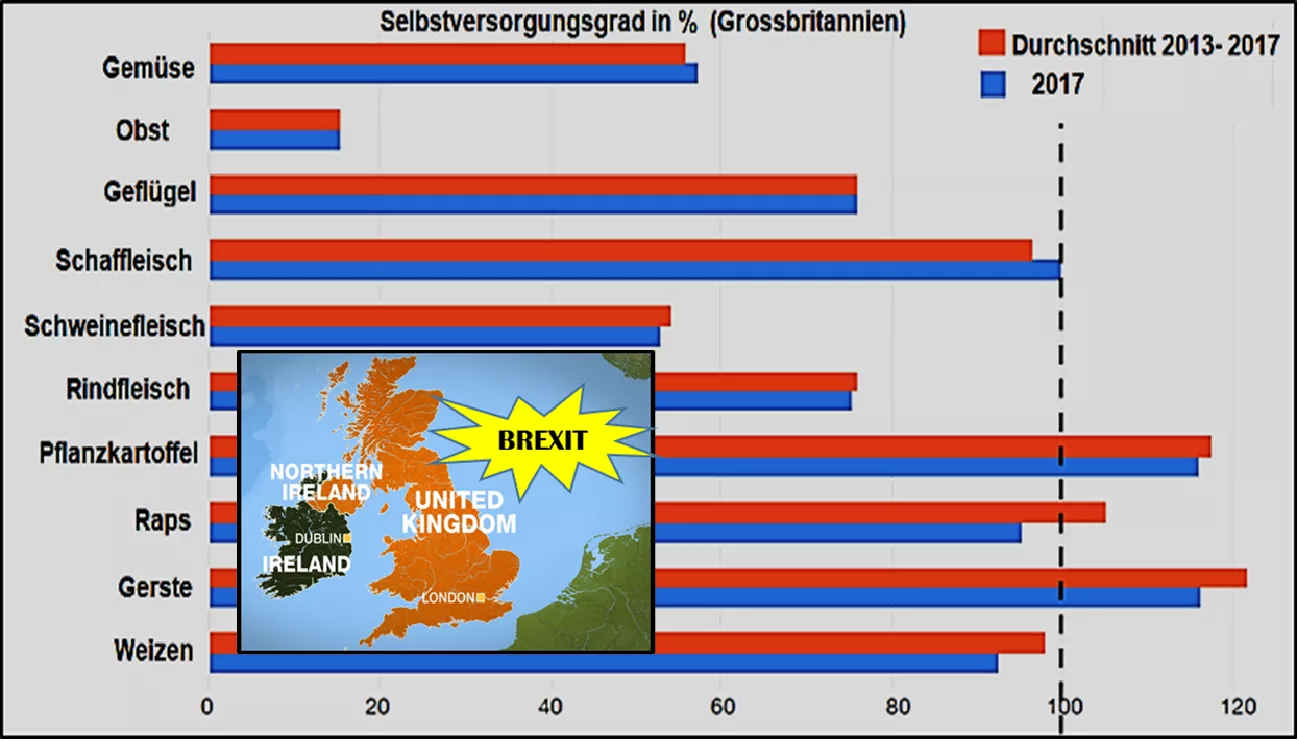

No-deal-Brexit on 31st October 2019 becomes more and more probable - Consequences in the agricultural sector An orderly exit of Great Britain (GB) from the EU becomes increasingly unlikely with the approaching deadline of 31st October 2019. There is no discernible single-minded effort on either side of the Channel to bring about a mutually satisfactory agreement on a regulated separation. What consequences can be expected in the agricultural sector? Great Britain and the other EU Member States are very closely linked in the agricultural sector. Great Britain relies heavily on imports of food . In the case of fruit, self-sufficiency (SVG) is below 20%, vegetable and pork 55%, and beef and poultry meat 75%. There is a net import demand for bread grain and dairy products, and more recently rape. The supply relationships are not only one-sided in GB, but there are also returns to the EU, different depending on the individual product. Permanent GB exports can only be detected with barley and seed potatoes.The main suppliers for GB are Ireland, Denmark, Germany, Netherlands, France and Italy. In the grain sector, there are the fewest problems. The GB barley surpluses of approx. 1 million tonnes are mainly to Spain, while bread-making wheat comes in quantities varying annually by 1 million tonnes, mostly from France via the canal. In the free internal market, goods can be moved so far without customs duties and greater administrative burden. In the case of a no-deal Brexit , new customs regulations are pending. Future UK imports will be subject to World Trade Organization (WTO) duties set to zero in the case of cereals and oilseed rape. The forthcoming UK exports to the rest of the EU will be subject to EU regulatory tariffs , which are around € 95 / t . Depending on the market prices, this is a tariff surcharge between 40 and 50%. GB grain will not be competitive in the EU in the future. GB surplus barley will soon have to be sold outside the EU. The 4 million tons of fruit and approx. 2 milliont vegetable imports of GB's can also be imported in the future without customs under WTO rules. The few exceptions such as bananas and beans have also been subject to tariffs that are the same for the EU as WTO. However, if exceptionally deliveries from the UK to the rest of the EU are intended, EU tariffs of 8.5 to 33% will apply. In the case of animal products , duty-free trade has become much more difficult. The pork supply in the UK plays a prominent role with an SVG of only 55% . From Ireland (350,000 t), Denmark (225,000 t), Germany (150,000 t), the Netherlands (160,000 t) and Belgium, GB currently draws duty-free approx. 950,000 t pork or 90% of all pork imports. In the future, the imports will be subject to WTO tariffs of € 7/100 kg. The tariff surcharge is comparatively low in relation to the future necessary control and administrative expenses. Especially at the import ports one expects long processing times. In return , GB exports pork in the order of rd. 350th000 t, of which approx. 190,000 t less valuable parts of the known kind to China. The rest (including sow meat, the British do not like) is sold to the continent. In the case of no-deal brexit, however, the high EU import duty of € 0.54 / kg will apply in the future. This will make British pork in the rest of the EU no longer competitive.Example:

