Pork market: €1.25/kg; (Range 1.20 to 1.25 €/kg) The weekly slaughter figures are higher at 825,937 (previous week 786,871), the slaughter weights have remained the same at 97.3 kg . With 247,000 pigs (previous week 274,600 ), the pre- registrations have decreased significantly, and provide a clear signal for a significant decrease in future slaughter numbers. When reselling the cuts to food retailers, processors and for export, the average prices remained unchanged at a lower level. At the ISN auction on Fri, February 18th. an average price of €1.29/kg was achieved. Of the 610 pigs offered, 22% remained unsold. Status and prospects at the pork market (mid Feb.2022)

| Germany | EU internal market | third countries | |

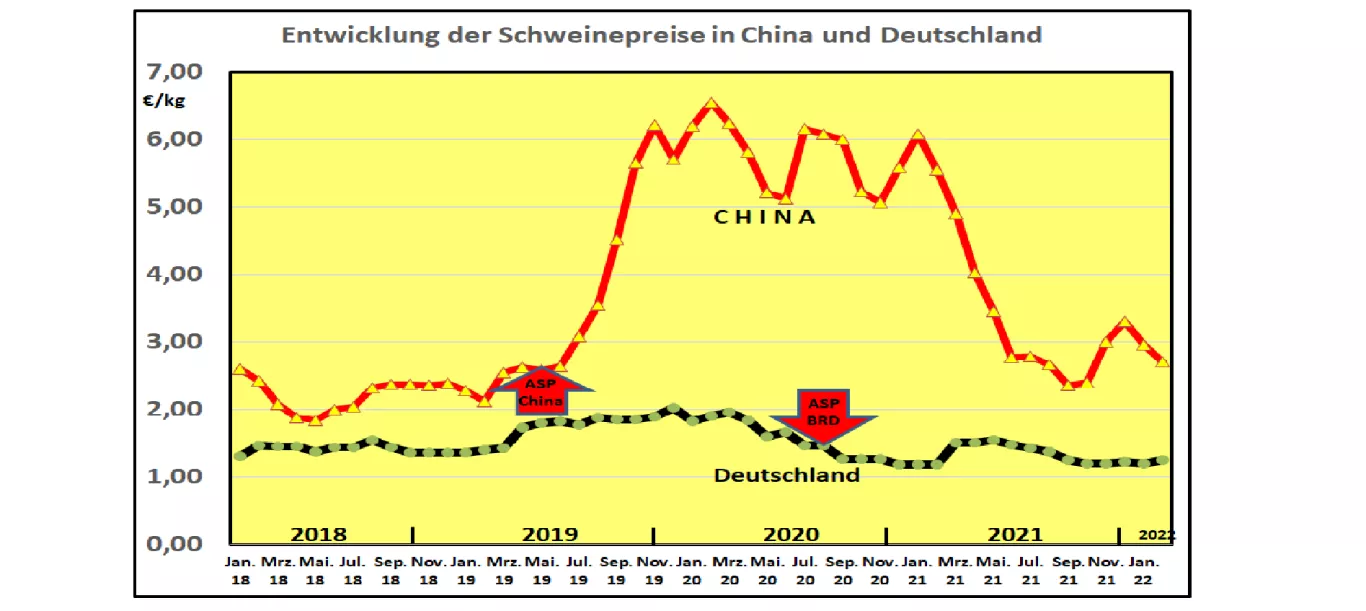

| Current status | Declining number of slaughterers Low unit prices V price: 1.25 €/kg at the upper range Reduced exports to Italy Delivery ban for China and othersCountries Import pressure from other EU countries | Low price level in the EU internal market but: Falling prices in Italy (because of ASP) In Poland, Romania Slightly increasing prices in Spain, France, Belgium, Denmark, Germany | China: after the New Year, falling demand and prices from 3.17 to 2.73 €/kg USA: sharply rising prices from 1.20 to 1.77 €/kg (low stocks, low slaughter numbers) Brazil : rising prices from 1 .00 to 1.15 €/kg |

| Prospects 2022 | Declining pig numbersMeat production (- 7%) Imports (piglets/pigs) on the decline Removal of the Covid restrictions, more sales in gastronomy High expectations for the barbecue season ASF in Germany : China is not expected to recognize the principle of regionalization Insufficient exports to third countries Persistently high feed prices | Total EU pig population little changed.Higher stocks in Spain, pig stocks in 9 EU countries : -6.7% in Germany -9% in Poland - 12.7% in France - 3.4% in Belgium -2.8% in the Czech Republic - 3.4% in Slovenia -5.7% in Denmark -1.8% Pork production Slightly above previous year around 23 million t Consumption around 18 million t Increasing need for export | China: Pig herd build-up curbed. Goals: 41 million sows 95% SVG Reduced import requirement around 4 million t Japan: Import demand rises to 1.5 milliont USA: Reconstruction of the stocks reduced due to Covid Stock exchange prices in summer 2022 at 2 €/kg Brazil: continuing to expand with rising prices |

The miserable economic situation in the pork market is not over yet. Only minor improvements can be seen. With declining imports and reduced import prices, China dominates the entire international pork market. Overall pork production in the EU is hardly declining; however, in some Member States, with a focus on Germany, the reduction is significant. In this country, dampened hopes are pinned on easing in gastronomy and a favorable barbecue season.