On pressing export US pigmeat - strong competition in the export business

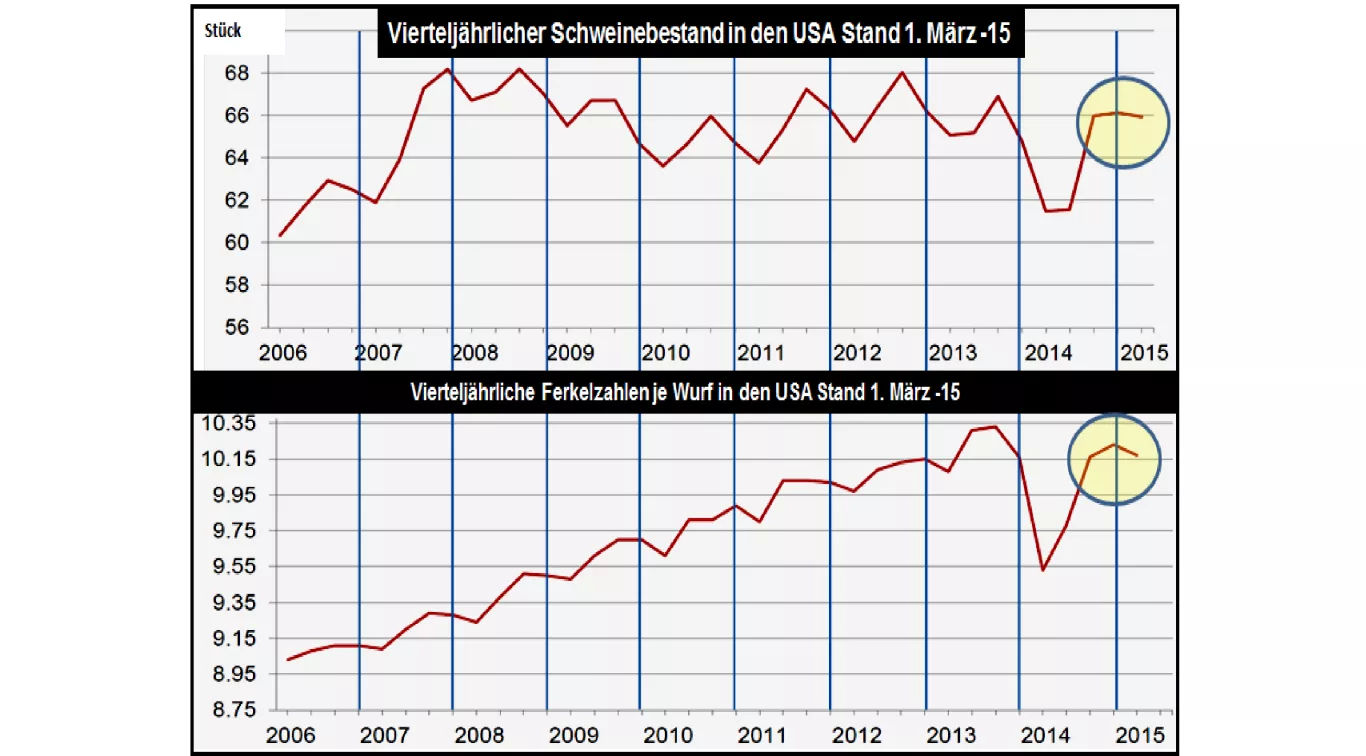

The latest quarterly US pig stand count as of the date of March 1, 2015 has caused some uncertainty. It was initially expected that consisted of US pigs should have increased. Strongly fallen pig prices were cited as evidence. It was clear, but also from the outset, that a comparison of the current Schweinebestandes to compared with the peak of PEDv plague can cause little meaningful results. Actually, 7% were considered more pigs.

However, comparing the latest results of March 15 with the more 'normal' March 13 figures, the increase is just 1%. Comparisons with the previous Sept. 14 and Dec. 14-results revealed virtually no increase until March 2015.

But why come to strong pork prices by 1.70 compared to less than €1.20 / kg in the current spring then? The explanation is essentially that you not have been scaled back in the last year to compensate for missing animals around 5 to 7 kg increased slaughter weights. Again normalisation quantities this heavy because much more meat.

The recent monthly cold storage report from the Feb 2015 shows that the stocks of meat, including for significant parts have increased pork by 8%. The additional volume of meat could be sold so in nor abroad sufficiently. The stocks emerging have put prices under pressure.

The assessment of US stocks of sows is similarly critical to tackle. The direct comparison with the previous year with an increase of 2% is little meaningful. Medium-term consideration is to assume a stabilization of farm animals at the average level of the last years.

The number of piglets per litterare crucial for the prospects for further development. Again, these have reached the highest level after last year's disaster. This is still the finding that the PEDv disease attenuated level is still virulent.

For the future assessment of the U.S. pork market is to assume a further de-leveraging off course of the PEDv plague in the warmer growing season. The piglet volume is stabilizing on fewer losses, increased throw numbers at sturdy sow inventory will lead to sufficient numbers of ante-mortem. Crucial will be whether and to what extent the increased slaughter weights under the pressure of low pig prices or not taken back again. Usually the battle weights be daylight saving time and less. There are only a few signs so far.

On the demand side are the opportunities limited. The domestic consumption is stagnating already elevated level. Exports will be affected by the strong dollar . The expected U.S. price history goes beyond not only little about the brand of €1.40 / kg in the coming summer months.

It takes little imagination to produce the consequences for the European market . At a low initial price level the US exporters will be required to ensure sales despite strong dollar. The world's largest pork exporting country United States will use its competitive power, the competition from the second largest export territory EU in chess to keep. The upper limits for the EU pork price level are connected.