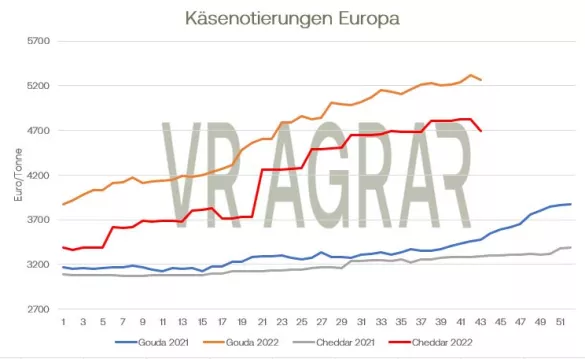

Less milk is currently being delivered than in the previous week. The decrease is about 0.4%. Looking at the same week of 2021, however, the milk volume is 1.8% higher. A total of 0.8% raw milk is missing over the year. Prices on the spot market fell significantly. For the 43rd calendar week, the ife Institute reports an average spot market price of 55.4 cents/kg, which corresponds to a decrease of 1.9 cents. The cream prices have also dropped, due to the weakening demand for block butter, the demand for industrial cream is also lower. The prices for skimmed milk concentrate are stable in the federal average compared to the previous week's level. The form butter orders from the food retail trade are brisk. The public holidays this week have led to regional pull-forward effects in the past week. New contracts between dairies and food retailers from November have fallen slightly according to the first reports, but the listing in Kempten was continued unchanged due to the generally good demand situation. In the block butter market, buyers continue to exercise restraint.Short-term requirements are inquired about and covered, but expecting prices to fall further, buyers are hesitant about longer-term contracts. The listing for block butter in Kempten fell accordingly and was fixed by an average of EUR 0.15 per kilogram to EUR 6.40 - EUR 6.65/t. Internationally, butter was up 0.2% on Tuesday's Global Dairy Trade Tender. Converted, a ton of butter costs 4,894 euros, which means that European prices are still not competitive despite the current exchange rate. A little more butter was traded on the EEX last week. Prices declined on a weekly basis and, with the exception of the November contract, are listed below the 6,000 euro/t mark in all trading months. Price pressure due to weak demand is also evident in food-grade skimmed milk powder. The listings in Kempten were once again very significantly reduced. At the lower end of the trading range, the southern German butter and cheese exchange lowered the listing by EUR 220 and at the upper end by EUR 300 per ton. In the Global Dairy Trade Tender, skimmed milk powder lost 8.5% and thus costs the equivalent of 2,988 euros/t, which is well below local prices.Twice as much skimmed milk powder was traded on the EEX compared to the previous week. Prices were weaker in the early dates in particular, but were within the current quotation range up to and including December 22. The animal feed market remains extremely calm. Trading activities can only be observed sporadically, prices tend to be correspondingly weaker. Whole milk powder fell both in the Global Dairy Trade Tender and in the price quotation in Kempten. EU goods are also hardly competitive when it comes to whole milk powder, but deals are currently being made with European industrial customers. The whey powder market is also showing restraint. New business comes about sporadically, animal feed goods are in slightly higher demand than food goods. The prices for animal feed grades are stable and unchanged, food grades are sold on average at 20 euros per ton lower. The traders at the cheese market are extremely satisfied. Demand and orders for semi-hard cheese continue to be described as brisk. The food retail trade has great demand, in particular private labels and small packaging units are in demand by consumers.Industrial customers are mostly hesitant due to the high energy costs, but the bottom line is that they are generally satisfied with the calls from bulk consumers. The listings were continued unchanged at a high level. Inventories are recovering slightly and are at a level that is typical for the season. Cheddar was up 0.9 percent in the Global Dairy Trade Tender.

ZMP Live Expert Opinion

The milk market is under pressure, albeit at a very high level. The market is characterized above all by reluctance to buy and speculation on the part of customers that prices will continue to fall, especially for skimmed milk powder. The dairy prices are stable or have risen slightly, but a correction at the beginning of the year is likely to follow.