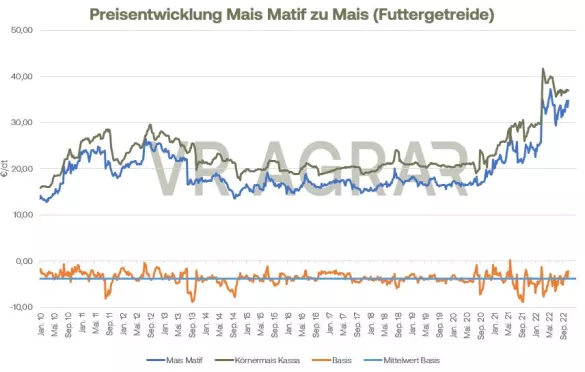

Politically - with this one word the weekly development on the grain markets can be summarized. Even if there was fundamental market news, Russia's exit from the grain agreement last weekend and the backward roll on Wednesday shaped the course of trade and the market for wheat and corn. Wheat contracts on the Euronext/Matif have also increased slightly on a weekly basis. Yesterday, the price on the display board was EUR 340.75 per tonne in the front month of December, a price that was EUR 3.25 higher than last Friday. Corn in the most traded February contract also increased by around 3 euros on a weekly basis. The future of the grain corridor continues to occupy the markets. UN Secretary-General Guterres yesterday called on Russia and Ukraine not only to continue implementing the agreement, but also to negotiate an extension of the agreement. According to plan, the agreement only runs until November 19 of this year. According to its own data, Ukrainian agricultural exports in the current marketing year reached a volume of 13.4 million tons of grain, including 5.1 million tons of wheat.According to the Istanbul Observatory, which is responsible for inspecting ships, since the agreement began on July 22, 9.89 million tons of agricultural products have been shipped, with corn accounting for the largest share at 43 percent and wheat at 28 percent. However, the main buyers were less poor countries, which should be particularly supported by the agreement. Spain, Turkey and China lead the list of buyers of Ukrainian agricultural goods. The cash markets in Germany remain calm. The Reformation Day and All Saints' Day holidays, which were celebrated in various federal states, certainly contributed to the low sales volume. The increased price level for wheat on Monday and Tuesday due to the temporary end of the grain corridor has therefore not prompted farmers to offer more goods. The spot market listings have mostly increased on a weekly basis. Overseas, yesterday's export figures caused wheat prices to correct slightly downwards. With a sales volume of 348,100 tons, the lower end of the analysts' expectations was met. The US dollar, which has risen again, is further depressing the mood on the CBoT.Support was provided by the latest crop report, which assessed winter wheat stocks in the USA at just 28 percent in good or very good condition. Usually, at least half of the holdings are in the top two rating categories at this point. Little rain on the Great Plains and warm temperatures have hurt wheat stocks. In Argentina, the grain exchange corrected its forecast for this year's harvest again by 1.2 million tons to 14 million tons of wheat. The country continues to be plagued by a severe drought, although there were occasional rain showers last weekend. On the Matif, corn contracts were firmer on a weekly basis. The small harvest in Germany and in Europe as a whole is providing price support and at the same time low turnover in the cash markets. Traders are expecting less corn acreage in the coming season, particularly in south-west Germany. Because of the bad experiences this year, many farmers have already switched to winter wheat, malting barley or rapeseed, as they expect better harvests here. However, these developments have not yet been confirmed.With the most recent FED decision to raise interest rates by another 75 basis points and the statement by the FED President that interest rates should continue to rise into the first quarter of 2023, the US dollar again appreciated significantly, clouding the prospects for the US -Exporters on. Mais corrected in the wake of the decision. In addition, the interest rate decision also ensured that the risk of a recession has increased further, which could dampen demand, especially for ethanol production. However, ethanol production numbers picked up in the US Energy Agency's latest report.

ZMP Live Expert Opinion

Russia influences the market. Whether with their own large harvest, the threats against Ukraine or the recent back and forth in the grain corridor. The markets will continue to look to Kyiv and Moscow. The uncertainties remain, the price level remains high but volatile.