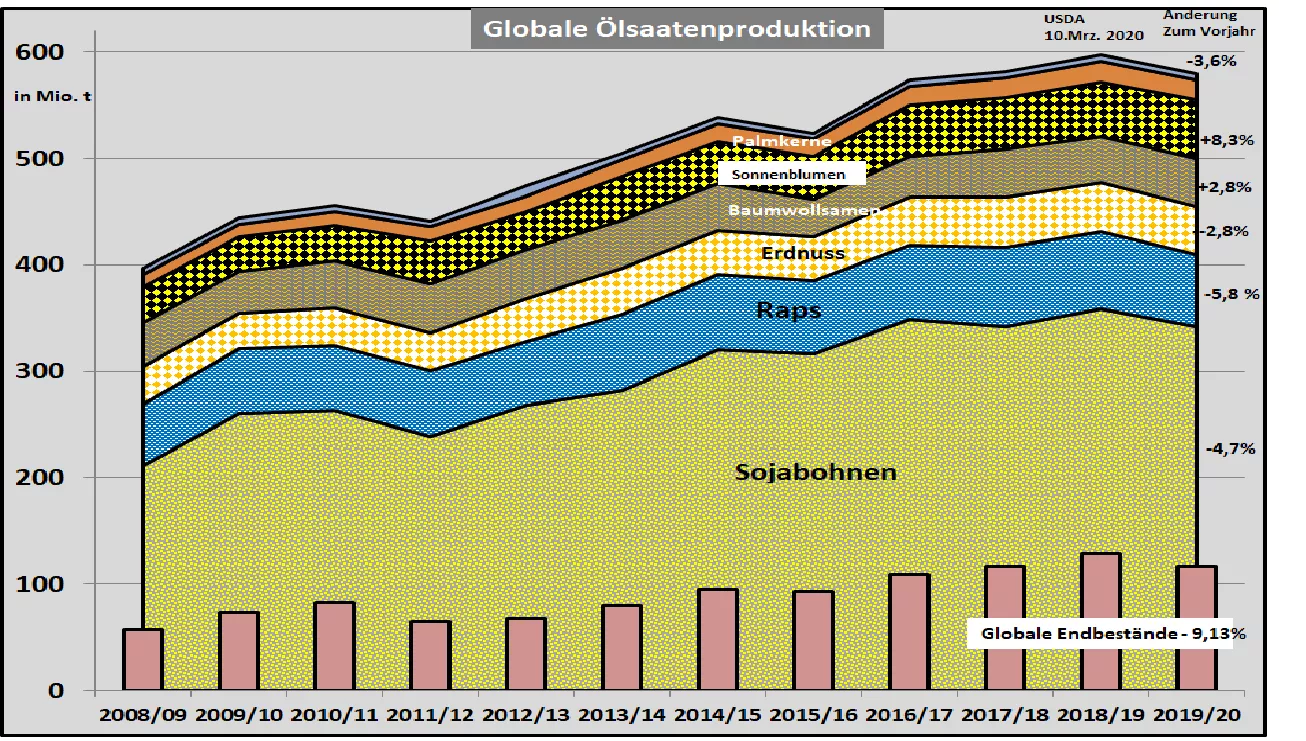

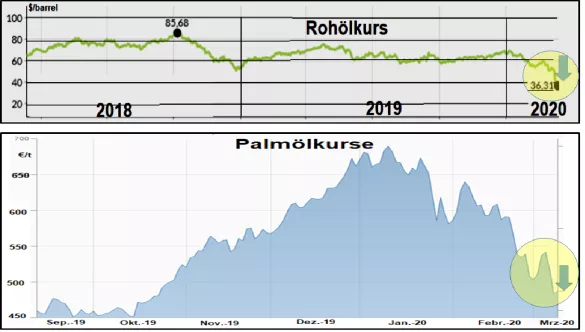

USDA: Oilseed Quotes Banished by Crude Oil Price Crisis In its March 2020 issue, the U.S. Department of Agriculture (USDA) only slightly increased global oilseed production as of the previous month. Global production is estimated at 580 million t, consumption remains unchanged at 498 million t. The surplus stocks increase from 114 to 117 million tons. This provides a good average supply situation. The oilseed sector is largely determined by the soy market with a production share of almost 60%. A weak US soybean harvest in autumn 2019 with a decrease of approx. 25% is largely offset by a current record harvest in Brazil of 126 million t. The Argentine soybean harvest is increased to an average of 54 million t, of which only 30 million t of soybean meal is sent for export. The reason for the new Argentine export taxes. China dominates on the demand side with an import volume of around 88 million tons of soybeans. 60% the market and price events. It remains to be seen whether the ASP and coronavirus epidemics will contribute to further disruptions in business.The Chinese have so far not realized contractually guaranteed higher US purchases. First business contacts are said to be made. A strong dollar rate and relatively high purchase prices do not make the US goods particularly attractive for shopping. In contrast, the high Brazilian harvest offers an inexpensive offer. Compared to the previous month's estimate, the USDA increased the surplus stocks from 98.8 to 102.5 million tons. Nevertheless, the stocks are 11 million tons behind the previous year. Despite a declining overhang, the supply situation in 2019/20 in the soy sector remains above average. The global rapeseed harvest 2019/20 is again weaker than in the previous year at 68 million t. Worldwide consumption is estimated at 70 million. The lack of need for the harvest is settled by reducing the stocks. With a production share of less than 15%, the scarcely supplied rapeseed market has only a limited impact on pricing. The extensive exchange options between the oilseeds mean that scarce conditions in sub-markets can be compensated for.The other oilseeds such as sunflowers, cottonseeds and peanuts are only of regional importance in terms of market and price. 70% of the oil meal market is dominated by soybean meal. Around 67 million tons are to be exported worldwide. Argentina supplies almost half of this with 30 million t. Other exporting countries are Brazil with 15 million tons and the USA with 12 million tons. The largest importer of meal is the EU with almost 19 million tons of soybean meal. The main supplier countries are Argentina followed by Brazil. In view of the upcoming high South American harvests, a sufficiently secure 2019/20 soy supply can be expected. The market for vegetable oils is managed by the two market leaders palm and soybean oil with a production share of approx. determined two thirds. Due to the high price value of palm oil, this product is of greater importance in terms of market and price. Palm oil will increase by approx. 1 million t less are available. Production in the two main growing regions of Indonesia and Malaysia is growing only half as strongly as the demand.In particular, the 30% blending share of biodiesel in Indonesia, which has increased since this year, ensures a rapid reduction in inventories and a sharp reduction in export potential. The ratio of final inventory to consumption is expected to drop to the lowest level in 25 years. The palm oil prices brought a strong price increase in January 2020. The relapse at the turn of the month of February was temporarily intercepted again. But recently, the massive drop in the crude oil price is putting pressure on palm oil prices. Such a development affects oilseed oilseeds such as rapeseed to a large extent. It can be assumed that the crude oil price has seen the lowest point at $ 40 per barrel.