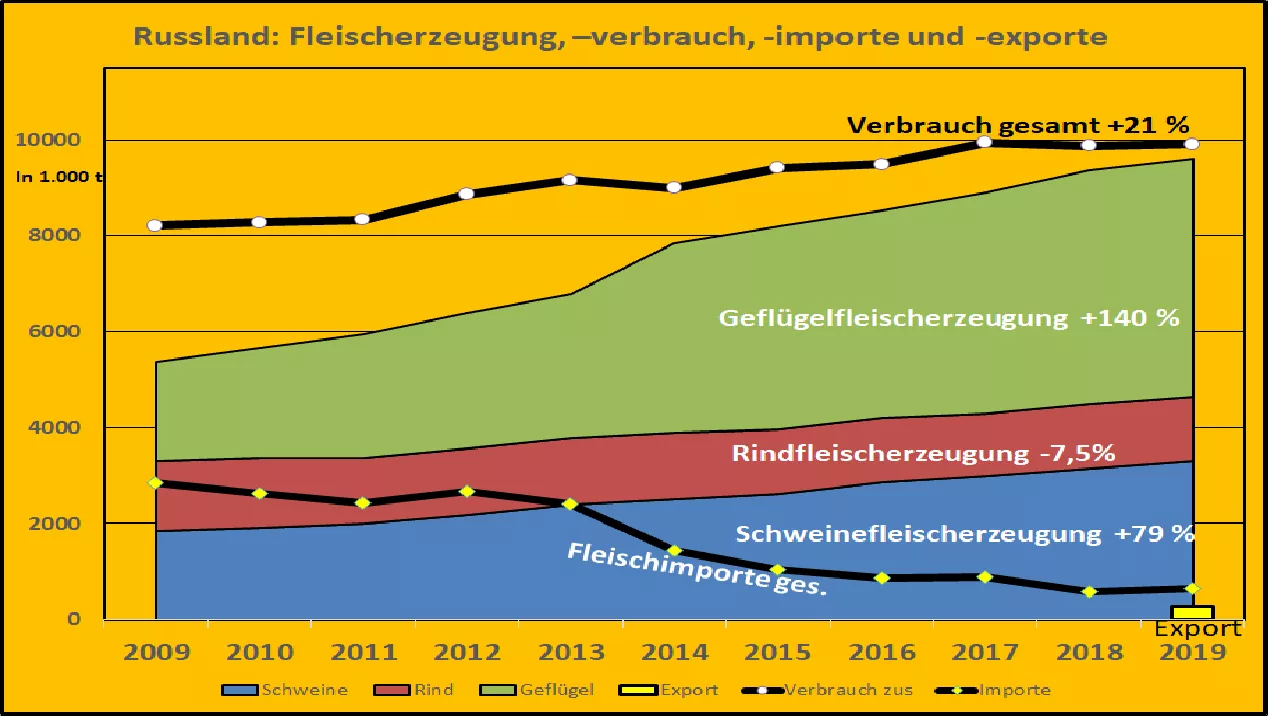

Russia's meat market: from one-tenth of an importer to a budding exporter Just 5 years ago , Russia imported between 2 and 3 million tonnes of meat . The main imports were beef and pork but also poultry. Most of the supplies came from nearby EU countries . Despite all efforts, it was only possible at that time to cover the increasing consumption by increasing the domestic production to a limited extent. By 2014 , there was a significant break. The Crimea and Ukraine conflict led to an abrupt stop to imports from the previous supplier countries, with a focus on the EU, USA and Australia. Although meat from non-affected export countries, including Brazil, was still sourced, import volumes were significantly lower . On the one hand, the subdued consumption trend contributed to this, but also a strong upward trend in self-generation. Russian meat production is supported by substantial government subsidies .Medium-term funds are made available for production and processing, but these are usually to be repaid after 8 years. Favorable profit opportunities opened up for major Russian companies. Due to the politically induced scarcity, meat prices were well above the cost level. With the high profits, the loans could be repaid until more recently. In the last two years, however, the tide has turned. With the approach to 100% self-sufficiency , the former high meat prices could no longer be enforced on the market. Less efficient companies had to declare bankruptcy . This happened primarily in the agricultural intensive southern district of Russia. In anticipation of an increasingly narrow domestic market, a large number of initiatives were taken to mobilize exports . Initially, the neighboring countries were targeted, but their receptivity is small.Other areas are Southeast Asia and the Near and Middle East. However, pork sales in these regions are limited due to religious reservations . In addition, the African swine fever in Russia keeps the potential export sales in check. In the case of poultry meat exports, more frequent outbreaks of poultry flu virus are likely to prevent a major export. Beef exports are not very attractive given the low level of self-production and the high price. Despite all the obstacles, Russian meat companies will try to intensify meat exports in the coming years . The main focus is on China . The supply gaps arising there from the AFP could contribute to bridging certain political and economic reservations.Russia has favorable conditions for pork and poultry meat production due to the huge areas and the increasing grain surplus with low feed prices . Disadvantages are the high construction costs and less developed sales logistics to the possible import areas. The latter can be organized. Russia has become one of the leading grain exporters in recent years and has created strong competition on the international market . It is possible that a similar development is in store for meat exports.