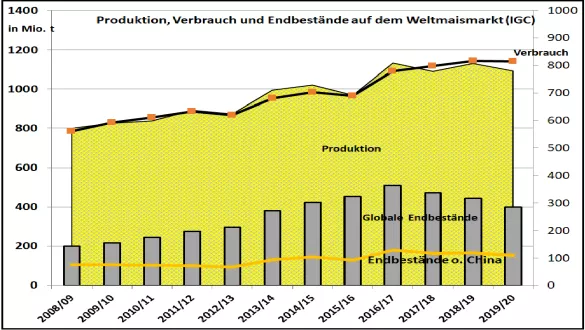

IGC: World crop harvest 2019/20 by 36 million t smaller than consumption - narrower supply situation The International Grains Council (IGC) estimates the World Grain Harvest 2019/20 in its latest issue of July only 8 million t lower than in June . 2,148 million t . Compared to the previous year's harvest of 2,142 million tonnes , this year's result should only be slightly higher. Global grain consumption is estimated to be 19 million tonnes higher at 2,184 million tonnes than in the previous year. The higher consumption this year compared to the current harvest leads to a reduction in inventories from 621 last year to 585 million t. From this the price-determining supply ratio of 26.8% final stock can be calculated for consumption. The ratio was 28.7% in the previous year. In the peak year of 2016/17, the figure was 30.8% . Thus, it can be assumed that this year's global grain supply will be considerably smaller.Should there be any further unforeseeable crop failures, the stock levels available for clearing will become smaller and smaller. The consequence is a higher average grain level compared to the previous years. The supply decline in the corn sector is particularly pronounced. An estimated maize harvest of 1092 million tonnes, which is 38 million tonnes lower, is offset by an insignificant decline in consumption of 1,141 million tonnes. Inventories accordingly fall from 322 to 273 million tonnes. The final stock is only 23.9% of consumption ; in 2016/17, the number of pensions was 33.24%. In view of the outstanding risks associated with grain formation and maize harvesting, the corn market will be particularly exciting this year. In any case, the global corn sector will set the tone in this year's grain price formation. The supply situation in the wheat sector is above average.A harvest of 763 million tonnes is offset by consumption of 755 million tonnes. This results in an increase in inventories to 270 million tonnes or 35% in terms of consumption. If corn prices move closer to wheat prices, more wheat is expected to land in the feed trough than previously thought. Thus, rising corn prices will pull up the wheat price. As a rule, the IGC estimate receives little attention on the stock markets compared to the USDA estimate. With the new numbers, however, the provisional US past estimate may continue to take a back seat. The next USDA market report will be published in the 2. August week with hopefully more reliable results published.