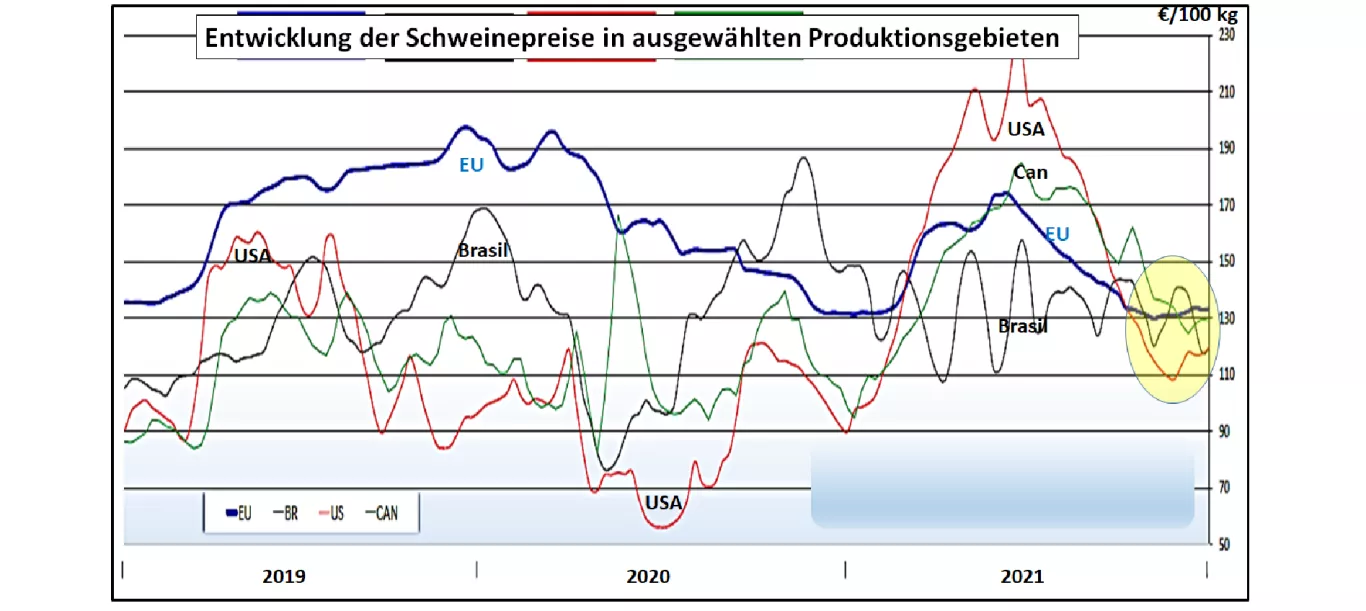

Pork market at the beginning of 2022 After the holidays between the years, meat demand is usually very restrained in the first few weeks of January. In particular, the higher quality cuts such as fillet and salmon are difficult to find in the market. In addition, the restrictions in the catering industry make sales more difficult. The processing industry is only slowly picking up speed again after the usual company holidays. The cold store supplies are sufficient for the front demand. On the supply side , the usual traffic jam for pigs ready for slaughter is considerably lower this year. Only a few days of slaughter due to public holidays were missing. However, the Covid-related restrictions on employees limit the potential for slaughter and cutting. The unusually high slaughter pig accumulation of the previous year cannot be observed this year.The significantly reduced piglet stalls in the previous months should be noticeable in significantly falling slaughter numbers. The considerably reduced advance registrations in the order of 265,000 instead of the previously usual 300,000 around pigs provide information. As before, however, third country sales will severely restrict sales and price leeway due to the ASP-related import bans in Asian countries, with a focus on China. The resulting lack of meat must be accommodated against strong competition in the EU internal market. The reduced Chinese import demand means that export-oriented production areas such as Spain, Denmark and Holland are increasingly looking for sales opportunities in the domestic market. The V price quotation in the 1st week of 2022 has remained unchanged at 1.23 € / kg (range 1.23-1.25).House prices for non-tied pigs continued by the companies concerned. The ISN auctions on Tuesday, 4th and 7th January 2022 provided a first glimmer of hope with average prices of 1.27 to 1.28 € / kg and an offer of 500 to 700 animals with no significant excess. After weeks of failures, the degrees provide promising information. The average of the partial prices for resale to food retailers and processors also maintained their level of 1.72 € / kg . In Nov 2021 only 1.68 € / kg were paid. The prices in the major EU countries show almost exclusively a fixed tendency, even if regional overhangs are spoken of in some production areas. Only in Italy have the courses yielded a little. At the world level there is movement in the market and price events.In the USA , pork prices are rising again to the equivalent of € 1.23 / kg due to low slaughter figures and below-average cold store stocks. The significantly reduced pig populations on the occasion of the inventory on December 1, 2021 are to be cited as drive amplifiers. This set back the year-long increase in production considerably. For the first half of 2022 , prices of up to € 1.65 / kg will be traded again on the Chicago Stock Exchange. The Canadian pork prices are based with a certain distance on the US quotes. In Brazil , pig prices fell from the equivalent of € 1.35 to € 1.21 / kg at the turn of the year 2021/22, but the expectations of future duty-free exports to Russia are opening up new sales opportunities. Export earnings to China fell sharply in the last month of the old year.The elevated by preparations for the Chinese New Year beginning Febr.-22 pig prices of approx. 3.30 € / kg in the months Nov./Dez. 2021 have recently decreased again to € 3.17 / kg . For the first months of 2022 and only 2.60 to 2.80 € / kg will be traded on the Dalian stock exchange; behind this is the usual drop in consumption after the New Year celebrations. The prices for September 22nd are already back at 3.31 € / kg with an upward trend. The reason is, among other things, that the Chinese Ministry of Agriculture has limited the benchmark size of the sow population to 41.5 million animals. That is not enough to cover self-sufficiency, but it stabilizes pig prices. The shortfall is ensured by inexpensive imports of less valuable parts. The import volumes are estimated at 4.75 million t in 2022 (previous year 4.5 million t).