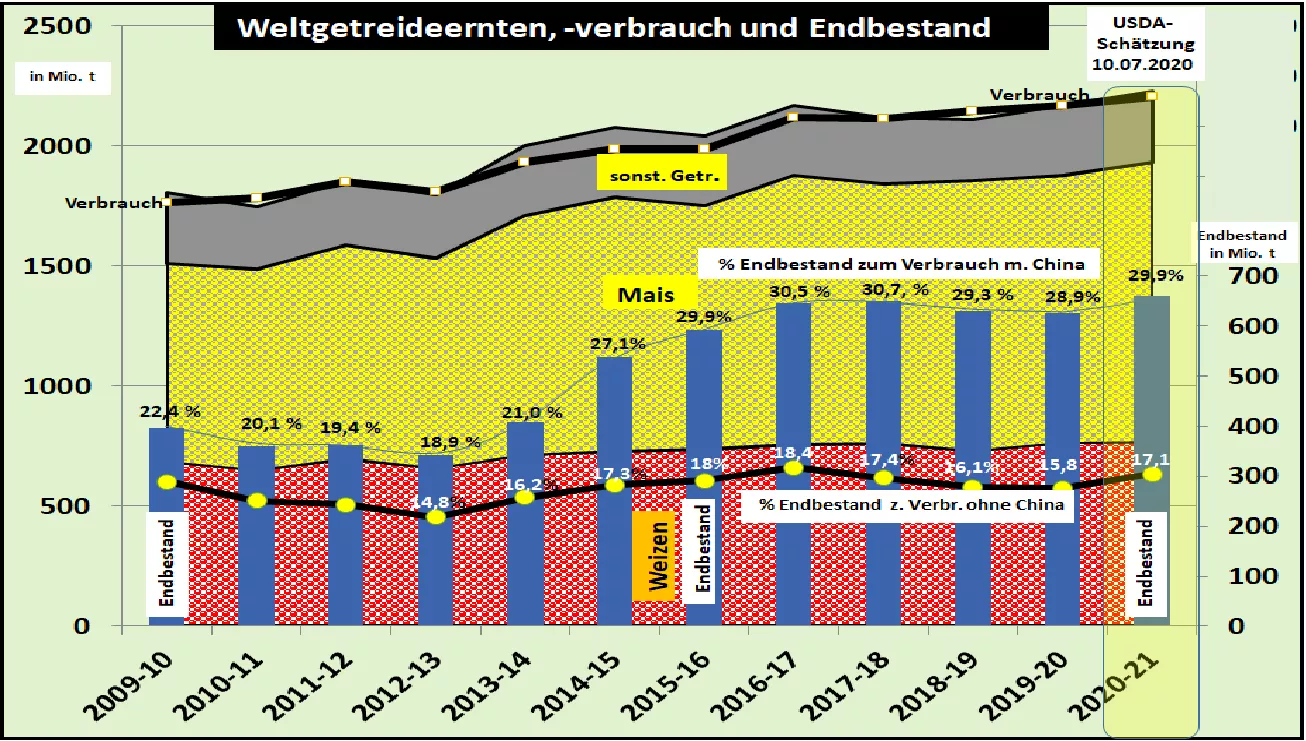

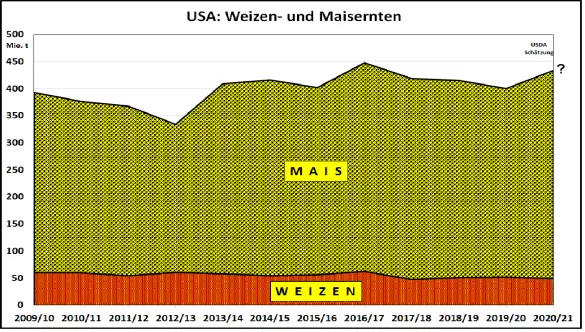

USD estimate cuts global grain production 2020/21 - wheat prices rise, US corn prices not In its July 2020 estimate of the global grain market 2020/21 , the US Department of Agriculture (USDA) cut production to 2,228 million tonnes a month earlier. However, this result is still 2.75% above the previous year. On the consumption side, 2,205 million tons are predicted or an annual increase of 1.7%. This results in an increase in final stocks of 35 million tonnes to 661 million tonnes. The supply figure increases from 28.9 to 30% final stock for consumption. That is still at the highest level. Without China, with weak participation in world trade, but with half of global inventories, the supply figures of 17.1% are significantly below the high level of previous years. This would make the supply situation in 2020/21 less predictable than in previous forecasts. Global wheat production cuts the USDA by 4 million tonnes lower to 769. million tonnes than in the previous month. The reductions for the US and EU wheat harvests are 1.5 million tons each.The wheat harvest is 5 million t higher than in the previous year. Increases are forecast in particular in Australia ( + 25%) , Argentina (+10%), Canada (+5%) , India (+3.4%) and China (+2.3%). Under-harvesting in the EU (-9%), Ukraine (-9%), North Africa (-5.5%) and the USA (-3.2%) largely offset the increase in production. Wheat consumption is estimated at 751 million tonnes a little lower than in the previous month, but remains slightly above the previous year's result. The global final stocks grow by 5 %% to 315 million tons. Without China, the overhang quantities are only half as high, but increase to a similar extent. Wheat stocks excluding China last for 89 days (previous year 85 days). In view of changing trading activities under Covid pandemic conditions , the supply situation should be classified more carefully.Global corn production will be cut by 25 million tonnes in the previous month to 1,163 million tonnes. The redemption is caused almost exclusively by the USA with a lower harvest of 381 million tonnes due to the area. The area yields were set above average despite acute dry periods in the US growing regions. Therefore, the US result should still be overestimated. The increase in the Mexican corn harvest by 30% compared to the weak previous year remains unchanged. Ukraine expects an increase of 8%. The previous year Global corn consumption is estimated to be 3.5 million t lower than in the previous month to 1,160 million t . The USDA assumes that corn use for bioethanol production will stabilize again in the coming marketing year. In the feed sector, too, higher consumption quantities are predicted due to the large number of animals. The global inventories of corn will be of 338 million tonnes in the previous month to 315 milliont reduced and mathematically sufficient for 99 instead of 106 days. Without China, the range is 50 days compared to 45 days in the previous year. There have been no significant changes to the rest of the grain . For the EU-28 , the USDA estimates a total harvest of 303 million t, of which 139.5 million t wheat. Union exports are expected to drop from 48 to 37 million tonnes. Imports should remain largely the same. The USDA calculates the EU surplus stocks to approx. 26 million t, 2 million t lower than in the previous year. Due to the delay between reporting and publication, the recent results of the extremely weak wheat harvests in France and the UK have not been taken into account. Russia also has threshing results that fall short of previous expectations. The USDA publication of the global grain supply, which is usually delayed, is likely to be too cheap due to the known or foreseeable lower area yields.This applies in particular to the maize harvest with the majority. In a first reaction, the wheat prices on the Chicago stock exchange rose to the equivalent of 176 € / t . The previous upward trend has thus continued. However, the US corn prices fell below the € 120 / t mark. On the Paris stock exchange, wheat prices are € 186 / t and corn are € 166 / t, and the trend is rising. European grain prices continue to be capped by global price developments despite the weak harvest prospects here.