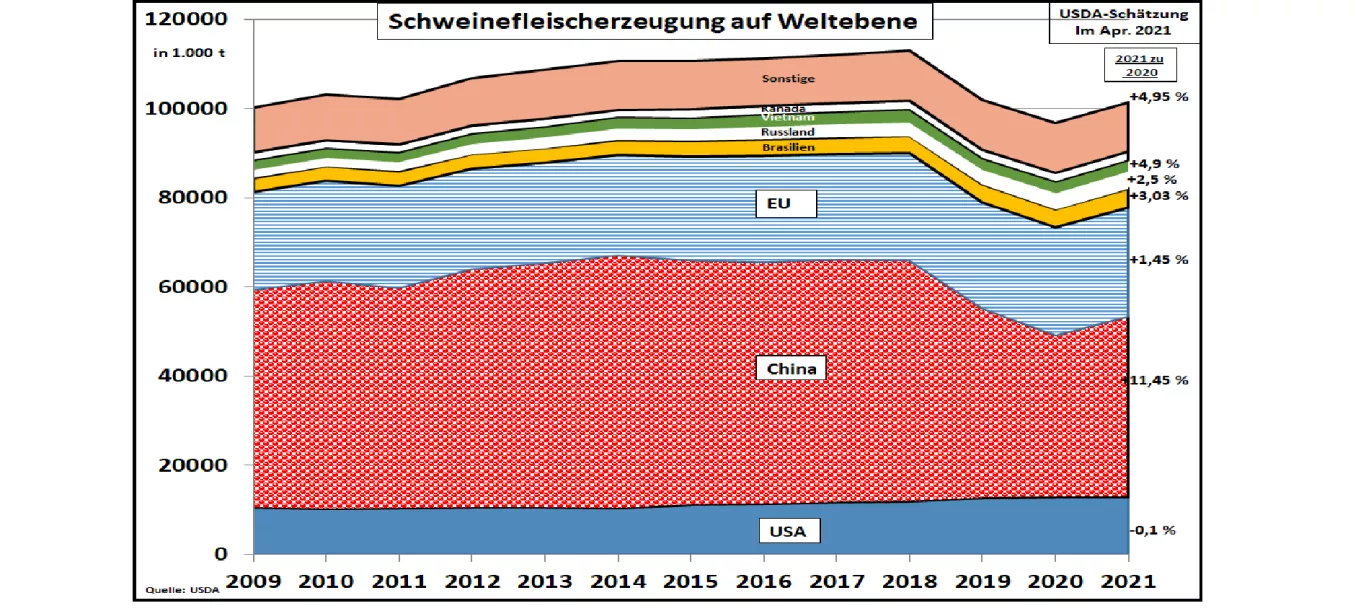

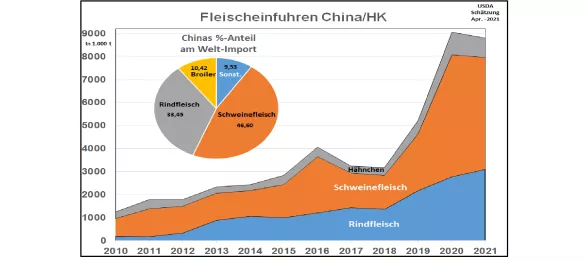

USDA: Global Pork Production 2021 Lower Than Expected Global pork production in 2021 is expected to improve by almost 5% compared to 2020, but remains below 90% compared to pre-ASP 2018. The US Department of Agriculture (USDA) has the earlier result in its most recent quarterly estimate of global pork production in early April Reduced by around 2 million t in 2021. The main reason is the resetting of the Chinese numbers after the recent ASF outbreaks that have become known and the lower than assumed productivity in piglet production. The high Chinese feed costs also contribute to the reduction in production with reduced slaughter weights. Consumption in the Middle Kingdom is also revised downwards. Therefore, imports of 4.85 million tons of pork are estimated to be significantly higher than was assumed in January 21. However, the high import figures of 2020 of 5.28 million t are not expected to be reached again.For comparison : in 2018 before the ASF outbreak, imports amounted to 1.45 million tonnes of pork. After the soaring of the Chinese pig prices in the order of magnitude of the equivalent of 6 € / kg, the current exchange rates are around 4.70 € / kg with a possible further downward trend in the course of this year. The reasons for this are initially the increasing self-production with a seasonally flattening demand, but also the persistently high and inexpensive meat imports of beef, pork and poultry. For the EU-27 , the USDA estimates a slight increase in pork production to 24.5 million t and a slight increase in domestic market consumption of 20.1 million t. Accordingly, high exports of 4.4 million t are expected again (previous year 4.5 million t). Around two thirds of these go to China / HK . Spain receives the lion's share with deliveries of around 1.5 million t.After the month-long low in EU pig prices, a limited upward movement can be observed again. Spain and Italy rank at the highest level around 1.75 € / kg, while in Germany the ASP-related import bans in some third countries are also causing problems. The world's third largest production area, the USA , will leave pork production largely unchanged at 12.8 million t. A low US pig price level in 2020 with occasional quotations below € 1 / kg was the reason to limit the US pig population. The latest feed price increases exacerbated this development. Persistently high domestic demand and exports will ensure rising prices at the beginning of 2021 , which reached 1.80 € / kg in April 21. In view of the usual high summer demand, a tendency to increase cannot be ruled out. However, US exports are becoming less competitive.Brazil's rising pork production is expected to continue a little in 2021 at 4.25 million t , but remains significantly below previous forecasts of + 3.5%. As in previous years, exports with significant support from deliveries to China are estimated at an increasing 1.25 million t . For comparison: in 2016 it was just 0.6 million t. After a short soaring at the beginning of the year, Brazilian pork prices have landed again at 1.15 € / kg. A weak currency contributes to this. In view of the price differences to the USA, the Brazilians are gaining in competitive power, especially in the Asian business. Canada's pork production is expected to remain unchanged at 2.1 million tonnes in 2021. Exports also stabilized at 1.53 million t . After the political tensions surrounding the arrest of the chairmen of the Huawei group have been resolved, China will become a growing market for Canadian pork.Russia 's rising pork production of 3.7 million t goes beyond the level of self-sufficiency and is increasingly moving into the focus of the global pork trade. However, the quantities of 0.17 million t are still comparatively small. Small deliveries are concentrated in neighboring Russian countries. Exports to Vietnam and Hong Kong are already becoming more important, but have not yet reached the usual international levels. In view of the growth dynamics to date, the question arises whether Russian production can compete in terms of price in international business. So far, Russian pork prices have moved between 1.50 to 2 € / kg and sometimes even more. There is also the ASP problem that has existed for 15 years.