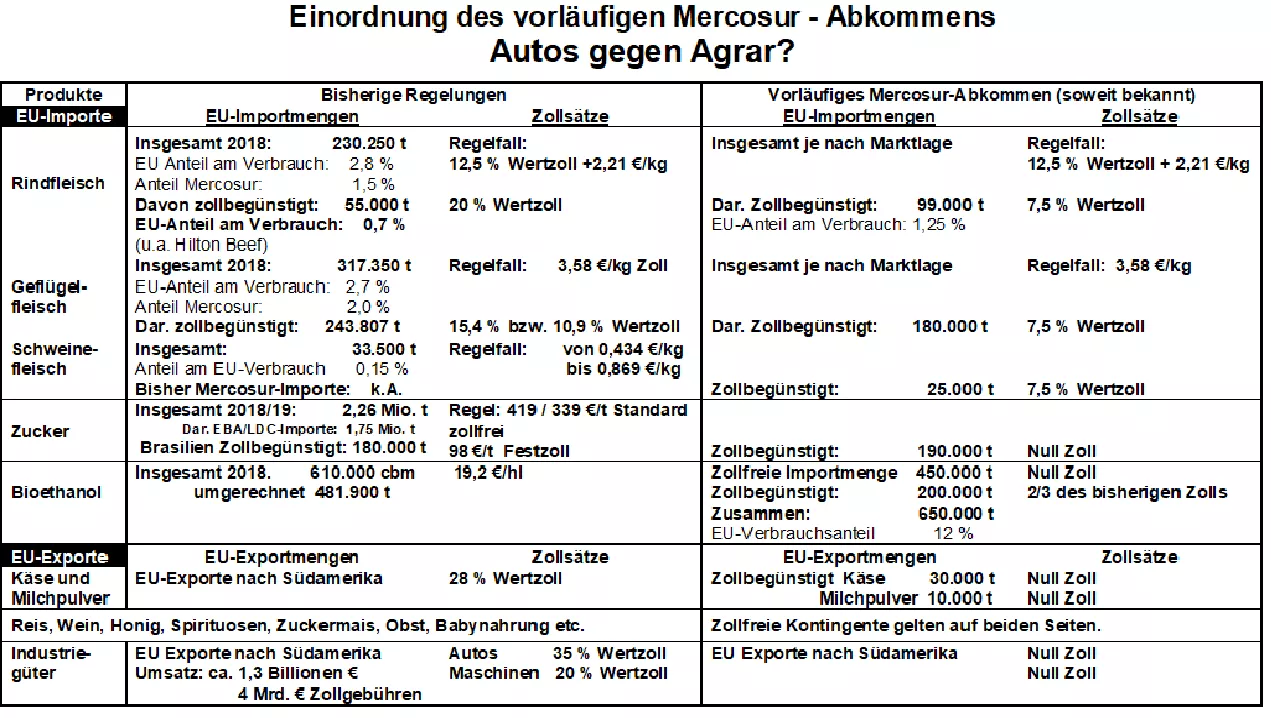

Preliminary Mercosur agreement - cars against agriculture - advantages and disadvantages - excessive criticism After 20 years of negotiation, a preliminary paper of a free trade agreement with massive tariff reductions of the EU with the Mercosur countries Brazil, Argentina, Uruquay and Paraguay was submitted for ratification , The object of the "Mercosur" contract is a largely duty-free or customs-friendly exchange of goods between the contractual partners with approx. 250 million people on the Mercosur side and around 500 million consumers in the EU. The South Americans want to reduce 91% of their import tariffs to zero over a period of up to 10 years. In return, the European Union wants to reset 92% of its import duties to zero. On the side of the Europeans, this should benefit industry in particular. The Mercosur countries have so far imposed 35% on EU car imports and up to 20% on EU machinery imports. The future tariff will be reduced to zero. All in all, European exporters are to save around four billion euros in customs duties each year.Exemptions for EU agriculture However, restrictions are made in the sensitive area of agricultural goods. These are mainly EU imports of beef, pork, poultry, sugar, rice, bioethanol and honey, sweetcorn, fruit spirits, baby food and 350 other individual products from the Customs Catalog; Milk powder, cheese, wine and others are on the EU export list. The transitional period ranges from 6 to 15 years. In the main, tariff reduced import quotas should apply to EU agricultural imports: 99,000 tonnes of beef, 180,000 tonnes of poultry meat, 25,000 pigmeat, 180,000 tonnes of sugar and 650,000 tonnes of bioethanol. The implementation should take place in these cases for 6 consecutive years. Customs should be reset to 7.5% for these subsets. For both sides, 30,000 t of cheese and 10,000 t of milk powder are granted duty-free. Previous tariff quotas Customs beneficiaries The EU has known agricultural import quotas for decades. In the case of beef, Mercosur countries such as Argentina (30,000 t), Brazil (11,000 t), Uruquay (7,000 t) and Paraquay (3,000 t) together have 55.000 t Customs-based delivery right to the EU with only 20% ad valorem duty. It is high quality beef, so-called Hilton beef. However, the Mercosur states have averaged approx. 230,250 tonnes (= 70% of EU imports). The non-tariff quantities are increased by 12.8% ad valorem duty to the import value plus 2.21 € / kg. Example calculation: With a purchase price of 3.50 € / kg + 0.45 € / kg value inch +2.21 € / kg, a minimum import price of 6,41 € / kg is calculated. Within the existing import quota, only 20% duty will be added to the import value, ie € 4.20 / kg minimum import price. This leaves only high-quality cuts of beef in the EU competitive. In the future, only 7.5% ad valorem duty will be charged on 99,000 tonnes of beef (= 25% of EU imports), compared to only EU-27% of EU beef consumption. What will happen: In the case of a largely unchanged total EU import, highly tariffed quantities will be exchanged for the new customs-approved quantities. The EU imports around 33.500 tonnes of pork, which comes to more than 60% from Switzerland and the rest from neighboring EU countries. In terms of total production, this is 0.15%. The general duty is 0,869 € / kg or in the preferential case 0,434 € / kg slaughter weight. The 25,000 tonnes of pork imports foreseen in the "Mercosur" agreement can hardly be classified as market and price disturbing, accounting for 0.1% of EU consumption. Brazil: Declining exports of poultry meat to the EU Brazil's poultry meat shipments fell from 0.5 million tonnes in 2015 to 0.31 million tonnes in 2018. The import share has dropped from 57% to 37%. Argentina achieves just under 1% of the 7,350 t of small EU imports. At a preferential duty rate of 15.4%, Brazil is now allowed to deliver salted chicken meat up to a quota of 170.807 tonnes. Add to that boiled chicken at 73,000 tonnes with a reduced duty of 10.9%. For additional deliveries the general duty of 3,58 € / kg applies. In the "Mercosur" agreement, a quota of 180.000 tonnes of poultry but at a significantly reduced tariff of 7.5%. Measured by chicken meat production in the EU, the proportion is 1.5%. On Mercosurseite it is only 1.2%. In this case too, if the overall import tends to decline, an exchange of quantities between the different customs categories will take place. Excessive criticism The tariff-favorable quantities mentioned in the "Mercosur" agreement have neither a quantifiable additional impact on the rain forest problem nor "flood" the EU market. In view of the ASP-related shortage in China, approx. 15 million tons of meat will be swept away the global meat market anyway and settle a higher international price level. But this also applies: Import options at a duty rate of 7.5% can be in market-critical times to tip the scales and trigger additional price pressure.