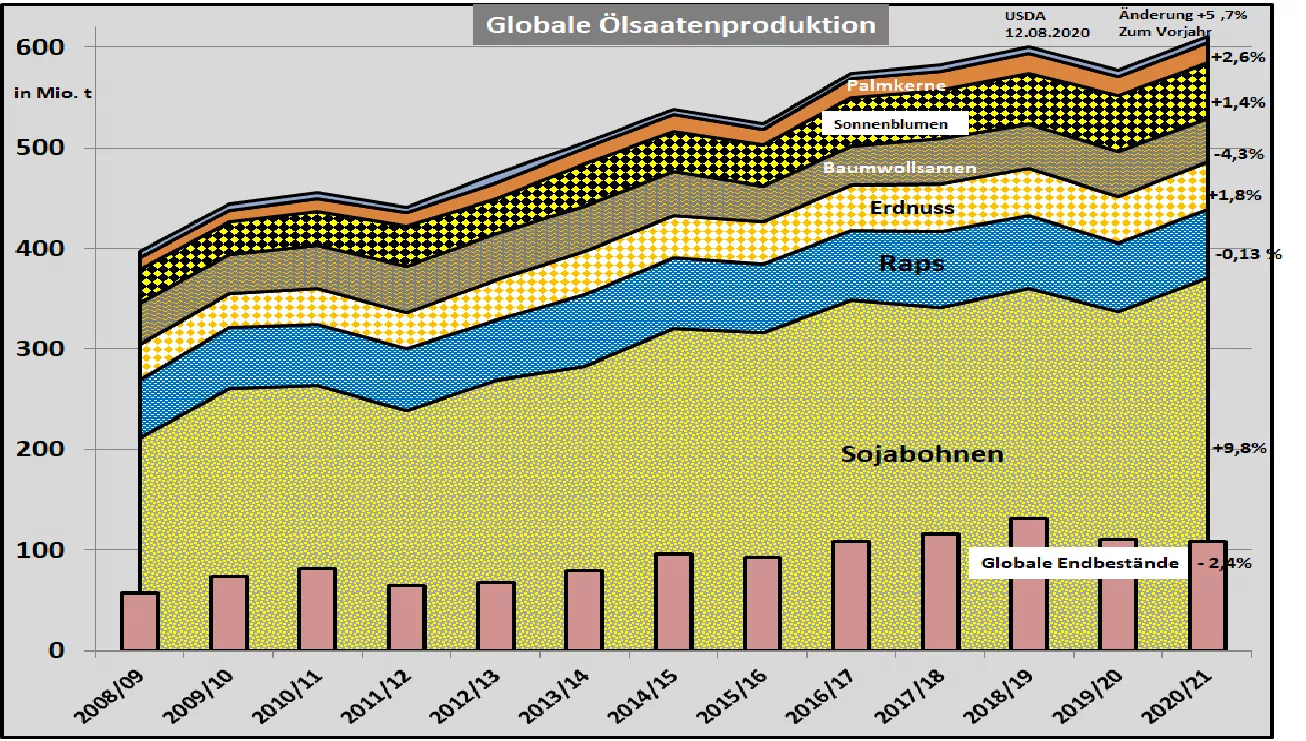

Oilseeds: USDA increases oilseed harvest in 2020 - soy grows sharply The latest Aug. 2020 estimate by the US Department of Agriculture (USDA) showed a global total harvest of 610 million t or approx. 5.7% higher than in the previous year. The increased soybean harvest with an increase of 9.8% played a decisive role in this. The global rapeseed harvest was revised down slightly. The remaining oilseeds were changed only slightly. According to the USDA report, the processing of oil seeds is expected to increase by 10 million t to 515 million t. This leaves a high excess stock of slightly reduced 108 million t. This means that the “supply” is sufficient for 76 days compared to 80 days in the previous year. The supply situation thus remains at an above-average level. The global soybean harvest reached 370 million tons. 60% of the world's oilseeds. The strong increase over the previous year comes from a Brazilian record harvest of 131 million.t and a significantly increased US harvest of 120 million t. Argentina only achieves a below-average 53.5 million t. The global trade in soybeans is determined by China with an import share of more than 60%. The USA increases the Chinese import volume to 99 million . t during this marketing year. According to USDA estimates, soybean processing is expected to increase by 12 million t to 320 million t. This means that the stocks remain at a high level at 95 million t and ensure a high level of security of supply . The rapeseed harvest at world level is approx. 68 mln t well below the level of recent years. Canada, the world's largest growing region, is 19 million t below the previous year's results. The EU falls even lower to 16.8 million t compared to earlier harvest quantities of over 20 million t. Global rapeseed consumption is estimated to be slightly lower at just under 70 million t.It follows that the closing stocks will halve compared to 2018/19. The supply situation drops from 47 to 23 days of supply. That is well below the multi-year average. The other oilseeds change little. The second market leader in the oilseed business alongside soybeans is palm oil with an estimated 75 million tonnes of harvest. The increase over the previous year is only slight at + 3%. The two growing areas in Indonesia with a slightly increased 43.5 million t and in Malaysia with 19.7 million t are decisive. The palm oil consumption is estimated at a somewhat larger 74.4 million. This means that the palm oil stocks remain at their high level of 10 million t. The above-average supply situation for soy and palm oil means there is little potential for price increases. The rapeseed market has to adapt to this situation due to the substitution options.The falling stock exchange prices in the soy complex have already given the direction. In Paris, the rapeseed price slipped well below the € 380 / t mark.