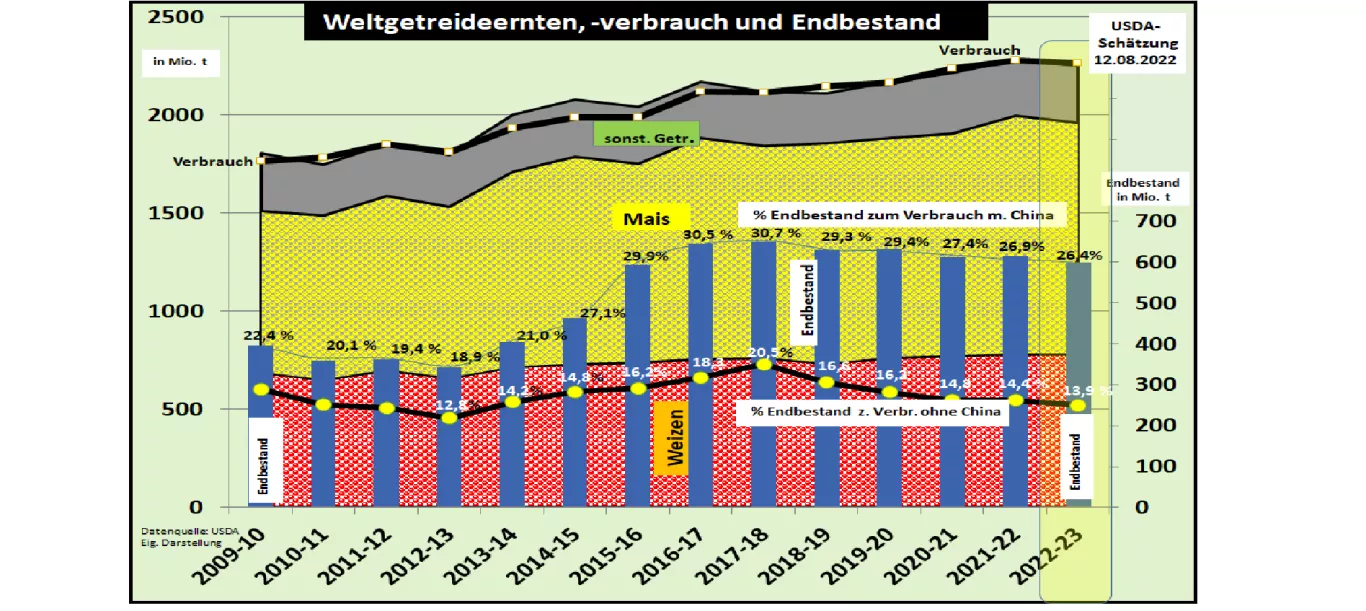

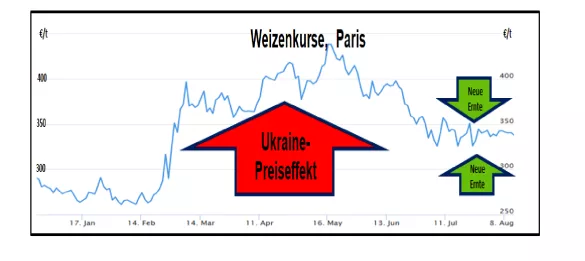

USDA further corrects global grain supply 2022/23 downwards Results compared to previous year The US Department of Agriculture (USDA) estimated the world grain harvest 2022/23 for the fourth time in its Aug 2022 edition. Global production is estimated at 2,249 million t (previous year 2,280 million t). Global consumption is also classified as lower at 2,265 million t (previous year 2,280 million t). The ending stocks fall just below 600 million t (previous year 615 million t). The supply figure is calculated at 26.4% ending stock to consumption (previous year 26.9%), without China it decreases to 13.9% (previous year 14.5%). The global supply development, which has been declining for years, is continuing. The assessment of security of supply against the background of the war in Ukraine is becoming increasingly important.Fear of supply becomes a price-determining factor. In global world trade , the quantities were estimated lower at 436 million t (previous year 465 million t). In the case of Ukraine exports , an export quantity of around 25 million t (previous year 50 million t) is predicted; for Russia , the USDA estimates export quantities of 52 million tons of grain (previous year 42.5 million tons ). Around 20% of world grain exports come from the Black Sea countries. Higher exports are forecast for Canada, USA, Australia and the EU. Despite the drought , India is expected to export wheat at the previous year's level. On the import side , the critical supply situation in the North African and Middle Eastern countries is confirmed with slightly reduced import quantities.China is to reduce its maize imports by around 10% . Results compared to the previous month 's estimate The corrections to the August estimate compared to the previous month are comparatively small. Although the global wheat harvest is increasing, it is offset by rising consumption. Inventory levels remain tight. The rest of the grain crops, with a focus on corn, will be cut while consumption levels will be reduced only slightly; the already reduced ending stocks continue to fall. How are the further market and price prospects to be assessed? For the rest of the grain year 2022/23 (autumn), large maize harvests are still pending in the northern hemisphere, which account for around 40% of the world harvest. The precipitation deficit is currently leading to ongoing deductions in yield estimates. In November/December 2022 , the wheat harvests are due in Argentina and Australia. The current forecasts are still very uncertain.The corn harvest in Brazil will take place in the late spring/early summer months of 2023 . A significant part will only be sown after the soybean harvest (Safrinha) in Febr.23. There is still a lot of potential risk. The Black Sea region remains an unpredictable export area. High inflation rates and an impending economic recession are dampening demand. Increased fertilizer and energy costs lead to reduced use of resources with the result that there is no prospect of increased yields. A necessary replenishment of inventories through an above-average harvest in 2023 is hardly to be expected. After a lengthy downturn, wheat prices on the stock exchanges have moved back up to around €350/t. Corn quotations experience an even higher price boost. The Ukraine effect has weakened in price-driving effect.The new harvests and the prospects for the further supply situation determine the price level and development.