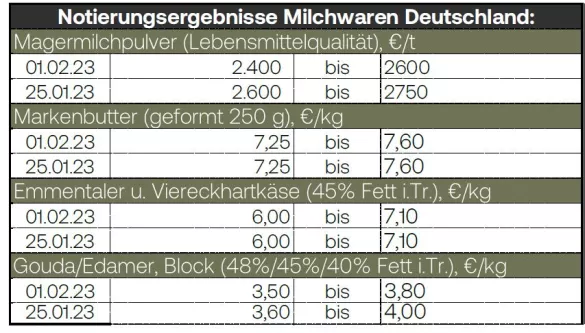

The increase in milk volume did not continue in the third week of January. Compared to the second calendar week, the dairies recorded 0.3 percent less raw milk. In the first three weeks of 2023, however, a total of 4 percent more milk was served than in the first three weeks of 2022. The price of cream has recently stabilized. Skimmed milk concentrate was relatively scarce and was therefore also able to stop the downward trend. The listing on the spot market fell by one cent. The Ife Institute in Kiel determined a national average price of 31.3 cents/kg. The milk volume has also recently increased globally. More raw milk was produced in Europe and the US in November 2022, but supply in the southern hemisphere shrank slightly. In the case of the first dairies, there are indications that there will be a significant drop in the prices paid. The significant drop in consumer prices is a major topic on the butter market. These are on average for the 250 gram pack at 1.59 euros / piece. The consumer prices are thus following the prices for block and formed butter, which have been falling for some time. Overall, the shaped butter market has recently picked up again somewhat, and orders have become more lively.Also due to the new contracts with food retailers, some of the calls for formed butter are going better than many market participants had expected. The price quotations for block butter are falling again this week. However, call-offs have increased again recently and demand for short-term supply contracts has continued to pick up. In the clear expectation of further price reductions, buyers continue to refrain from entering into any medium or long-term block butter contracts. Slightly firmer prices for block butter were recently seen on the EEX in the front dates. However, trading activities on the Leipzig stock exchange have recently decreased again. The downward trend in cheese prices that has existed since the beginning of December continues this week. The listing commission in Hanover lowered the trading range for bread products at both ends by 10 cents to 3.80 to 4.30 euros/kg. Block goods fell by 10 cents at the lower end of the trading range and by 20 cents at the upper end to 3.50 to 3.80 euros/kg. orders and business activities in the food retail sales channel are stable and extensive. However, not all of the cheese producers' expectations were met in terms of the quantities called off.Large consumers are hesitant and only order what they need in the next few weeks; they don't want to commit themselves in the longer term. The recent fall in cheese prices means that German and European cheese products are once again internationally competitive. Demand from third countries is definitely more lively than it was a few weeks ago. There are also increasing inquiries from Eastern Europe and Spain, which also result in business deals. Inventories continue to build up despite increased export calls. The age structure of the warehouses is increasing. Food grade skimmed milk powder continues to be under pressure with the turn of the month. The South German Butter and Cheese Exchange cut the listing by 100 euros at the top end of the trading range and 50 euros at the bottom end. Due to the higher milk deliveries since November, inventories have increased significantly and are putting pressure on manufacturers to sell. Demand from customers is still below average.At least the exporters have hopes that China will soon be appearing again as a buyer - also in Europe - after last week's New Year celebrations. On the EEX, contracts across all maturities went south, although the fall in prices had less of an impact than the prices on the spot markets. The trading activities for feedstuffs are still subdued, the prices were also reduced here. Trading activities for whey powder were also subdued in the past week. The availability of raw materials has grown due to higher cheese production. Prices for whey powder are very heterogeneous within Europe, which is why there are also significant price discussions with buyers here. Demand is calm on the world market. Industrial customers show little demand for whole milk powder . Although the number of inquiries is increasing slightly, business deals are rarely concluded. In international competition, the local whole milk powder prices continue to lack price attractiveness.

ZMP Live Expert Opinion

Germany's largest dairy has already announced a 7 cent reduction in the basic payment price. This means that what the market milk values have been suggesting for a few weeks now also applies to the cash market. The increasing quantity of milk in Germany and Europe increases the availability of butter, powder and cheese significantly. The downward trend in product prices is still intact.