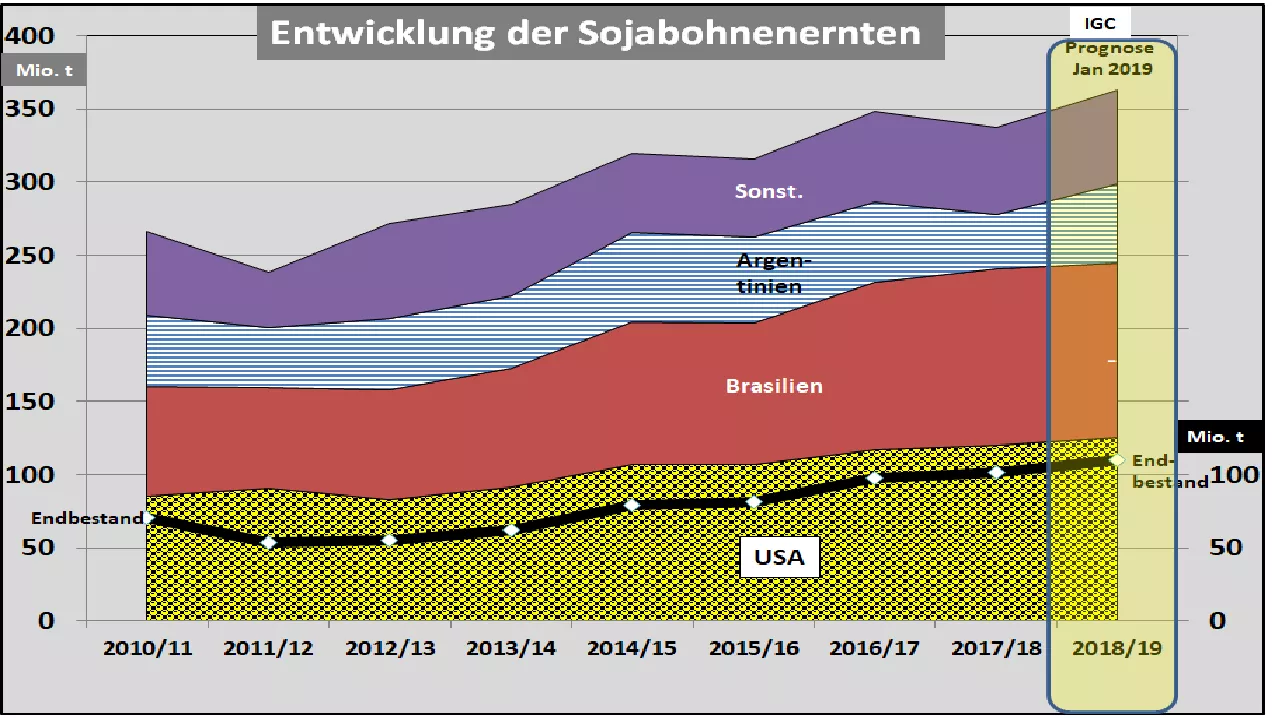

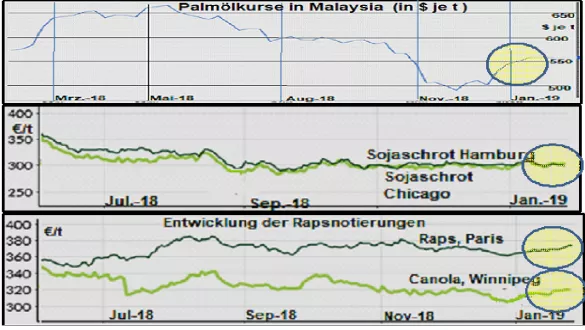

Oilseeds market: soybean production slows - palm oil prices are rising The International Grains Council (IGC) has revised its soya supply downwards slightly in 2018/19 compared to the previous month's estimate. The world harvest is estimated at 363 million t by approx. 5 million t down. Global consumption is estimated at a slightly reduced 353 million tonnes . At the end of the financial year, a stock of 54 million tonnes remains, indicating an above-average supply situation for the current financial year . The crops in the southern hemisphere already counting for the coming 2019/20 marketing year are no longer estimated at record levels. As a result of drought damage, Brazil's current harvests are only 116 million tonnes (previously 121 million tonnes), in Argentina 54 tonnes instead of 56 million tonnes and in Paraquay 9.7 million instead of 10.1 million tonnes.However, the decline is largely offset by the high overhang stocks. The US is increasingly hearing voices suggesting a smaller soybean acreage in 2019. The reason for this is the unfavorable soybean / corn price ratio, which is currently only 2.4 to 1. Only from a ratio of 2.5 to 1 on average over the years does the soybean prove to be the more profitable fruit. The final decisions of the US farmers will fall in the next few months. The weather conditions for sowing in April / May 2019 still play a decisive role. The advantage of soybean: the sowing window is longer than in corn The US-Chinese negotiations on the future trade relations between the two countries have not yet led to any foreseeable result. By the end of March 2019, however, "solutions" should be found.China has an advantage in terms of soybean trade, as the new Brazilian harvest has begun early and will provide adequate supply to the US in the foreseeable future, with high expectations for the US. Soybean prices have not changed significantly at major stock exchanges. However, the soybeans have taken a small boost in the US, but still shows some instabilities After the descent in Nov./Dec. In 2018, as a result of the seasonal peak of the harvest, palm oil prices recovered, but without reaching the previous level. The slowdown in production and the rapid reduction in inventories from 3.2 to 2.5 million tonnes pushed prices up again. The prospects of increased blending proportions of biodiesel developed a supportive effect in the wake of stable to rising prices of the two market leaders soy and palm oil, the rape prices have gained some value.In Paris , prices rose to 375 € / t , in Winnipeg , the mark was reached by 320 € / t . However, there is little movement for the other dates in the coming months. The 25% reduction in rapeseed acreage in Germany leads one to expect a continued shortage of rape in the coming year. It remains unclear how high the Auswinterungsschäden will be and how high the area yields will be. On the other hand, rapeseed cultivation in Ukraine is expected to increase by approx. 22% have been extended. Ukrainian oilseed rape is mostly exported to the EU. Overall, a firmer trend can be observed in the oilseeds market .