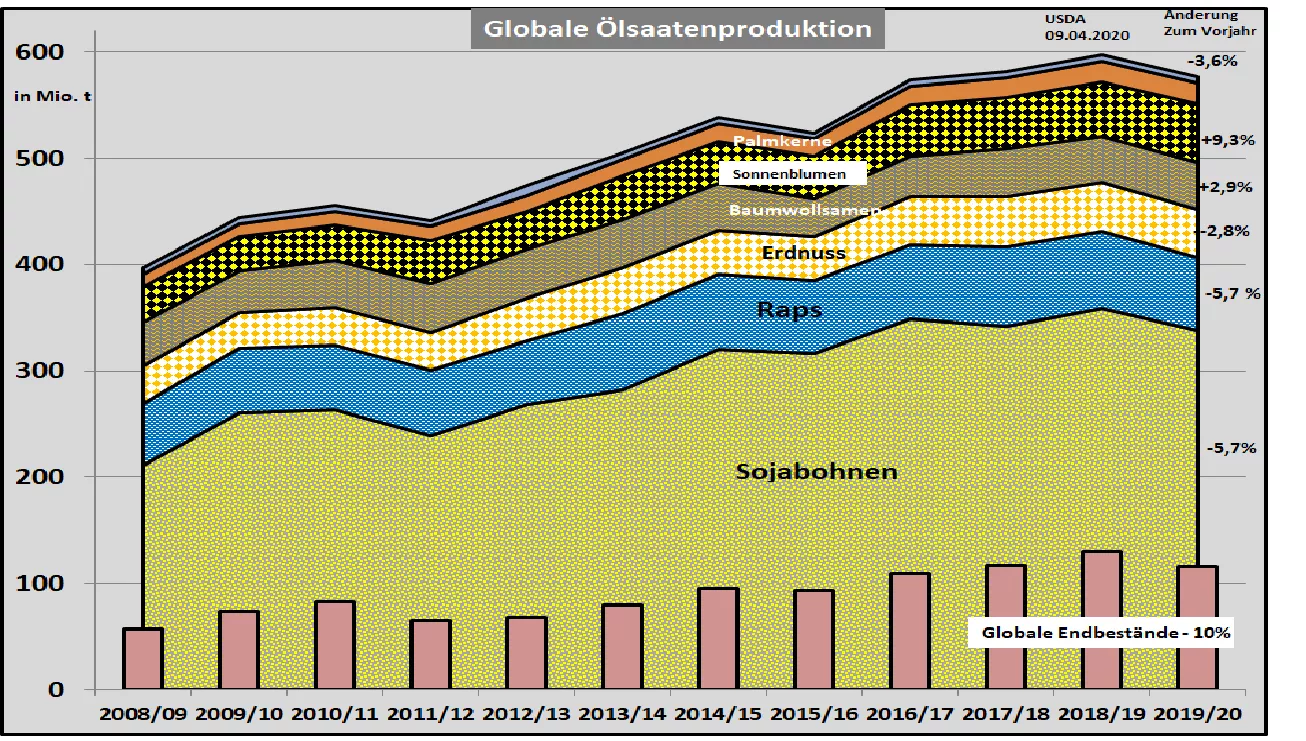

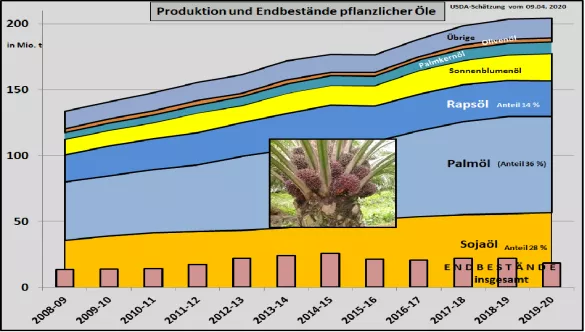

USDA Reduces Global Oilseed Production 2019 / 20– Smaller Soybean Harvest in South America In its latest April edition, the US Department of Agriculture (USDA) cut global oilseed production to only 577 million tonnes. In the previous month's estimate, 580 million tons were still assumed. In the previous year it was 597 million tons. The decisive factor is the lower soybean crop . Compared to the previous year with a soy production of 358 million tons, this year it is only 338 million tons . The decisive factor is the 13 million t lower US harvest with only 96.8 million t in autumn 2019 as a result of the unfavorable sowing conditions. The high forecasts for the 2020 spring harvests in Brazil and Argentina are also not fulfilled. The high expectations for the Brazilian harvest are missed by 1.5 million tons. The USDA estimates only 124.5 million tons . The Argentine harvest is also 2 million behind the forecasts. The US Department of Agriculture estimates only 52 million tons .Global soy consumption is expected to increase from 298 million tonnes last year to 303 million tonnes . China, the USA and, to a lesser extent, the EU played a major part in the increase. Trade in soybeans is almost 60% determined by China imports . Compared to the previous year, imports are expected to increase by 7 million t to 89 million t. The EU-28, as the second largest importer, imports only insignificantly increasing quantities of 15 million tons. In addition, there are still 18.5 million tons of soybean meal deliveries to the EU. According to the USDA estimate, the global ending stocks fall by 10% to approx. 100 million t back. However, this still guarantees a supply situation that is significantly above average. The global rapeseed harvest remains unchanged from previous years by 4 million t compared to the previous month's estimate. The decisive factors are the low results of the two largest producers Canada (19 million t) and the EU (17 milliont), which together account for 55% of world production. Chinese and Indian rapeseed harvests are also rated lower. The inventories are in the lower average range. For the first time, palm oil production will lag behind the previous year's results . 85% of world production is generated in the two largest production areas, Indonesia and Malaysia. The slump in crude oil prices and the fear of CoViD 19 spreading among plantation workers has contributed to a reduction in palm oil production. Inventories are declining rapidly. Oilseed prices are a result of the interchangeability of the products are closely related to each other and are due to the oil used for biofuels affects fundamentally the crude oil price. The impending agreement by the oil countries to cut oil production has already brought crude oil prices out of the trough. The palm oil courses in Malaysia followed immediately. The rapeseed courses also show upward movements.After a short soar , the courses in the soy sector have returned to their original level.