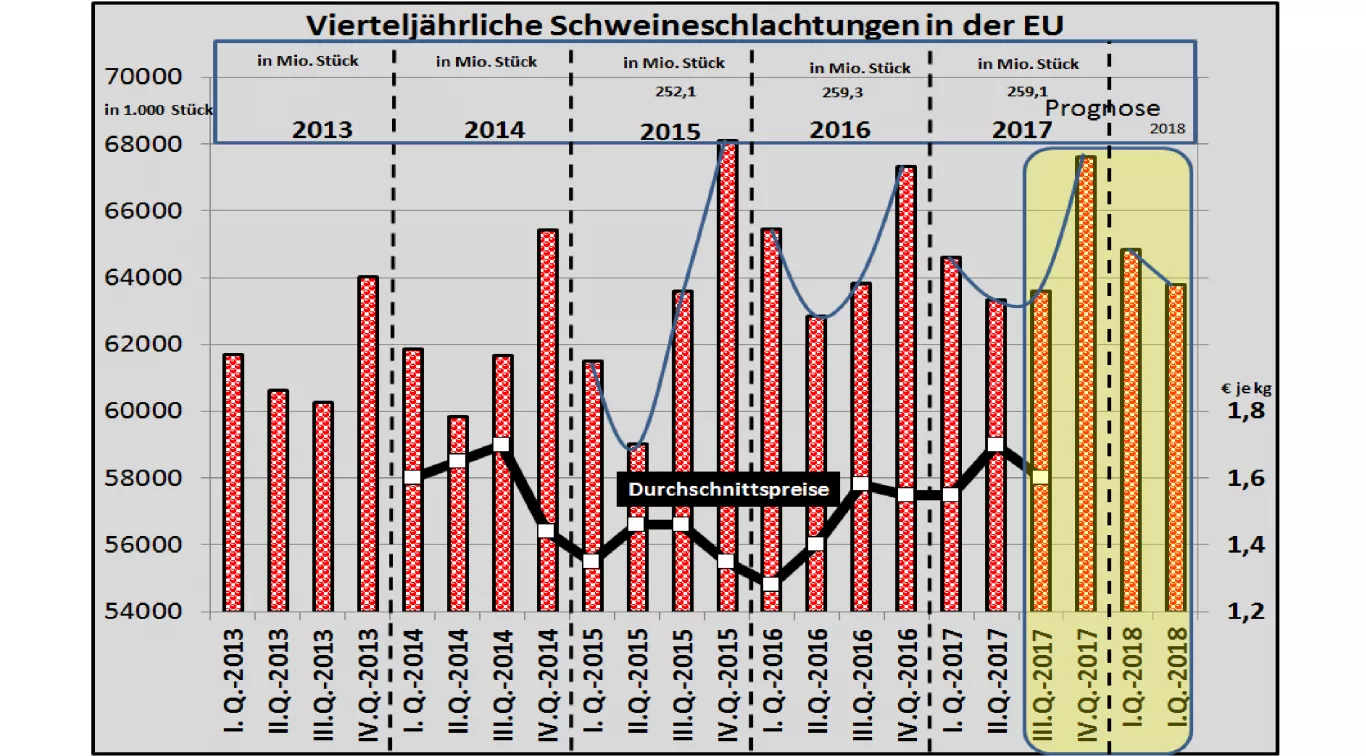

Forecast: EU pig slaughterings At the end of 2017 / beginning of 2018 The EU Commission census figures for the rest of the fourth quarter of 2017 and for the first half of 2018 have been used to calculate the estimated slaughter figures. The slaughter figures for the largely expired 3rd quarter of 2017 are slightly below those of the previous year.Despite the declining export volumes, the hitherto high pig prices underline these Assessment. The forthcoming fourth quarter has traditionally had the highest slaughter figures on a yearly basis. For the 4th Q.-17, 67.6 million slaughterings or +0.4% more are expected in the EU than in the previous year. The increase to the preceding 3rd Q.-17 is at approx. 6% slightly higher than last year. For the 1st Q.-18 , the EU Commission expects 64.8 million slaughterings, which are only slightly higher than in the previous year at 0.3% .In addition to the reduced days in February, the holidays have to be considered. In the second quarter of the year, 63.76 million are expected to be slightly lower than in the first quarter of the year. Compared to the previous year, the increase of 0.7% is comparatively low. A total of +0.48% more slaughtering in the EU will be foreseen for the coming 3 quarters .In the EU's largest production area Germany , the slaughter numbers will be slightly higher in the next 3 quarters with 0.16 %. In Q1 and Q2, even lower results are expected. In Spain, as the second largest producer, an average of the next 3 quarters with further growing slaughter figures is calculated by the order of + 1% . Denmark's slaughter figures are expected to increase by + 2.9% over the period from 4Q.17 to 2nd Q.-18.Similar high rates of growth of 2.5% are predicted in Poland . Significant declines are estimated for Italy with -1.8% , the UK with -0.8% and France with -0.5% . In other smaller production areas, falling slaughter numbers are also to be expected. For the assessment of the price development during the period of observation 4Q.-17 to 2. Q.-18 is next to the slight increase in the offer to take into account the fact that the export boom to China during the past year is markedly weaker, however is still above the multi-annual average. Domestic demand is hardly expected to be significant. The pork prices are expected to yield on a seasonally average scale. An extreme price decline can not be seen even today.