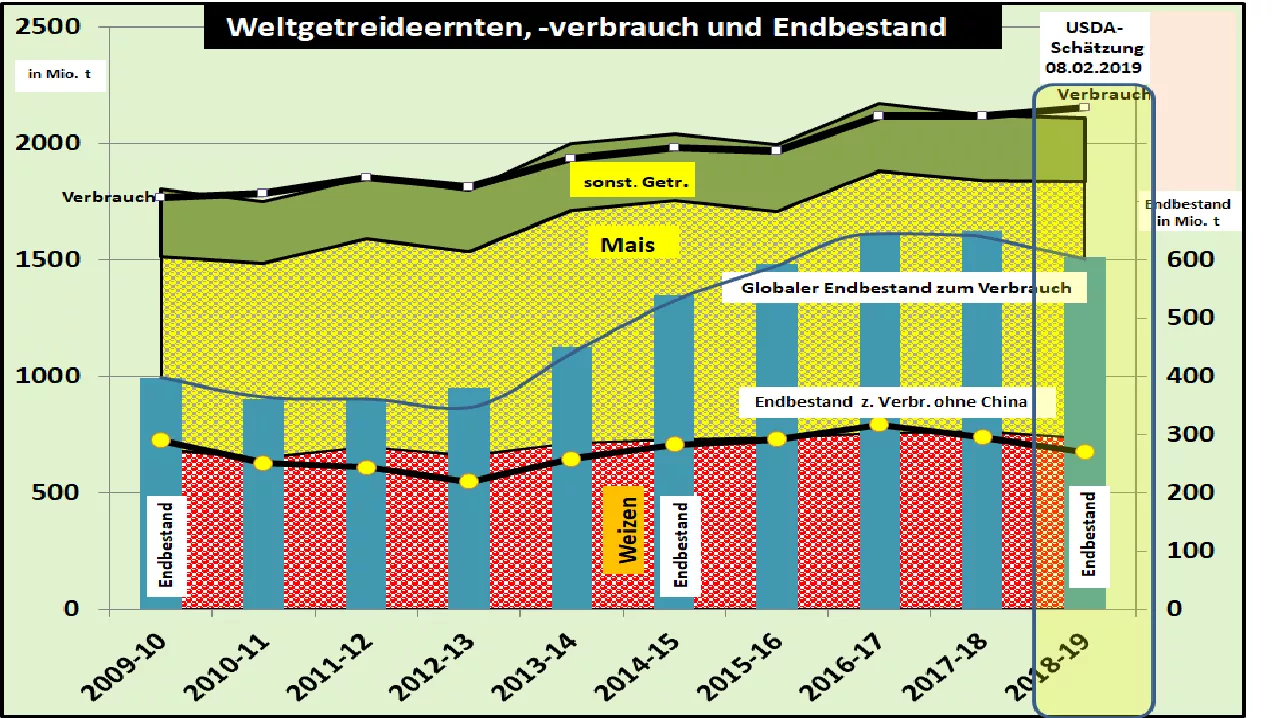

Breath of relief: the USDA report of Feb. 8, 2019 provides fundamental directional data once again The so-called shut-down in the USA has prevented the ongoing reporting on developments on central agricultural markets from being published in January 2019. Now temporarily suspended measure has at least brought the monthly report in February the world situation on the cereals market concluded the latest assessment of the supply situation in the global grain market has hardly changed. The world wheat harvest was raised slightly to 734 million t (2017/18: 763 million t) in December-18. The remainder of the grain harvest was slightly adjusted downwards. Compared to the previous year , volumes are estimated to be 16 million tonnes higher at 1,372 million tonnes. Worldwide consumption of cereals exceeds the volume of current production of the year by approx. 48 million tonnes , which must be served from the stock of inventories .Wheat accounts for a deficit of 13 million tonnes , while in the feed crops sector, approx. 34 million tonnes missing Global final stocks fall by 7% to approx. 600 million t or 28% of consumption. The surplus quantities without China drop from just under 300 to approx. 270 million t. This means that the global supply situation is significantly lower than in previous years. The lower wheat harvests in the current marketing year are almost entirely attributable to drought-related losses in the EU of 137 million t (-14 million y / y) and the decline in Russia to 71 million t (-14 million tonnes) and Australia (-2 million tonnes) Fewer cereal crop yields were down on the one hand due to losses in the EU of -5.5 million tonnes and Russia of -7 million tonnes. t and the USA with -4 million t.On the other hand, there are positive results of higher harvests, above all Argentina with just under 54 million t or + 38%, Ukraine with +10 million t or + 30%, Brazil with +12 million t or +14% and some smaller ones Production areas For the EU-28, the USDA calculates a flat grain shortage between production and consumption of around 6 million tonnes. However, the different trade flows of each Member State should be taken into account, depending on the conditions of supply and distribution. High wheat grades amounting to 6.5 million tonnes will be introduced, while average wheat grades of around 22 million tonnes will be exported. In the feed grain sector , an increased import volume of 22.5 million tonnes is estimated, while exports fall to almost 7 million tonnes. The overhang stocks are to be increased from 30 million t to 24 milliont fall, the lowest supply for years. The low EU surplus stocks are a prelude to supply in the coming year The first reactions on the Chicago Stock Exchange was a slight increase in wheat for the delivery months of March and May. The increased level of the rear appointments in the coming 2019/20 fiscal year remains largely unchanged. By contrast, corn prices fell slightly. In this case too, the higher prices of the later dates showed relatively little movement. On the Paris stock exchange , prices showed slight upward trends. March dates rose to € 203.25 / t in the case of wheat and corn closed at € 176.25 / t.