Who determines the soy meal prices for Europe?

The current situation on the soybean meal market is characterized by a very tight supply situation in the United States, record crops in South America, demand-hungry Chinese and Europeans almost must.

In the United States feared after total sale of own harvest from the autumn of 2013, there will be difficulties, even with the support of unsecured rhyme ports from South America to have no safe needs up to new harvest in September. Gets or sets the speculators on the plan to hoard the few remaining goods. On the exchanges, the cash transaction is reflected in excessive form, contributes again but on the other hand, to draw attention to the existing deficit and more economical approach, use of alternatives such as DDGS and increased imports in time to defuse the problem.

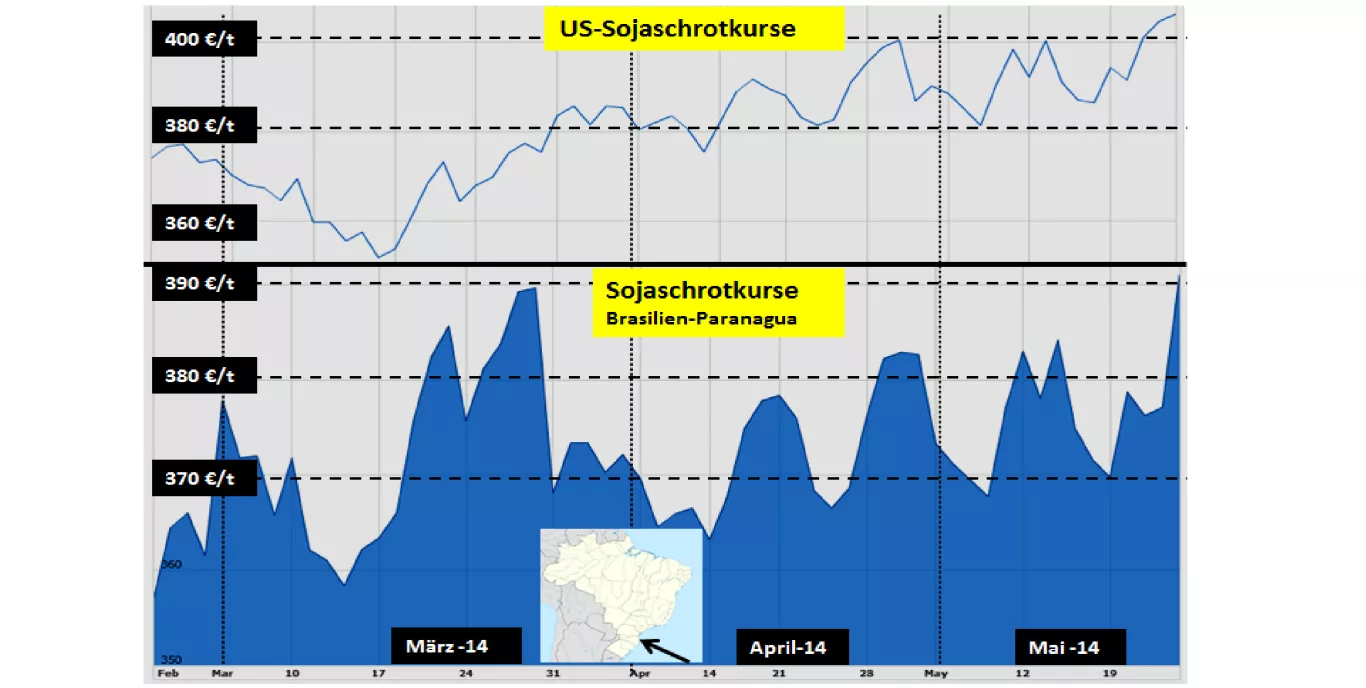

While the soy meal courses at the CME took a significant upward trend since mid-March a to next stable and slightly increasing in recent times course development for soybean meal is to watch for the Brazilian port of Paranagua - a main hub. The brasiliansichen courses can not fully escape the pull of Chicago quotes.

Comparing to the Hamburg stock exchange prices for soybean meal, a nearly parallel development to the Brazilian should be noted, that has to do with the Chicago listing... The explanation is that soybean meal are worried after the southern crops on a larger scale from South American ports.

However, Chicago quotes have a sufficient impact have to ship soybean meal there, where the higher price paid is therefore increase the prices on all parties of the market at a certain distance, if you want to sit not on dry land.

This game is so long dominated by Chicago as the tight U.S. supply situation continues. With progressive development should the attention to the South American transshipment points to focus however. Get the height of the processing and export figures and particularly the selling restraint in Argentina increasingly to the fore. You can say mid/late August something about the outcome of the new U.S. soybean crop. At the latest is to be expected with a basic orientation of new price. Until then, change the supply situation with Spa slut blows on the exchanges will be accompanied.

The game is known from the previous year. But one should be wary, to incorporate the experience without critical questioning. The situation of 2014/15 is no longer the same as in the previous year with an expected 2 bumper harvest in a row. The expectations for the remainder are aligned on a high until ample supply. Then change the prices. The question is not if, but when.