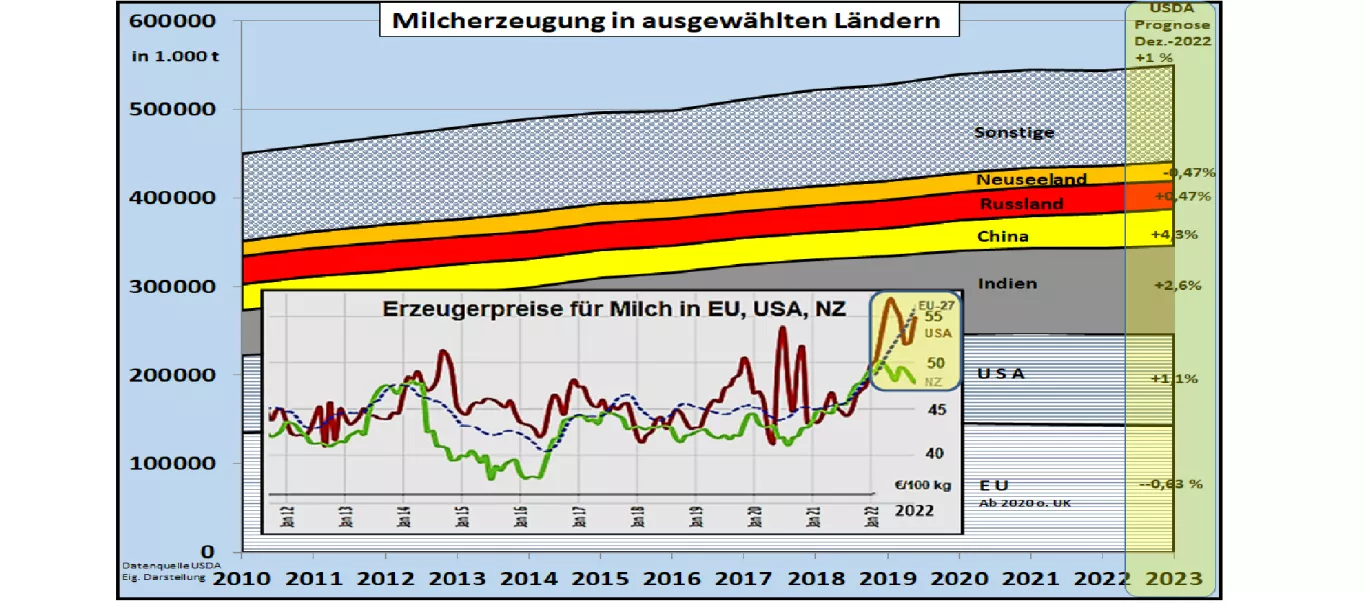

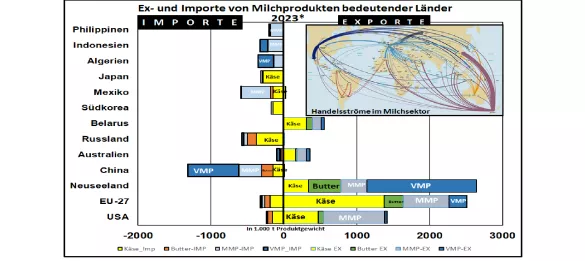

Brief review and outlook for the global milk market 2022 - 2023 Milk production in major production and export countries at world level experienced a significant decline in the first half of 2022 . The large production areas such as the EU, USA and the oceanic countries of New Zealand and Australia have reduced their production. The increased feed costs and the sales opportunities with milk prices still low played a decisive role here. With increasing shortages, milk prices rose more sharply in the second half of 2022 and stimulated production at least in the world's two largest production areas, the EU-27 and the USA. In contrast, New Zealand, the world's largest exporter, and Australia continued to retreat. In both oceanic regions, a limit of area-related carrying capacity has been reached. The high export dependency of both countries leads to a particularly high sensitivity to the global economic restrictions with a special focus on the world's largest importing country, China.In its semi-annual forecast for 2023 , the US Department of Agriculture (USDA) estimates a 1% increase in global milk production in the larger production areas. The USA is in the upper growth range, while a slight decline is assumed for the EU-27 and the two Oceanic countries . As always, Indian production is growing well above average at +2.6%, although with almost 90% being used for the domestic fresh milk sector. Production and consumption of the various dairy products are developing differently. The rising trend in the cheese sector will continue in 2023. This is also predicted for the production and consumption of butter . In contrast, the changes in the milk powder sector are very small. In the case of skimmed milk powder , the increased energy costs in the main production areas of the EU and USA, which together account for 55% of the world share, are to be regarded as one of the decisive causes.One third of whole milk powder production takes place in New Zealand and around 25% in China. As the world's largest importer and consumer of milk powder, China has a significant share on the demand side . In 2022 , milk prices in the most important export regions have risen significantly from the lower level of previous years. After the Covid turbulence of previous years, the quotations for the USA have achieved somewhat more stability at an elevated level. In contrast, EU prices have marched steeply upwards. The milk prices in New Zealand , which were still high at the turn of the year 2021/22, fell again on average over the course of 2022; the main reason is the decline in export business, particularly in the direction of China. If you follow the futures rates on the various stock exchanges, the current high price level will not be maintained for the year 2023 , at least in the first half of the year. On average, a 10% reduction is assumed.