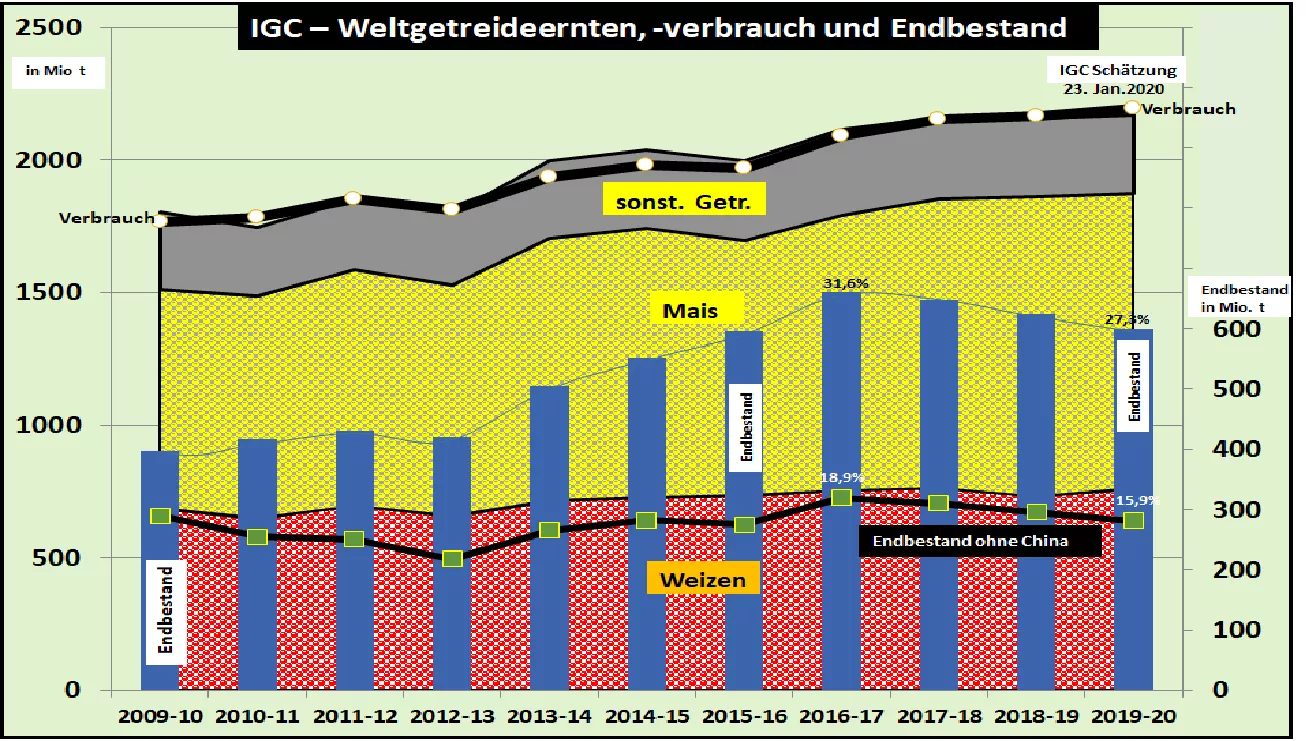

IGC slightly increased its estimate for global cereal supply 2019/20 International Grains Council (IGC) has updated in its monthly market report, the global grain supply. The 2019/20 harvest will be +1.3% higher to approx . Estimated 2,170 million tons compared to the previous year. Consumption is expected to increase by the same amount to 2,194 million t . The comparison of supply and consumption quantities results in a reduced final inventory of 599 million t. This means that a falling supply figure from 31.6% to 27% final inventory for consumption can be calculated. This corresponds to the midfield of previous results. If China is excluded due to insignificant participation in the export business, the supply figures are reduced from 18.9% to 15.9%. The 2019/20 wheat harvest is estimated to be 4.3% higher than in the previous year at 761 million t .Losses in Australia and Kazakhstan are offset by higher harvests in the EU, Russia, China and India . Worldwide consumption is said to be 754 million tons . This results in an increase in the final inventory to 272 million tons , of which approx. 50% on China. But China exports almost nothing. Without China , the final inventory is 144 million t or . 23% of consumption compared to the previous maximum of 25.2%. The global corn harvest 2019/20 falls by -1.6% compared to the previous year to 1,111 million t. The decline is largely due to the 4.6% fall in US production . The IGC estimates global corn consumption at a higher 1,150 million tons. The final inventory drops from 322 million t in the previous year to 283 million. In China alone, 66% of these are overlaid, based on official reports. Measured by corn consumption, the supply figure includesChina declined from 30.3% to 24.6%. That corresponds to a narrow midfield. Without China , the final stocks fall from 14% to 11% of consumption. Recently, reports and assessments of a shrinking supply situation in the second half of the year have been condensed. Several influencing factors contribute to this:

- massive crop and export reductions in Australia

- abrupt limitation of exports to Russia

- increased demand for US wheat

- Export delays in France due to strikes

- Delayed sowing dates for Safrinha maize in Brazil.

- Higher than expected import demand figures from different countries

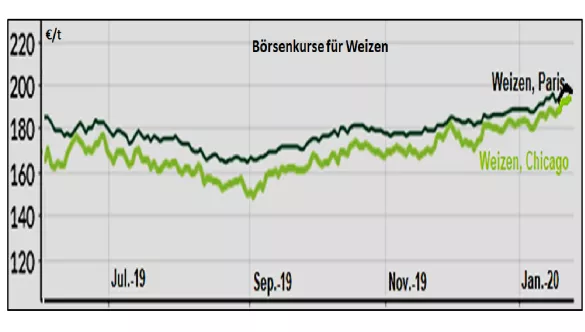

Wheat prices in particular have increased significantly on the international stock exchanges . In Chicago , prices have risen from € 168 / t to € 193 / t since mid-Nov 2019 . In Paris, prices rose from € 177 / t to € 198.50 / t.The magic line of € 200 / t is targeted.