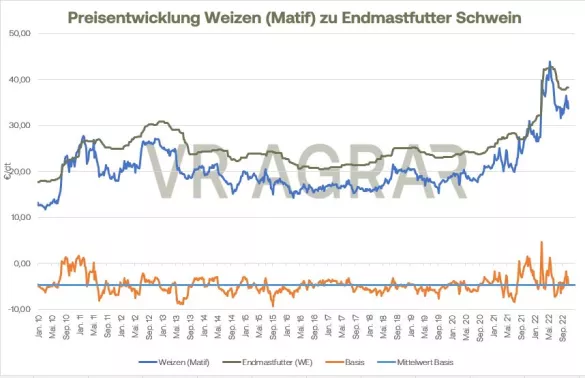

Wheat prices fell on both exchanges on a weekly basis. Last Friday, a settlement of EUR 339.25 per tonne was on the display board for the December contract on the Euronext/Matif in Paris. Yesterday, Thursday, it was still EUR 328.25 per tonne. Matif corn in the new front month of March 2023 lost EUR 12.25 per tonne in the same period and closed at EUR 321.25 per tonne on Thursday. With the start of trading on Friday, there are slightly green signs at the end of the week. The grain markets are still watching the situation in Ukraine. The previous deal expires on November 19, an extension is not yet known. Appropriate demands for the future of the grain agreement came from both the Russian side and the Ukrainian side. The United Nations also reaffirmed their will to continue the agreement. However, it is still questionable whether the demands from Russia in particular for more Western imports of Russian agricultural goods can be implemented. On Wednesday, the USDA released its monthly WASDE estimates of global production, consumption, and ending inventories.Although the Ministry of Agriculture reduced the production estimates for Europe and Argentina, these lower volumes can be offset by better harvests in Australia and Kazakhstan. The USDA experts increased global production volumes slightly and expect higher ending stocks compared to the October estimate, despite a slight increase in consumption. Compared to the previous year, however, the ending stocks are estimated to be significantly lower, as before. For Europe, the USDA continues to expect an export volume of 35 million tons. In the current export statistics, European exports have reached around 12 million tons and are thus above the volumes of the previous year. The favorable exchange rate against the US dollar had recently increased the competitiveness of European wheat prices. This week, however, the euro has stabilized again and has now been trading above parity since November 7th. Reports from Argentina confirmed the suspicion that the wheat harvest in the country was well below average. After a wheat harvest of around 22.15 million tons last year, the USDA only expects a harvest of 15.5 million tons due to the drought.The grain exchanges in Argentina are more skeptical. Yesterday, the Rosario stock exchange lowered its own estimate by 1.9 million tons to 11.8 million tons of wheat harvest, the grain exchange in Buenos Aires last week reduced its forecast to 12.4 million tons. The drought in the country is having a significant impact on plant growth. Weak export figures for US corn and negative indications from the wheat markets also caused corn prices to fall on both sides of the Atlantic. In the WASDE, the USDA once again cut its forecast for the European corn harvest, which did not give any impetus to the contracts in Paris. Globally, the production volume in the November WASDE hardly changed compared to October, the ending stocks were also corrected slightly downwards. European corn imports are very dynamic. Until 30.10. these are 9.57 million tons and thus more than twice as high as at the same time last year.

ZMP Live Expert Opinion

Geopolitical tensions remain. No breakthrough for the grain agreement is in sight yet. The chances of a continuation have recently improved from the perspective of the markets. The bountiful Russian harvest remains a drag, as does weak US export demand. Even if prices have fallen this week, there is little to suggest that the general price level will soon be abandoned – both upwards and downwards.