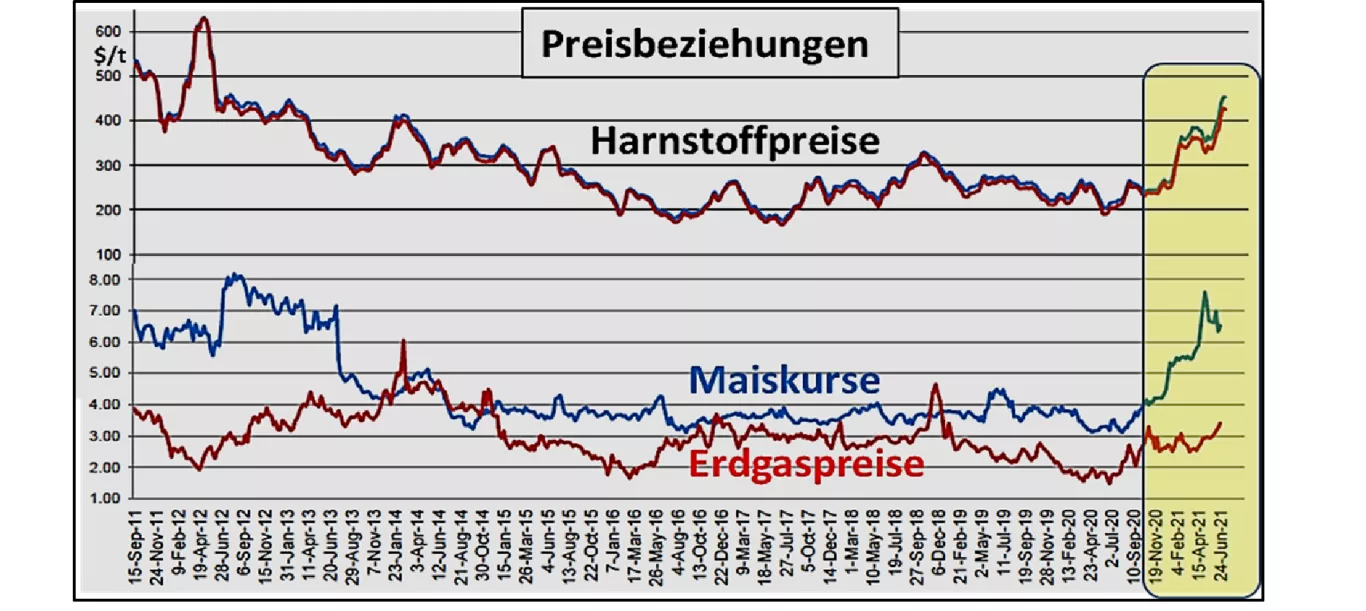

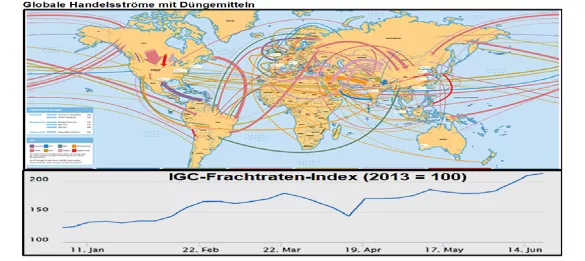

High price increases on the mineral fertilizer market: + 50% since the beginning of the year Contrary to the common decline in fertilizer prices after the end of the main fertilization period in early summer, prices have risen steeply this year. Falling fertilizer prices in the summer months regularly provide the foundation for a cheap early purchase for next year's fertilizer use. At first glance this cannot be seen this year. What's different this year? Fertilizer prices are essentially based on (1) energy costs , (2) international transport costs and (3) prices for market crops with a focus on grain. When it comes to energy costs, the price of natural gas is crucial because this form of energy is relatively inexpensive as a by-product of crude oil production.The production sites for fertilizer are based on the occurrence of raw materials, the location-favorable energy costs and are often far away from the consumption sites . As a heavy load, transport costs therefore play a decisive role in pricing. This year, the restrictions on international transport logistics are exacerbating price developments. Obstructions in the Suez Canal and Corona-related outages in central Chinese export ports are delaying and making deliveries more expensive. Another reason, at least as important, is rising grain prices . With the use of fertilizers, above-average additional revenues are achieved with high grain prices. No farmer with a lower than usual, yield-increasing use of fertilizer does not forego this additional income. Due to its monopoly-like structures , the fertilizer industry is able to enforce higher fertilizer prices without having to fear major sales losses.How is the further development to be assessed? A global economic recovery is calling for more crude oil. However, the funding should not be increased significantly more. Investors are increasingly turning to more climate-friendly energy sources, which, however, have yet to be developed. The forward rates for crude oil will remain at a high or possibly even rising level until well into next year 2022. The difficulties in transport logistics persist for the time being. Freight costs remain high. Although international grain prices have recently shown a slight downward trend, they still remain above average. However, the instabilities have increased. If you follow the forward prices on the stock exchanges until next spring, only moderate price declines can be seen. As an export nation, China is the driving force on the international market. Prices have risen sharply in the Middle Kingdom. The Chinese traditionally supply the severely undersupplied Indian market.India heavily subsidizes fertilizer prices to help increase food production. This unintentionally supports the price increase. And now China also wants to introduce an export tax in order to keep the goods inexpensive in their own country. The upward momentum of the courses therefore continues. It is possible that grain prices could decline due to the harvest, thereby slowing down the driving force behind rising fertilizer prices.