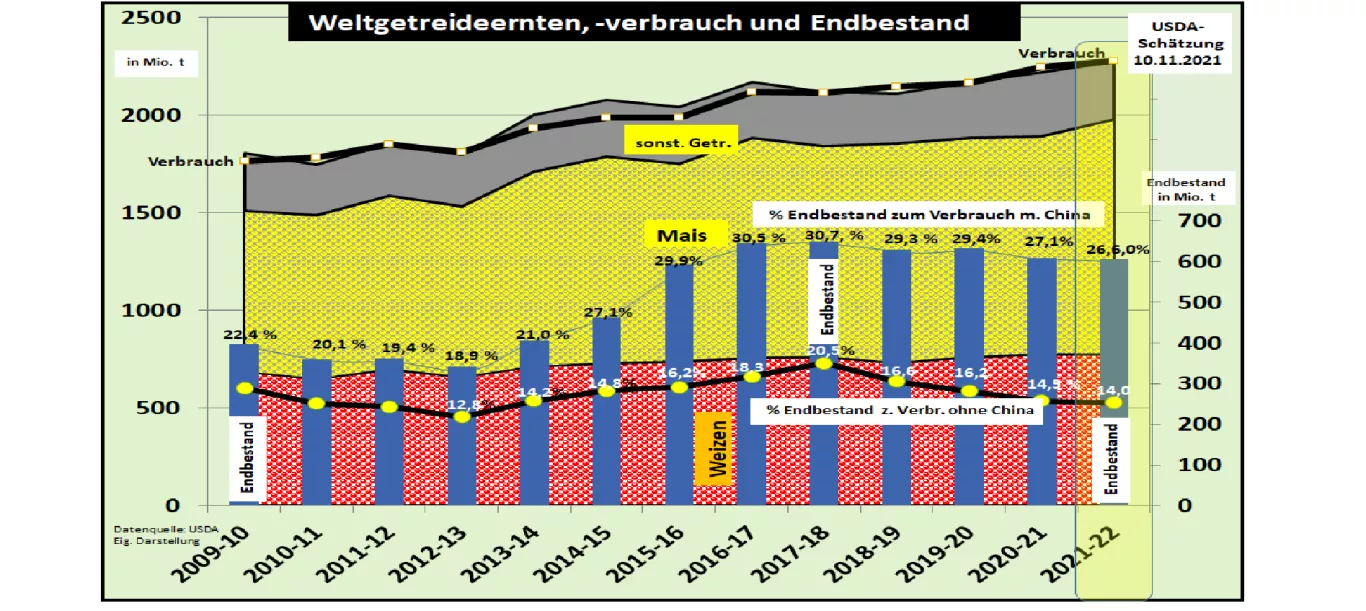

USDA cuts global wheat supply again, increases corn stocks In its Nov. 2021 edition, the US Department of Agriculture (USDA) estimated the world grain harvest in 2021/22 to be a little higher than in the previous month at 2,274 million t. Global consumption is also set to be somewhat higher at 2,278 million t. The inventories remain at around 605 million t. The pension figure remains unchanged at 26.6% of the end-of-life (previous year: 27.1%) of consumption, excluding China, a decrease of 14.0%. The multi-year development of a scarcer supply situation continues this year and is exacerbated by high transport and energy costs. The harvests in Russia with -15% (-12.5 million t) remain below the previous year, also in Canada with -27% (-18 million t). In the USA, wheat has lost almost 10% compared to the previous year. The cause in North America is the great heat wave in the northwest. In Russia, over-wintered stocks and poor grain formation were the main causes.In contrast, the harvests in Australia are still estimated at a high 47 million t. In Ukraine , the previously estimated record result of around 83 million t will only be reduced slightly . The USDA estimates the EU-27 harvest at around 294 million t (previous year 280 million t). The global wheat harvest will be reduced again to around 775 million t as a result of the losses in North America. Worldwide consumption is estimated at 787 million tons, somewhat higher than in the previous month. The consequence is a reduction in stocks (without China) to the supply figure from 21.1% final inventory to consumption (previous year 22.7%). Wheat exports from the world's largest exporting countries fell in Canada by -43% (-11 million t), in Russia by -6.5% (-2.5 million t) compared to the previous year. In contrast, increasing export volumes are expected in the Ukraine (+7 million euros).t) and the EU-27 (+6.5 million t) are expected. On the import side , however, a considerable increase from 194 million t in the previous year to 201 million t can be observed. The global maize harvest is classified by +6 million t to 1,205 million t compared to the previous month and is 7.6% above the previous year's result. Consumption is estimated to be slightly higher at 1,192 million t. The supply situation has improved by 12 million t compared to the weak previous year. Compared to previous years, the stocks in the maize sector remain in the lower middle range with 25.5% final stock of consumption (previous year 27%). The US corn harvest was increased again slightly to 382.6 million t (previous year 358.5 million t). Recent rainfall and a larger area under cultivation contribute to the increase. The US harvest, which accounts for around a third of world production and exports, has a major impact on global market and price developments. The harvest is in the final stages.After the weak result of the past FY 2020/21, the corn harvest in Brazil is expected to rise again to 118 million t in the coming year with 86 million t and a 35% decline in exports , but there are still risks for the second harvest after soy. In China , the maize harvest will remain unchanged compared to the previous month's estimate at 273 million t (previous year 261 million t). Favorable precipitation conditions in important cultivation regions more than compensate for the losses in the floodplains. Chinese corn imports are expected to decrease by 3.5 million t to 26 million t. Five years ago, China only imported 3 million tons. On the Chicago stock exchange , the USDA report triggered increases in wheat prices up to the equivalent of € 247 / t. December prices for corn are quoted at an increased € 189.50 / t. The prices on the Paris stock exchange followed with a time lag. December wheat is quoted at around € 287.50 / t and January 22 maize fell slightly to € 234.50 / t.The sensitive price situation is not only a consequence of tight supply-demand relationships but is also exacerbated by the bottlenecks in global transport with increased freight rates. Added to this are the poor prospects for the coming harvest as a result of the global fertilizer shortage and high fertilizer prices.