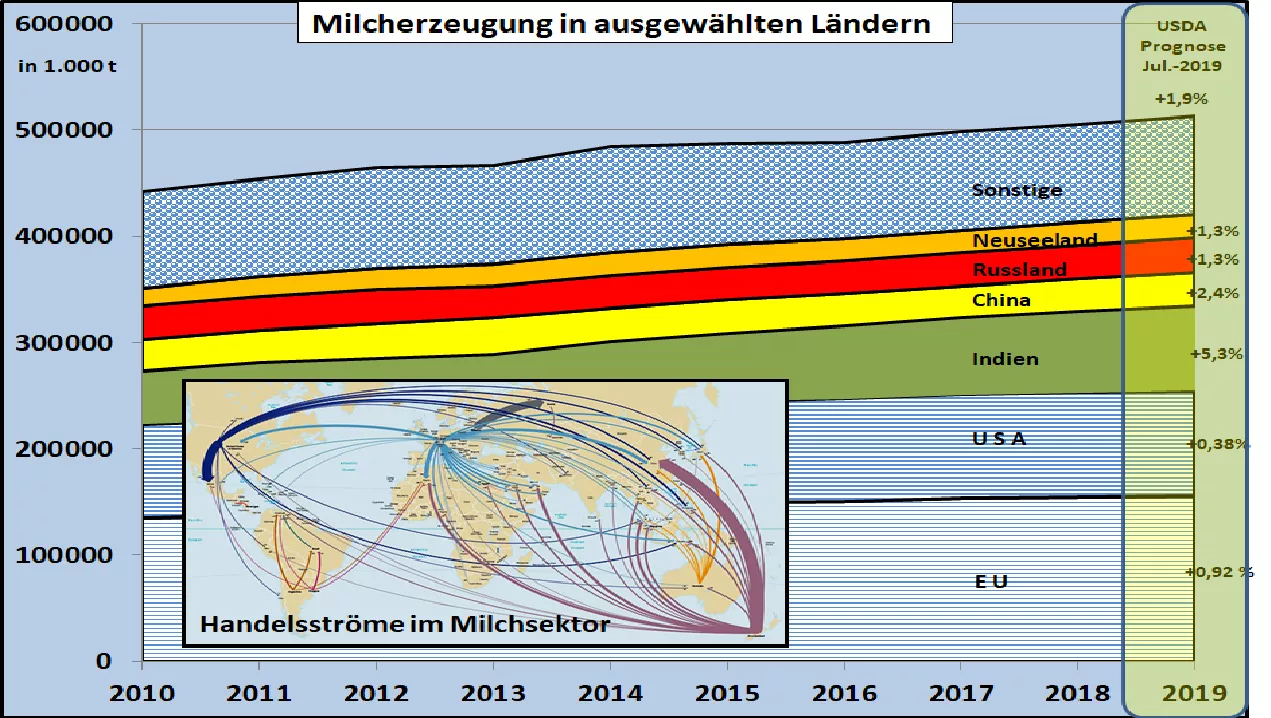

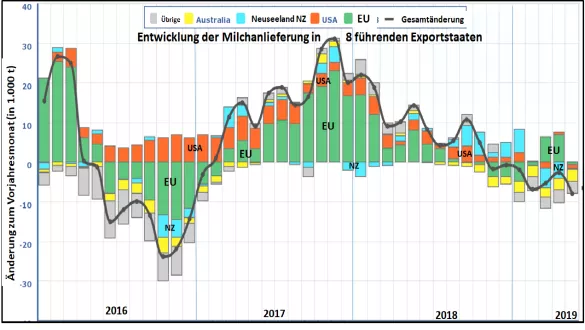

USDA: Milk Market Half-Yearly Report 2019 The 2019 milk market is growing at +1.4% worldwide, less than originally forecasted. The reason for this is weather-related feeding shortages in the major production and export areas. This is largely due to large production areas such as the EU with a market share of 30%, whose milk production increase is estimated at only 0.9% instead of 1.5. The US (20% market share) also fell short of expectations with an increase of 0.37% . It had been believed to reach the magic mark of 100 million t. Although New Zealand only has a milk production of 22 million tonnes (7 times smaller than the EU), it is the world's largest exporter of dairy products with an export quota of 95%. However, the weather in 2018/19 did not play a role in the almost entirely pasture-based milk production in order to reach the targeted record of 22 million t. Australia has fallen from its previous 12 million tonnes of milk production to 8 million tonnes.Repeated droughts in the southeast of the country have led to a significant reduction in herds of cows. The only average milk price level also provided little incentive to increase production on a larger scale. China is slowly increasing its milk production to 31 million tonnes with government aid. For reasons of competition, dairy cattle farming must concentrate on the low-yielding north of the country, but does not have a closed cold chain so that fresh dairy products can only be sold in the immediate vicinity. However, the consumption of dairy products is found in the port-related cities and in the south of the country, where rice cultivation dominates. The supply deficit is huge and can only be solved by increasing imports. On the consumption side , country-specific differences can be identified for fresh milk products . India, China and Australia are seeing rising trends, while stagnating sales are more likely to be seen in the US, the EU and other developed economies. Global butter production is too tight in line with rising consumption.India, with a 50% share as the world's largest producer, needs its growing production in its own country. However, EU exports as the second largest producer are on the decline. Then only New Zealand remains, that its exports have not brought back to the old state after a slump in previous years. Butternotierungen are in the highest price range. On the other hand skimmed milk powder prices do not return to the long-term average level. The reason is the continued strong export offer of the market leader EU. The US is also moving at a high level of exports. New Zealand is currently returning to earlier export volumes. The import demand of the leading countries Mexico, China, Philippines, Indonesia and Algeria is only slowly increasing. For milk powder no increase in demand is recognizable worldwide. The largest importer with 50% market share China only increases its imports moderately. The world's largest producer and exporter New Zealand has difficulty selling its growing production. The EU supplies the moderately growing North African market with Algeria at the top.Whole milk powder prices are in the midfield In contrast, cheese production faces a steadily growing demand. The EU has a market share of 50% in production and consumption. The US comes to approx. 25%. For international exports , the EU exports 40%. The US and New Zealand each create only half of it. Cheese imports are more or less evenly distributed with a growing trend in Japan, South Korea, Mexico and Russia. Global milk prices are being pulled up by the above-average level of butter prices. Cheese also supports this development. By contrast, the two milk powders are more of a drag, albeit not as strong as in recent years, with high levels of EU intervention stocks of skimmed milk powder. In recent years, upward trends have been apparent after the seasonally weak summer phase.