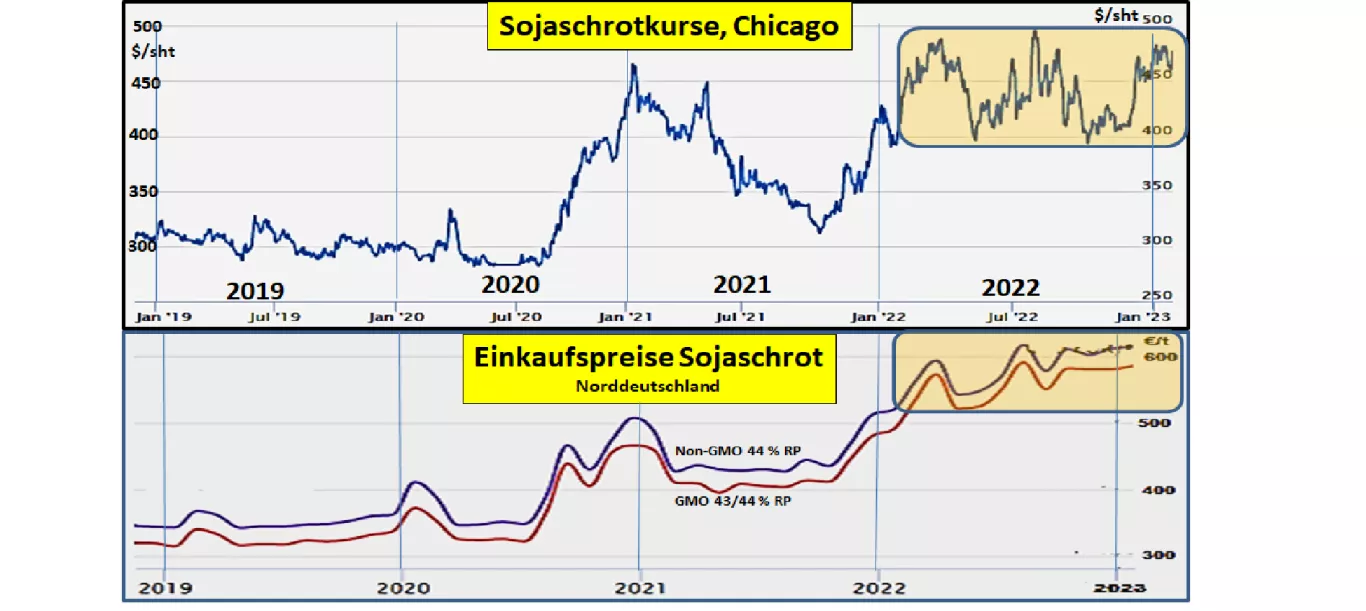

Will soybean meal remain expensive? If you look at the soybean meal price trend in recent years, a multi-stage development can be seen:

- Until the middle of 2020 , the purchase prices for GM0 goods with 43/44% RP in northern Germany were around the 350 €/t mark. The Chicago Stock Exchange quoted around $300 per sht (sht=907 kg) for 48% RP goods. This level corresponded to a medium-term average.

- In the first half of 2020 and the first half of 2021 , prices rose by around 30% on average. The background to this was somewhat smaller harvests in South America and the USA, while Chinese import demand was still strong.

- The temporary price drop in the course of 2021 is due to the declining Chinese imports due to the reduction in pig stocks caused by ASF.

- The price increase to a range of 550 to 600 €/t that occurred around the turn of the year 2021/22 is related to the export stop in Ukraine and the further consequences of the war.

- A price weakness on the Chicago Stock Exchange at the end of 2022 was short-lived because the high expectations for the US harvest had to be significantly reduced. The local purchase prices remained unimpressed at their high price level.

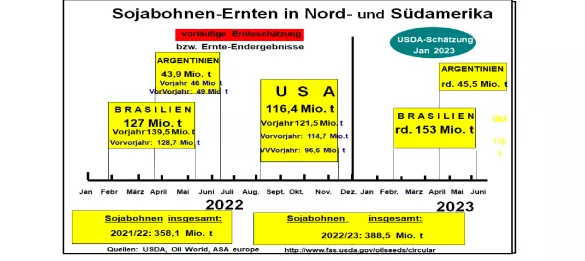

What's next? Based on an average global stock situation , the current Brazilian soybean harvest is currently in focus. The preliminary estimates assume a record result of 153 million t (previous year 129 million t). Exports are forecast at 91 million t (previous year 79 million t). On the other hand, the soybean harvest in Argentina will only slightly exceed last year's weak result in the next few months. This also applies to Argentina's exports of beans, meal and oil. On the demand side, China is expected to reduce its soybean imports from 99 to 96 million tons due to improved domestic production. Declining animal populations in the EU also ensure significantly lower import volumes compared to previous years.However, the new EU regulations on soy imports from proven deforestation-free regions could increase logistics costs. A more relaxed supply situation is expected for the first half of 2023 , which could lead to falling prices. The futures rates on the Chicago and Hamburg stock exchanges support this assessment. For the second half of 2023 , the price decline should accelerate again with the new US harvest.