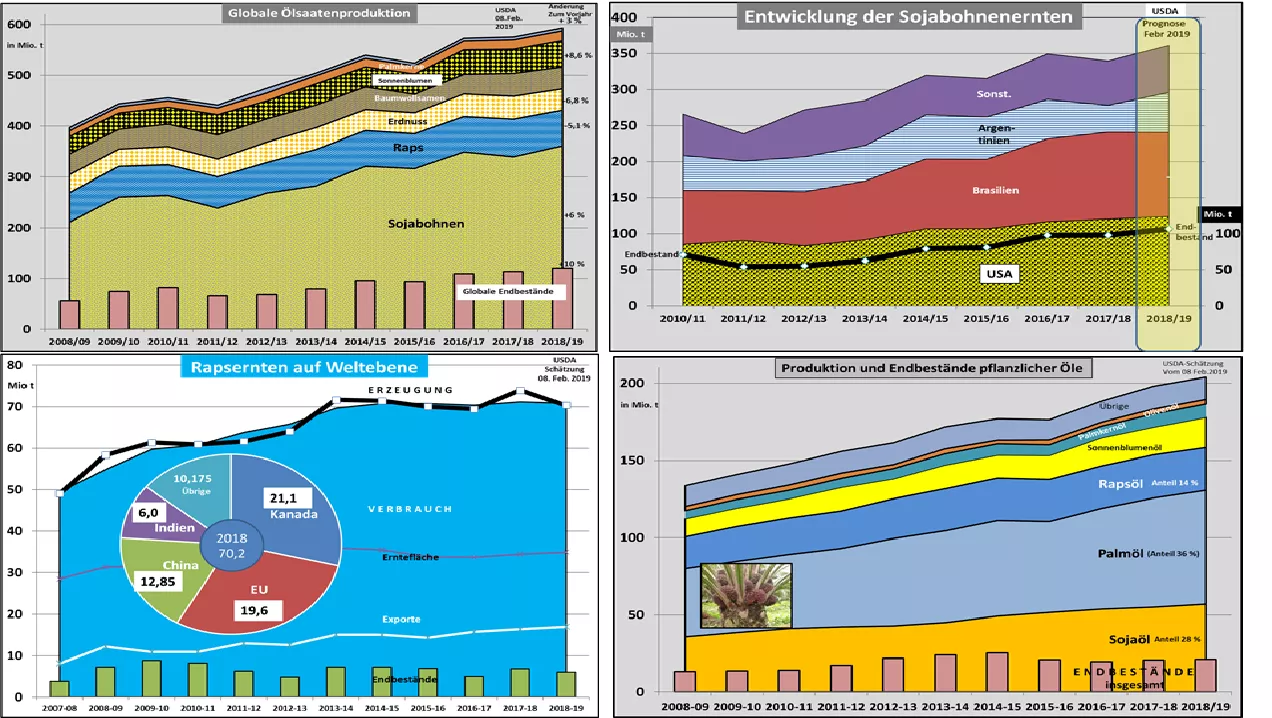

Reductions in soya harvests - continued tight rapeseed supply - palm oil mined The USDA estimates oilseed production in 2018/19 to be 3% above the previous year's level in its most recent Febr.19 issue. Soybeans have a production share of more than two-thirds, rapeseed averages 15% and sunflowers stay just below the 10% mark. Worldwide soybean production is more than three quarters determined by the US and Brazil . For 2018/19 a harvest of 6% is estimated over last year. Earlier forecasts for the US, Brazil and Argentina, however, had to be revised downwards . Due to the unfavorable weather conditions - too dry in Brazil, too wet in Argentina - the current harvests in South America are still more question marks. Nevertheless, production remains well above consumption, with the result that final stocks rise again. For the following year , however, lower harvests are expected due to a decline in acreage .The second market leader in the vegetable oil palm oil sector has again made significant gains for the current marketing year. At the end of 2018, inventories of 3 million tonnes or about 70% of production were accumulated. Recently, however, these quantities have been reduced to approx. 2 million tons have been mined. The increasing blending share of biodiesel is causing market and price relief in Indonesia and Malaysia. After the price depression at the end of 2018, prices stabilized at a higher level. In Malaysia, $ 538 per tonne was again quoted for Jan-19, while $ 489 per tonne was paid in Dec.18. For the remaining months, palm oil production continues to fall for seasonal reasons. The next seasonal highlight is expected again in Oct.-2019. The USDA estimate of the world's weakest rapeseed harvest of 70 million tonnes remains unchanged. The losses in the EU make a significant contribution to this. Canada's record canola harvest of a good 21 million tonnes is difficult to market.The Arctic temperatures in the Canadian production areas prevent and prevent the removal. Market observers report high stocks on the farms and central collection points. Moreover, China has not bought to the expected extent. With rising temperatures, therefore, a rising supply is expected in the near future. In the EU , the prospects of a continued tight rapeseed supply remain due to the reduced acreage . Stock market prices in the soya sector have increased slightly. In general, an upward trend is expected for the coming delivery months until the end of 2019. The rape courses in Paris tend to weakness again. After a recovery period, the recent Canola courses on the Winnipeg stock exchange again show signs of weakness. The offer of the two market leaders soy and palm oil is sufficiently large to compensate for the scarcity in the rapeseed sector. Reason is the high degree of interchangeability of vegetable oils in the reuse.Therefore, there is fierce competition, in which the rapeseed market has only the matching role.