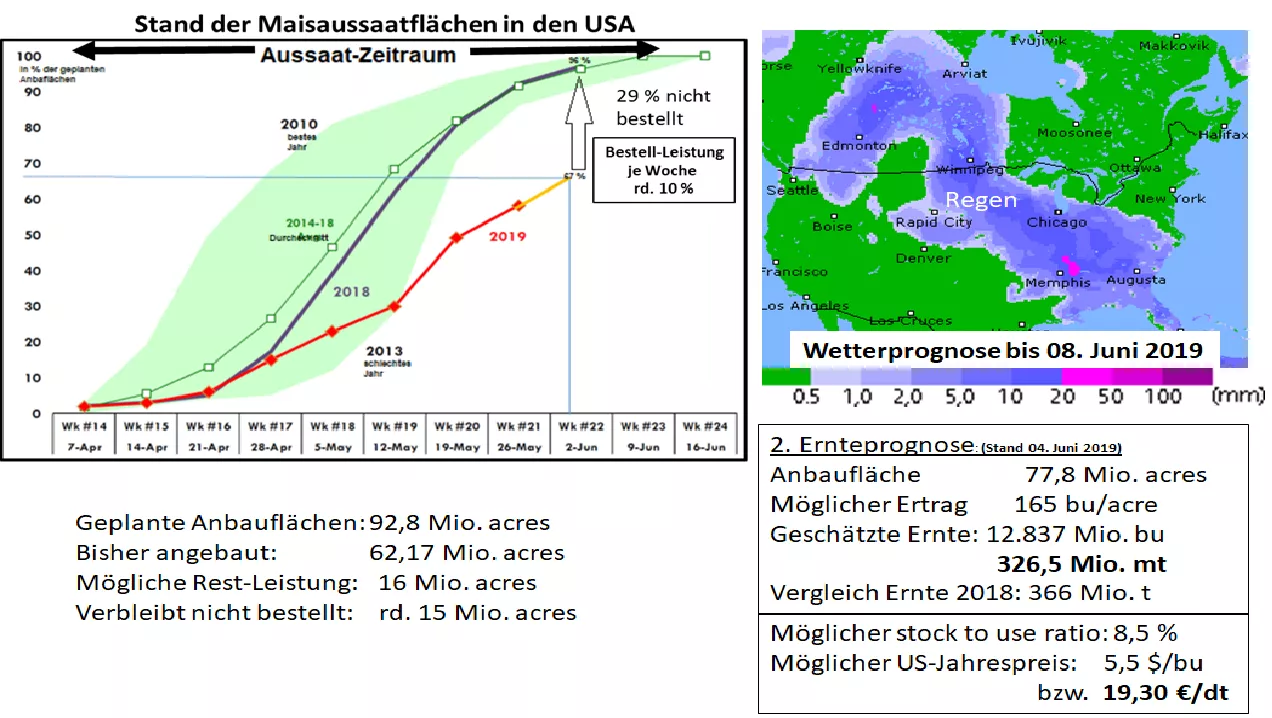

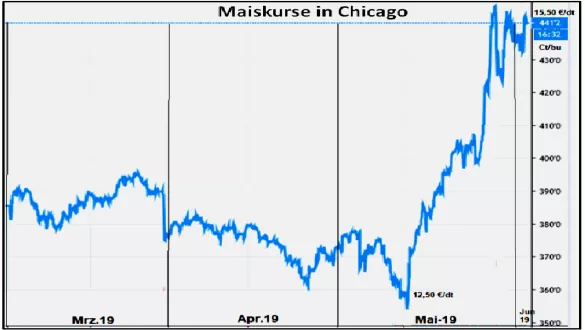

Dramatic escalation of corn sowing in the US - corn prices rise again As of 2 June 2019, only 67% of planned US corn areas were ordered. Continuous rainfall prevents and prevents rapid progress of maize seed. In the past week, only an additional 7% of the areas could be processed. With unimpeded order work could easily be done twice. The remaining time of 1 to 2 weeks is very close. Assuming that one or the other area can still be navigated in the face of continuing rainfall, a considerable amount of un-ordered space can be expected. Alternatively, the sowing of soybeans is conceivable, but here too the end of the order period is approaching. A rough estimate of significantly less acreage and lower-than-average yields per hectare as a result of the unfavorable weather-related start of growth could result in a US corn crop in the order of 325 million tonnes . In the previous year, 366 milliont, harvested 371 million t two years ago. This year's result was predicted a few weeks ago with 382 million t. A softening of the weak US corn crop is based on the high initial stocks of 54 million tonnes . In addition, exports to Mexico will be smaller as a result of trade tensions. High US corn prices also reduce the international competitiveness of US goods. Domestic consumption , on the other hand, is unlikely to decline as the large number of animals (pigs) consumes more feed. The 15% increase in the addition of ethanol to the gasoline sector could also lead to more demand, but is dependent on the price ratio to the mineral fuel price. In any case, the US corn market will be much closer to the market. The supply number "stock to use ratio" drops mathematically to 8.5%. Relevant research shows a statistical correlation between the supply number and the annual average corn price.If the latest crop estimates are true, average prices of $ 5.5 per bu or an equivalent of just over € 19 / dt are to be expected. High corn prices pull wheat prices with them, because given the expected price level, parts of the wheat for the feed sector are attractive. The US wheat crop is, however, with approx. 50 million t relatively small compared to maize harvests with a mean 360 million t. But no conclusive assessment is yet possible, because the coming months will once again be crucial for earnings formation .