FONTERRA is contrary to a pessimistic assessment of the milk market 2014

The average auction prices of the global dairy trade are fallen 25 per cent since the beginning of the year. It is believed that waning demand from China was responsible. Rabobank in this context refers China's own rising generation.

In contrast, in a study, the New Zealand dairy company FONTERRA holds that China 2014 may have had an uncertain 5% increase in production in the first three months. The consumption is increasing but much more. A demand deficit is estimated by 10 billion litres.

In the last 6 months, China its milk product imports has increased to 2 million tons, representing approximately 16% of the world import volume. When comparing year Feb 2013 Feb 2014. import growth is calculated by 39%.

The second largest importing country of dairy products is Russia. While China imports mainly powdered milk, there are rising cheese imports to Russia. Both countries together provide 27% of world imports of milk products. Also for Russia, FONTERRA sees rising demand numbers, especially after the demolition of Ukrainian cheese exports to Russia.

Fonterra estimates an increase of 3% world export trade. and 14.2 million tonnes.

more milk available is on the supply side. New Zealand itself has a 8.9% increase in the dairy year (may 2014) reached. Australia's about half as large milk production has also increased.

The US dairy industry has only a 1% growth reached. Problems with drought-related food supply in certain areas led to small increases as the USDA estimated at that time has.

The South American countries of Argentina and Uruguay could not meet its growth. Problems with the food supply and funding shortages are the main causes.

Considerable growth rates of milk production in the majority of countries are only in Europe. Overall the EU production in the first three months of the year increased by 2014 to 5.8% should have. Milk prices have eased significantly.

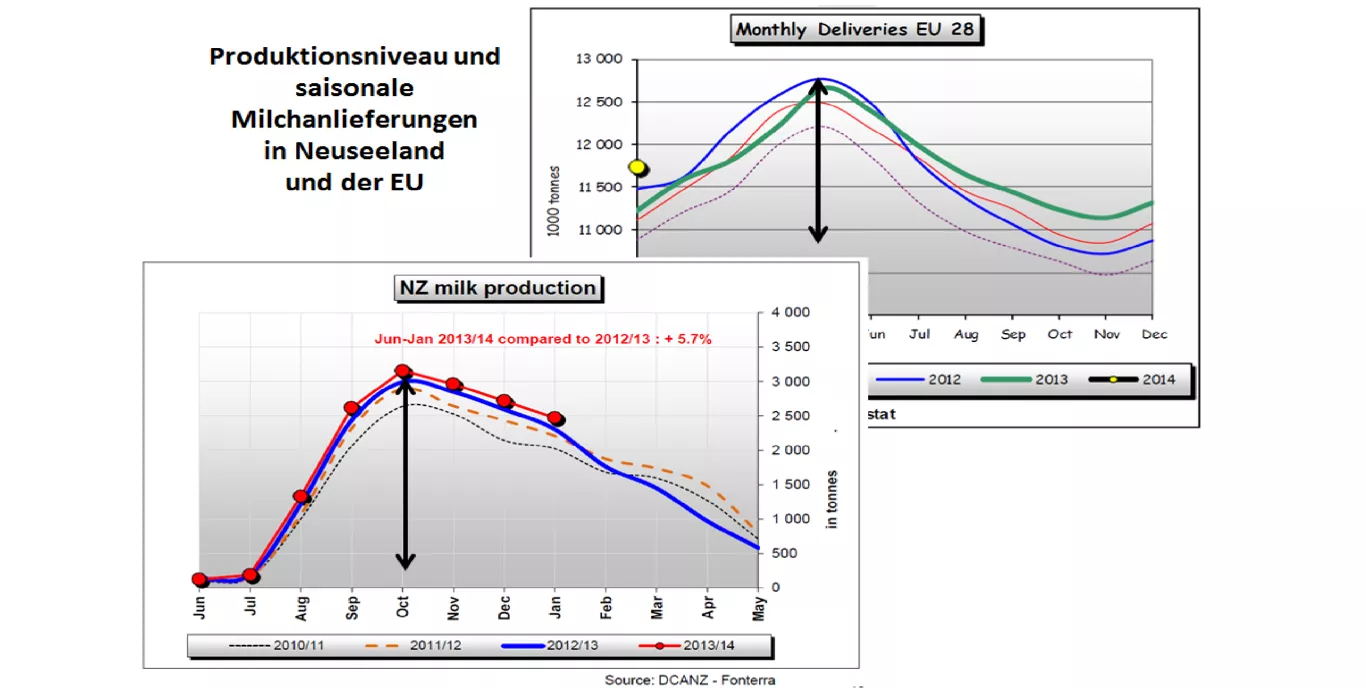

While in New Zealand and Australia, the seasonal low milk production is reached, are the milk delivery for the countries of the northern hemisphere at its seasonal peak. The fluctuations are but here much smaller, both in terms of volume as well as the relations. For example, the difference from the high to the tie is approximately 1 million tonnes or a surge by 8.5% in the EU. In New Zealand, the difference is approximately 2.5 million tonnes or about 1000%. The background is the New Zealand farming without force and winter food economy.