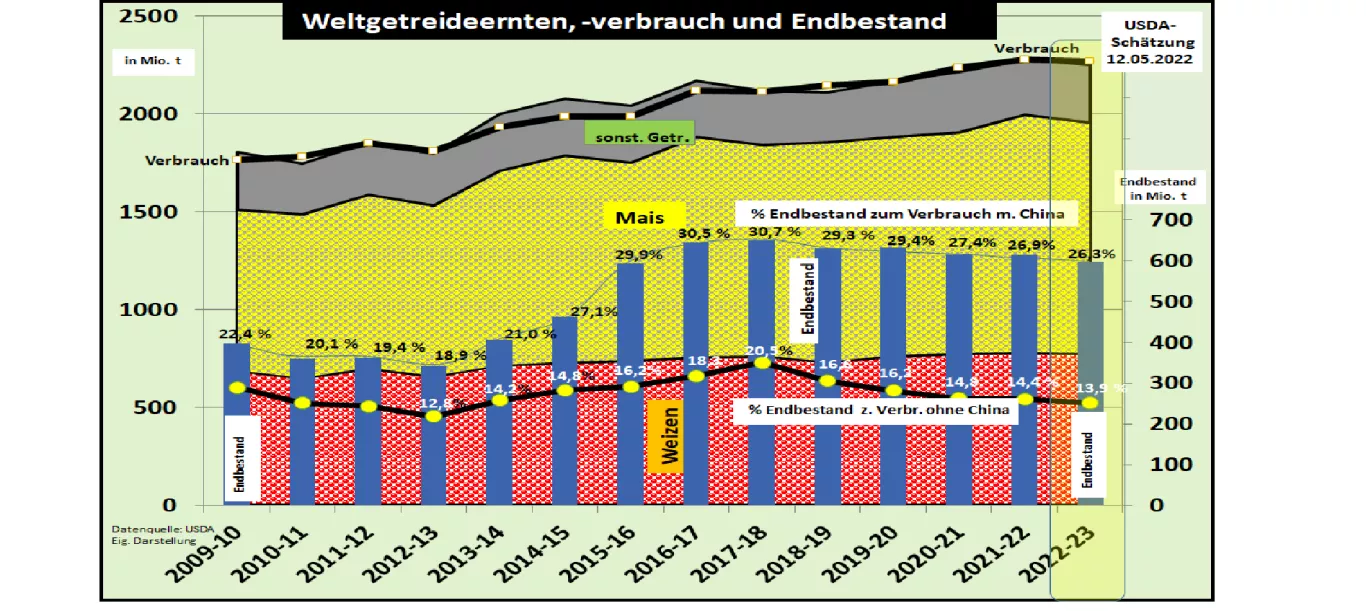

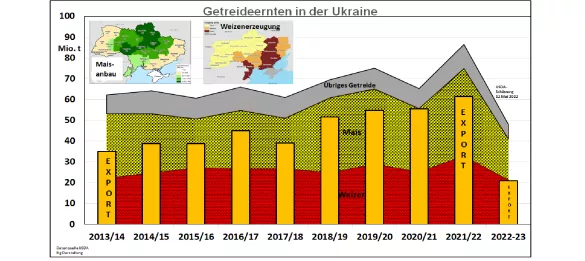

USDA estimates global grain supply for FY 2022/23 below previous year In its May 2022 issue, the US Department of Agriculture (USDA) estimated the world grain harvest for 2022/23 for the first time. The global production is estimated at 2,250 million t (previous year 2,280 million t). The decisive factor is the poor harvest in Ukraine due to the war. Global consumption is also classified as lower at 2,267 million t (previous year 2,287 million t). The ending stocks were calculated at around 597 million t (previous year 608 million t). The supply figure falls to 26.3% ending stock (previous year 26.9%) to consumption, excluding China to a declining 13.9%. The quantitative supply is still within the limits of previous years, but the assessment of the security of supply has become considerably more critical against the background of the war in Ukraine. Fear of supply has become a price-determining factor.In global world trade , the quantities were reduced to 433 million t (previous year 465 million t). In the case of Ukraine exports , an export quantity of around 20 million t (previous year 60 million t) is predicted; For Russia , the USDA estimates export quantities of 46 million tons of grain (previous year 42.5 million tons ). The export cuts are offset by export increases in Canada, the USA and the EU . Despite the threat of drought , India is expected to export wheat at the previous year's level. On the import side , the critical supply situation in the North African and Middle Eastern countries is confirmed with slightly reduced import volumes. China is to reduce its grain imports by around 10% . The USDA estimates the wheat harvest at just under 775 million tons , only slightly below the previous year's figure of 779 million tons.The world's largest producer, the EU-27 , will harvest only slightly less at 136.5 million t and export an increasing 36 million t. China's wheat harvest is estimated at 135 million tons with an import quantity of 9.5 million tons. For India , the USDA expects a wheat harvest of 108 million tons , of which 8 million tons are to be exported while stocks are reduced. For Russia , the USDA expects wheat production to increase by 7% to around 80 million tons; Russian exports are estimated at 39 million t (previous year 33 million t). The US harvest is estimated at 47 million t , of which 21 million t are exported. After last year's catastrophic result, a wheat harvest of 33 million t (previous year 21 million t) is expected in Canada , of which 24 million t will be exported. On the import side there are 28 countries that are existentially dependent on wheat imports .These include most countries in North Africa, with Egypt at the forefront, many countries in the Middle East and Southeast Asia. The USDA estimates the import volume to be only slightly lower than in previous years, but the high prices will still curb the import volume. The USDA estimates the global corn harvest at 1,181 million t (previous year 1,215 million t). This is compared with a consumption of 1,185 million t (previous year 1,199 million t). The arithmetical closing stock is reduced by 305 million t and lasts for almost 94 days as in the previous year. The US harvest is estimated at 367 million tons of corn (previous year 384 million tons). The decline is mainly due to the area, because more soya (without the need for N fertilization) is cultivated. The USA is expected to export 61 million tons of corn. The Brazilian corn crop is expected to deliver 126 million tons, of which 47 million tons are to be exported. A corn yield of 68 million tonnes is expected in the EU-27 ; 15 million t of imports are required to cover demand.A good harvest of 55 million tons is expected in Argentina , of which 41 million tons will be exported. Overall, global corn trade will increase noticeably compared to the previous year. In addition to the EU, major import regions, each with around 15 million tons, are Mexico, Southeast Asia and Japan . China is reducing its previous imports of over 20 million tons to this year's 18 million tons. The USDA report initially caused a sharp rise in prices on the stock exchanges . In Chicago and Paris, wheat is currently trading above 400 €/t again. In the case of corn , US prices jumped above the €300/t mark. The Paris Stock Exchange is currently trading rising €365/t corn .The later dates until autumn/winter 2022 indicate lower prices, but remain well above the range of 300 or 400 €/t depending on the grain type The assessment of the price development cannot be explained primarily on the basis of previous empirical values, but mainly from the point of view of tension-laden supply fears as a result of outstanding weather risks, high energy costs, uncertain supply chains and, last but not least, unforeseeable political and military developments.