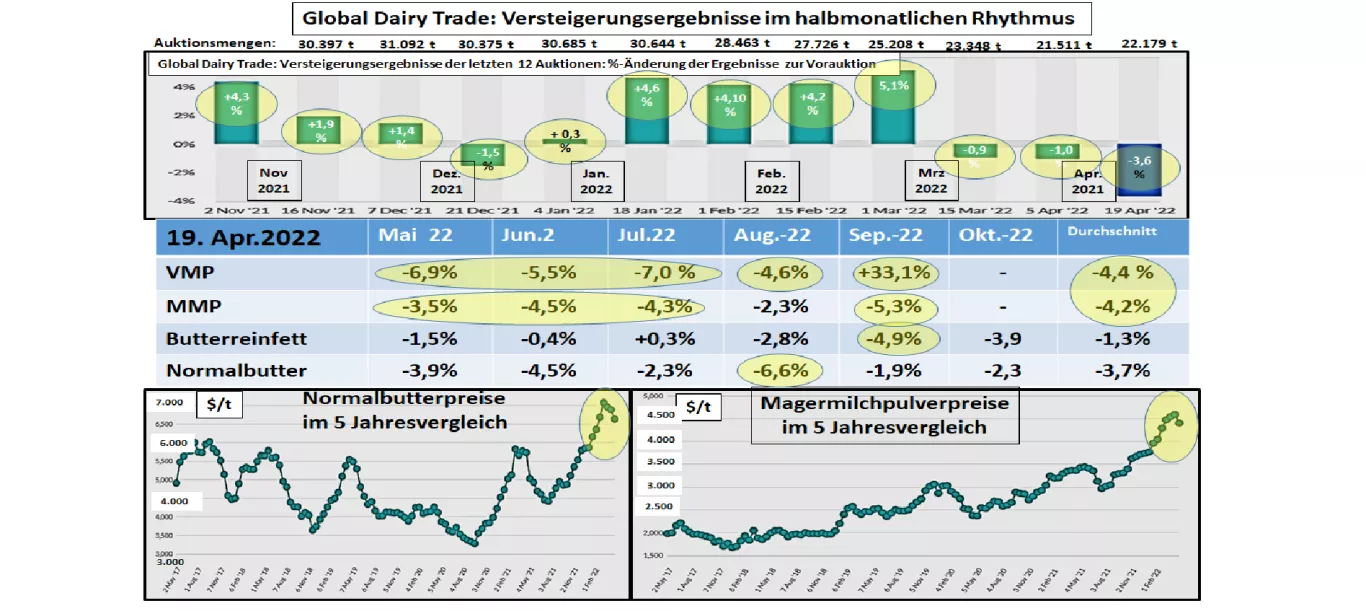

- GDT Auction in Apr. 2022: -3.6%

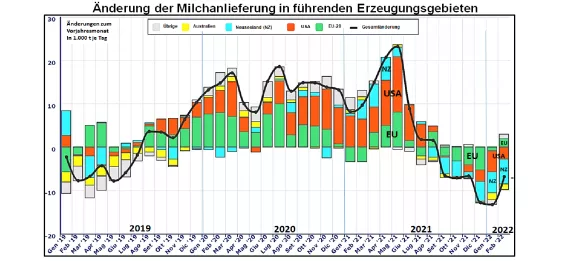

The second. Global Dairy Trade (GDT) Apr 2022 auction delivered a third drop in average auction results. Individual winnings from the pre-auction had to be withdrawn. Trading volumes remain at a reduced level for seasonal reasons. Whole milk powder (VMP) (50% market share) lost an average of -4.4% compared to the pre-auction. However, the month Sep-22 is striking with a repeatedly unusual surcharge of 33%. The price declines otherwise took place in all delivery months. The absolute prices decrease to $4,207/t, but still remain at the high price level of the last 5 years. Skimmed milk powder (SMP) (auction share 25%) had to completely give up the recent price gains of -4.2% . However, the listings remain in the highest price range of the last 5 years. All monthly results remain in negative territory. The absolute MMP prices reach with 4.$408/t, moving below the EEX rates ($4,563/t) but above the US ($4,007/t). After the significant losses in the pre-auctions, butterfat prices (share 10%) achieved a moderate result with an average of -1.3% . Only the month Jul -22 stood out with +0.3% increase, there was a need for correction. The average product price falls to $6,802/t but still remains above average. At -3.7% , normal butter (share 8%) again had to give up part of the surcharges in the pre-auctions. The month of August 22 turned out to be particularly weak with -6.6% . The absolute butter price falls back to $6,640/t but still remains within the high price range of the last 5 years. EEX Leipzig is quoted at the equivalent of $7,803/t and the Chicago rates are at $6,018/t. The repeated falls in the price of the most recent GDT auctions indicate that an internationally high price level has been reached and that buyers have reached the limits of their willingness to pay. Additional influence comes from the seasonality of goods availability. The high price differences for butter in a comparison of the EU, the USA and NZ are striking as a result of regionally different supply situations and limited transport options. Compared to the same months of the previous year , the milk delivery of the world's 9 most important production areas in the first two months of 2022 remains below the results for 2021. However, the reduction is no longer quite as high as in the autumn/winter months of 2021. Particularly significant reductions are in New Zealand and watching Australia . The EU temporarily gained some ground in Feb. 2022, but the latest figures do not indicate a continuation.Globally above-average milk prices could provide an incentive to increase production , but the high feed costs are a brake on such a conceivable development.