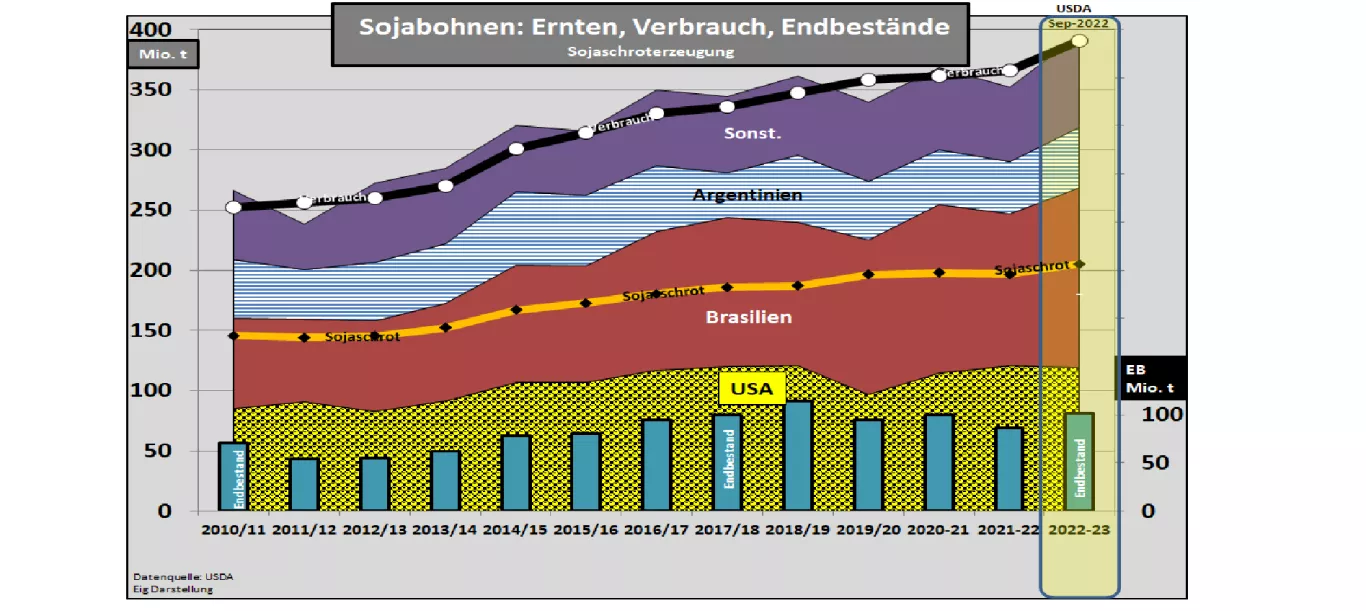

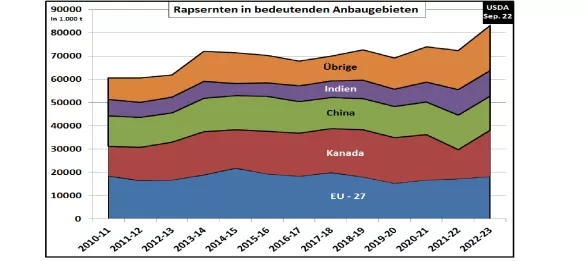

USDA estimates higher oilseed production in 2022/23 and even higher consumption In its September 22 estimate, the US Department of Agriculture (USDA) forecast the oilseed harvest for 2022/23 to be 7.1% higher than in the previous year at around 645 million t. However, the ending stock will decrease slightly due to an even stronger increase in consumption, but will still remain at a comparatively high level. Mathematically, the inventories are sufficient for 81 days, compared to 77 days in the previous year. The decisive increase is due to the higher harvests in the soybean sector. The USDA expects a worldwide increase from 353 to 390 million t. The additional volumes are mainly due to the record Brazilian soybean harvest and the expected high US harvest of 119.3 million tons in autumn. With 51 million t, Argentina only achieves a just average result. Increases in soybean consumption are reflected in falling ending stocks throughout the oilseed sector.China in particular stands out with imports of 97 million tons or 58% of world trade. The own soya production only suffices for 18.4 million tons. When it comes to soybean exports , Brazil is in first place with an expected volume of 89 million tons. The USA will not quite be able to maintain their exports of 56.7 million t in 2022/23. The EU cuts its soybean imports to 14.8 million tons; in addition, there are 16.8 million tons of soybean meal imports. The USDA estimates global rapeseed production at around 83 million t , which is 10 million t (!) more than in 2021. After the catastrophic previous year, Canada is expecting a harvest of 20 million t and exports that have almost doubled from 8 .5 million t. A harvest of 18.15 million t is expected in the EU , the import requirement is estimated at 5.7 million t. With 6.6 million t, Australia will have the second highest rapeseed harvest, around 75% of which will be exported.The drop in production of sunflower seeds in the Ukraine from 17.5 million tons last year to 10.5 million tons this year is causing a shortage of other oilseeds . The EU crop falls slightly behind. Argentina and Russia , on the other hand, are increasing their production so that the total decreases only slightly. The USDA estimates global palm oil production at 79 million t (previous year 76 million t). The increases are taking place in the two main producing countries Malaysia and Indonesia with a production share of 84%. The rising exports of the second market leader next to soya are putting prices in the entire oilseed sector under pressure.