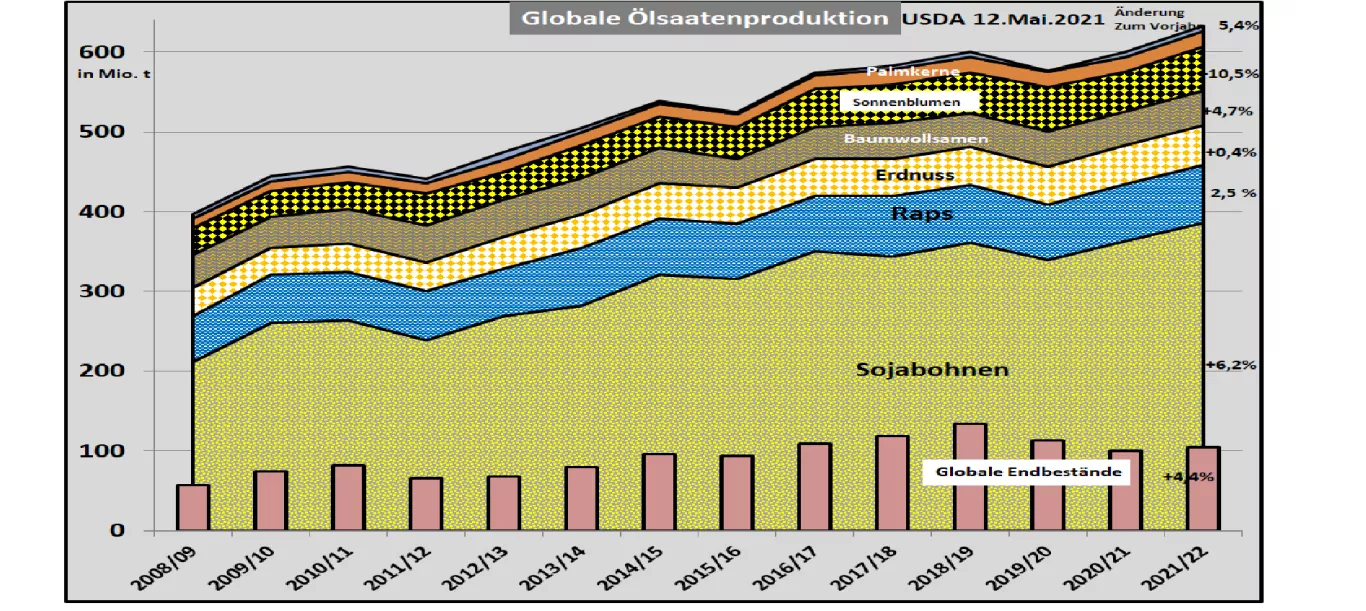

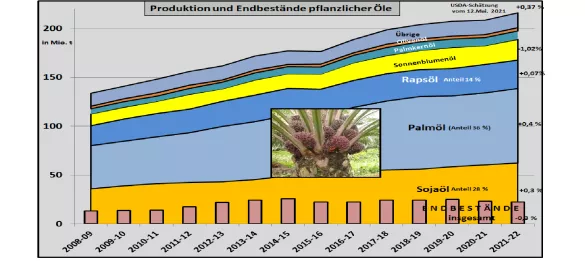

USDA May-2021: Global oilseed production up 5.4% year over year in 2021-22. In its latest May 2021 edition, the US Department of Agriculture (USDA) increases global oilseed production to 632 million t , around 33 million t higher than estimated in the previous year. All oilseeds are predicted to increase. The majority of the increases, however, are attributable to soybeans , which have increased to around 385 million t (previous year 363 million t). The rapeseed harvest is estimated at 73.2 million t (previous year 71.42 million t). The sunflower harvest is expected to recover from the decline in the previous year. The USDA estimates consumption at 531 million t (previous year 515). China accounts for the largest share of consumption with 138 million t (previous year 132 million t). However, the Middle Kingdom has to import 80% of the demand. This means that there is a strong Chinese influence on international market and price developments in the oilseed sector. The EU consumes a marginally increasing 47 million t and is thus in 4th place.Place after the USA and Brazil. The supply situation is characterized by a renewed increase in inventories of around 104 million t, but still lagging behind previous years . At 19.7% of the final stock of consumption, the supply figure is below the long-term average. The slightly increasing oilseed trade is largely determined on the export side by Brazil (soy) with a share of 47%, the USA with 29% (soy) and Canada with 7% (rapeseed). On the import side, the EU-27 ranks second among the importing countries after China with 11.5% . When it comes to EU imports , soy outweighs rapeseed. As one of the two market leaders, the soy sector has a major impact on the oilseeds market as a whole.The USDA estimates the coming Brazilian harvest in spring 2022 at a record high of 144 million t (previous year 136 million t). US soy production due in autumn 2021 is expected to just reach the 120 million t mark (previous year 112.5 million t). The Argentine harvest is expected to rise again to an average of 52 million tons after the previous dry year. On the demand side , China, with an unchanged 103 million tonnes of soybean imports, is of decisive importance for the market and price. The deliveries are increasingly coming from Brazil . The US share has decreased significantly. The EU, in second place among the importing countries, will import 15 million t of beans , largely unchanged; in addition there are 17 million tonnes of soybean meal . According to US estimates, the global ending stocks of soybeans will increase from 86.5 million t in the previous year to the current 91.1 million t .The supply situation is thus in the lower average range. However, there are still considerable risks, as most of the soybeans have not even been sown. The basis for the higher estimates are based primarily on the price increase-related area expansions. While the supply of soybean oil will continue to be scarce due to the strong demand, the soybean meal market is at an intermediate level. Palm oil production (2nd market leader) is suffering from the Covid-related shortages of plantation workers in the main production areas of Malaysia and Indonesia. In both countries, only a slight increase in production is predicted. The increase in demand is estimated at the same level. The current shortages in oil stocks are likely to continue in the future. That drives the prices of the oil-heavy oilseeds. The higher estimated global rapeseed harvest of 73 million t is in 1.Line attributed to the increasing harvest in Canada with 20.5 million t and the EU-27 with 16.6 million t. On the consumption side , the EU-27 is in first place with 22.6 million t , followed by China with 16.75 million t . Overall, the global rapeseed supply will tend to be even lower. The shortage of rapeseed will be felt in particular in the EU-27 as the world's leading importing country. However, the rapeseed prices are usually largely determined by the market leaders soy and palm oil . The rapid rise in the price of palm oil was interrupted for the first time at 954 € / t. On the Chicago stock exchange , soybean prices have fallen back below the € 500 / t line after their brief soaring. Soy meal (48% RP) was taken back in Chicago for the equivalent of 405 € / t.In Paris , the rapeseed forward rate for Aug 2021 fell to € 542 / t. In view of the extended weekend, the price development is to be classified as provisional.