| Imports of | Customs duties on import into EU | Future WTO tariffs on import in GB |

| Pork carcasses to GB | Import price 1.70 € / kg + fixed duty 0.54 € / kg yields 2.24 € / kg minimum import price | Import price 1,70 € / kg + fixed duty 0,07 € / kg yields 1,77 € / kg minimum import price |

British pig farmers fear that after a temporary uncertain market situationPork prices in the UK have come under pressure, given the significant reduction in foreign trade protection at low world market prices.In the medium term, however , due to rising imports of Chinese, relatively high international pork prices are foreseeable. In the poultry meat sector , GB has a net import requirement of approx. 600,000 t. The duty-free deliveries are subject in the no-deal case in both directions heavily differentiated duties depending on the value of the individual cuts. For fresh / chilled half chickens , customs duties of € 21.6 / 100 kg (= 10% of the market price) are required in the case of UK imports, while for imports into the EU € 35.8 / kg (16% of the market price) is required. are provided. The duty-free poultry meat trade, which was previously duty-free, will in future be exposed to severe disadvantages on both sides. GB imports approx. 270,000 t of beef (= 94% of imports) from EU countries. Of these, Ireland alone supplies 190,000 t or 70%. The Netherlands account for approx. 18,000 t, Germany 11,000 t and 15,000 t from Poland. The previously duty-free GB imports will in future be subject to WTO tariffs.For carcases of cattle, the import duty is subject to a duty of 6.8% plus a fixed duty of € 93/100 kg. Depending on the price, this duty means a price premium of approx. 33%. For cuts such as forequarters or hindquarters, other cuts with and without cooking, the duties are adjusted accordingly. In the case of GB beef deliveries to the EU , the higher EU standard import rates are subject to a duty of 12.8% on the entry price plus € 177/100 kg fixed duty. Depending on the market prices, a customs surcharge of 63% is due. As a rule, such an increase in prices means that the imported goods are not competitive with EU domestic goods. Customs tariff quotas, such as those for South American countries and, most recently, the USA, are not planned.Example:

| Import from | Customs duties on import into EU | In the future, WTO tariffs on imports in GB |

| Beef carcasses | Import price 3,50 € / kg + value customs 0,45 € / kg + fixed duty 1,77 € / kg yields 5,72 € / kg minimum import price | Import price 3,50 € / kg + ad valorem 0,24 € / kg + fixed duty 0,93 € / kg yields 4,67 € / kgMinimum import price |

The UK dairy market is only 85% supplied by domestic production.In 1st Line, the Republic of Ireland is the largest supplier. In the case of fresh milk and cream, the Irish import share is approx. 33% and in the case of cheese 28%. France supplies milk and cheese with shares of 18 and 16%, while Germany contributes 16% to milk and 14% to cheese imports. Holland, Belgium, Denmark and Italy are also involved in supplying GB's with dairy products. On the export side , high milk exports of 61% are striking; These are deliveries from Northern Ireland over the green border to the Republic of Ireland. Back Stop: There is a close link between production, processing and trade between the Republic of Ireland and Northern Ireland. A future customs border raises significant problems for any necessary unbundling and customs barriers. The old disputes between the Catholic and Protestant Irish could flare up again. Therefore, in the so-called.Back-Stop clause provided that for a transitional period, the old rules of the EU Customs Union should apply to the free movement of goods. This would also apply to the whole of the UK, with the consequence that GB remains in the EU customs union without having the right to have a say in the matter. This can not be done with the Brexiteers. For British farmers, the biggest problem is the elimination of area premiums . Scottish, Northern Irish and Welsh areas with high shares of less favored areas are particularly affected. A secured replacement from the UK budget is not provided. Conclusion:

- Supplying the underserved GB agricultural market is becoming more expensive for the British. Bottlenecks with rising prices can not be ruled out in submarkets.

- For the EU supplier countries, higher costs and possible sales cuts are incurred.

- GB exports to the EU are severely affected by high tariffs.

- The relations between the Republic of Ireland and Northern Ireland are subject to a serious border problem.

- Many British farmers fear considerable financial and subsistence problems when the area premiums are discontinued

- So far, self-regulating market processes need to be reorganized with high bureaucracy.